View:

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

May 06, 2024

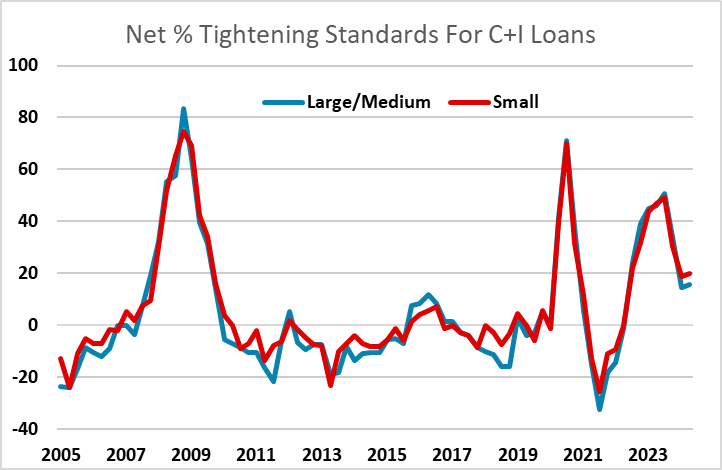

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

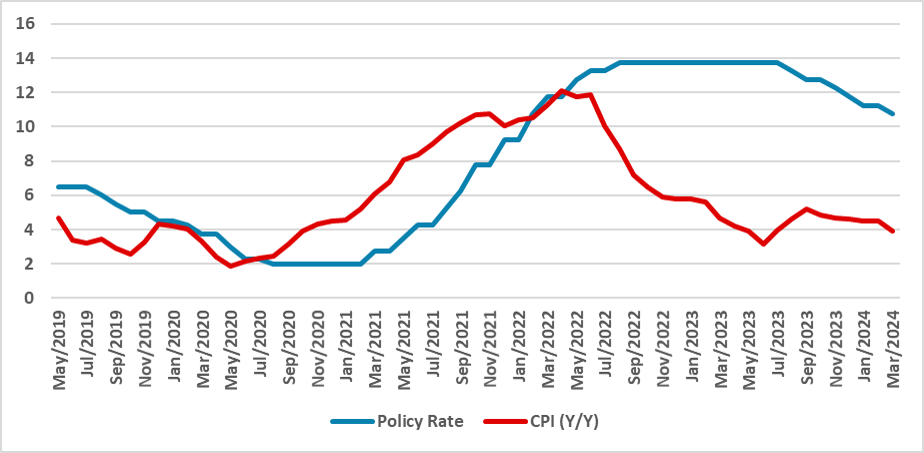

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 05, 2024

May 03, 2024

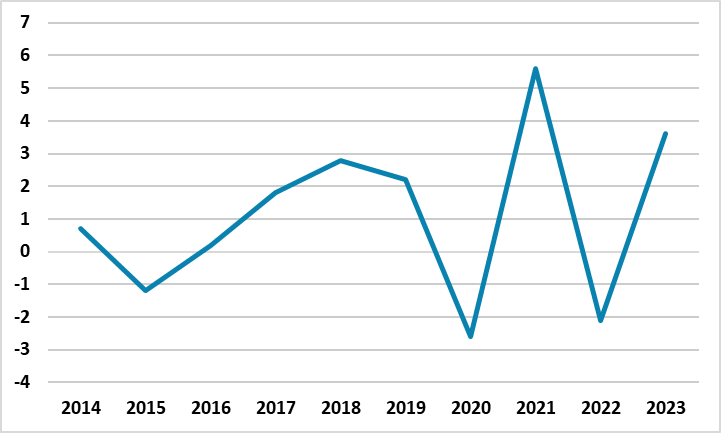

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

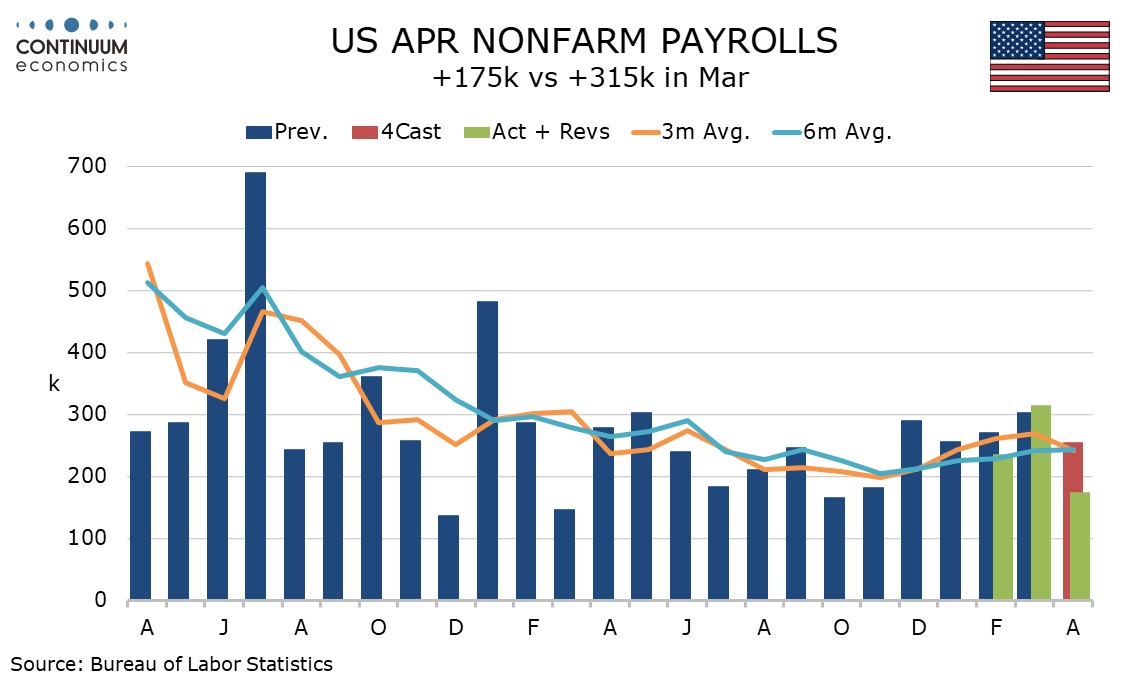

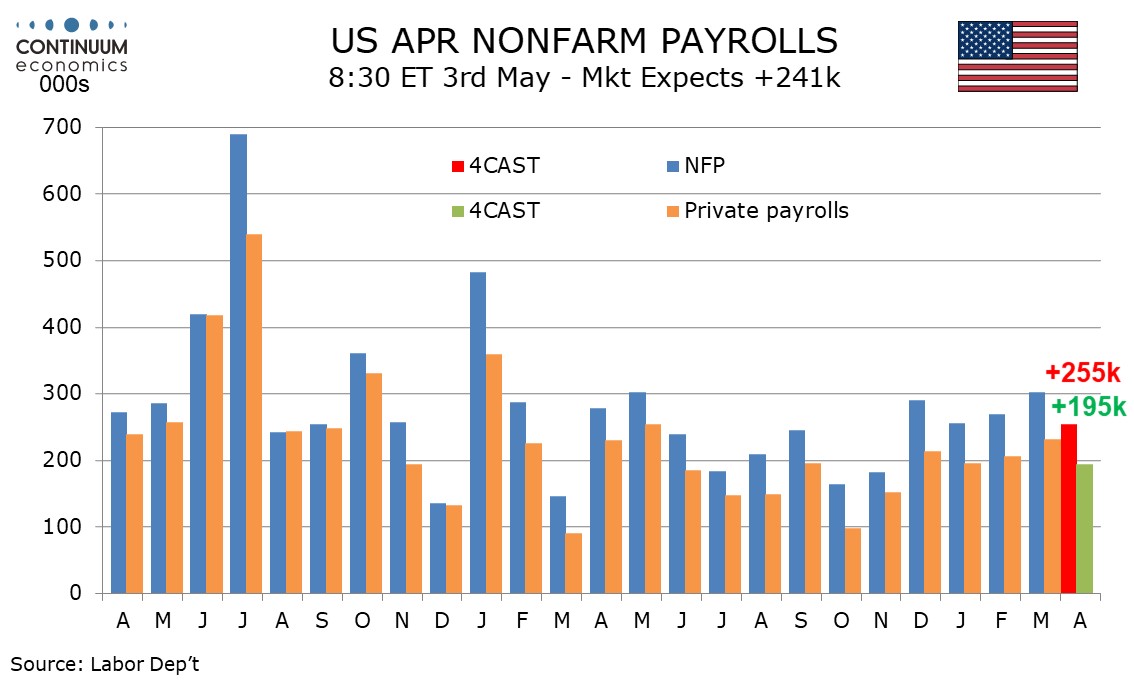

