View:

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