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

FX Daily Strategy: N America, May 3rd

May 3, 2024 9:04 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

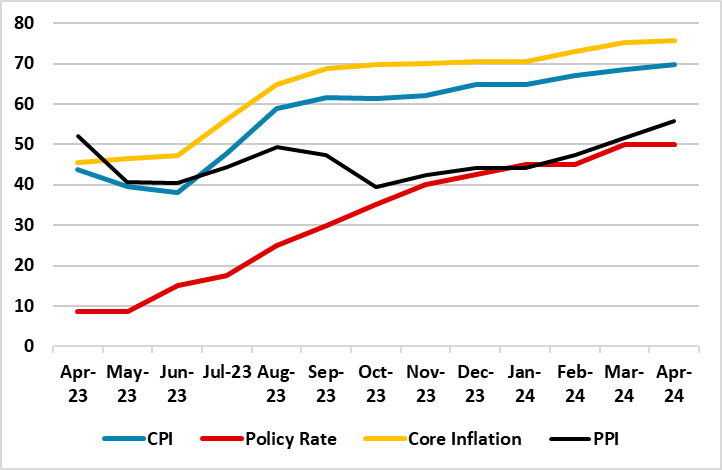

Turkiye’s Inflation Continues to Jump in April with 69.8%

May 3, 2024 7:40 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel u

FX Daily Strategy: Europe, May 3rd

May 3, 2024 5:57 AM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

May 02, 2024

FX Daily Strategy: Asia, May 3rd

May 2, 2024 9:00 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

FX Daily Strategy: APAC, May 3rd

May 2, 2024 3:12 PM UTC

USD to get support from US employment report

ISM services should be neutral, but some downside risks

JPY strength to continue long run, but some consolidation may be seen near term

NOK has upside scope despite recent weakness with Norges Bank likely to remain steady

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

May 01, 2024

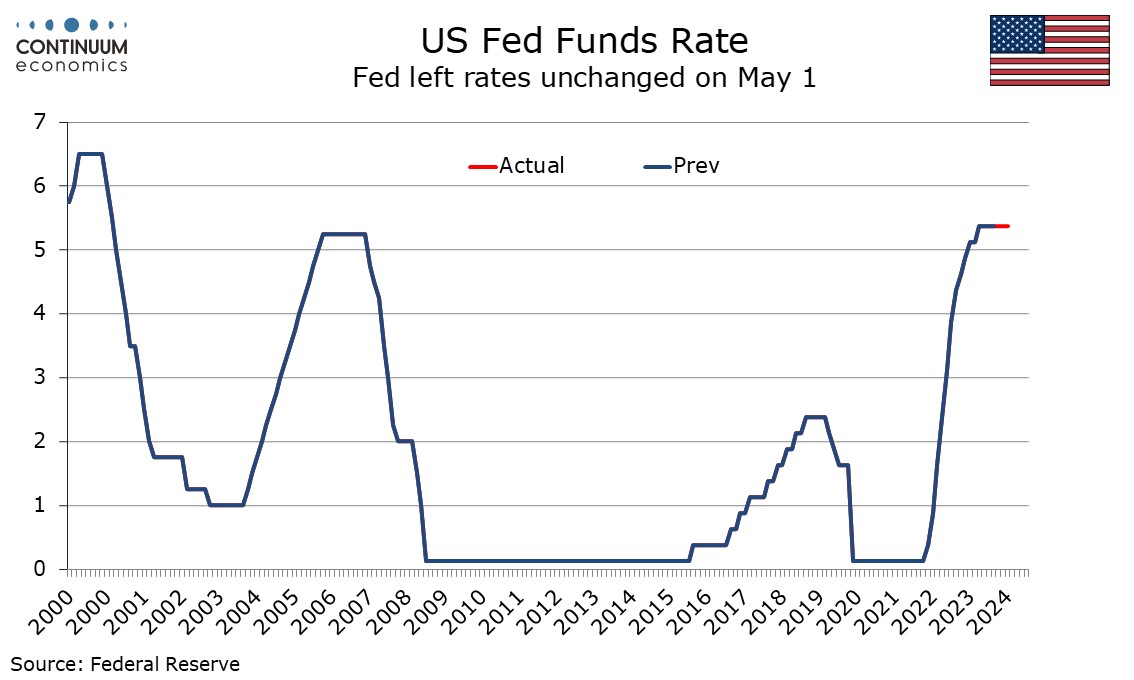

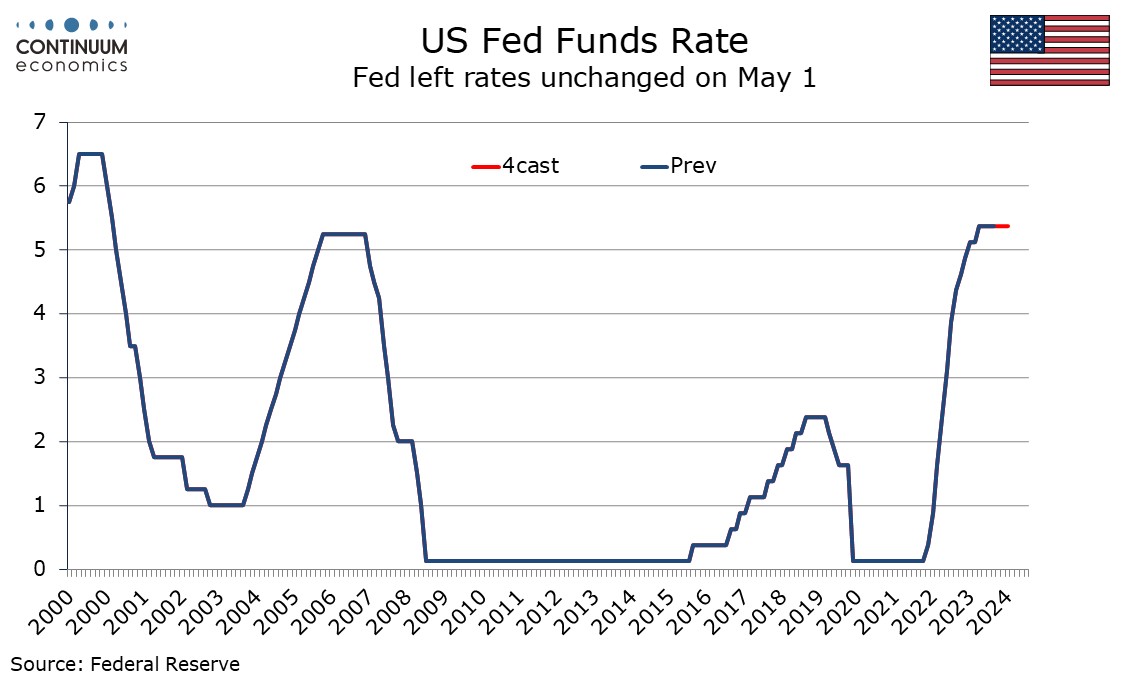

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu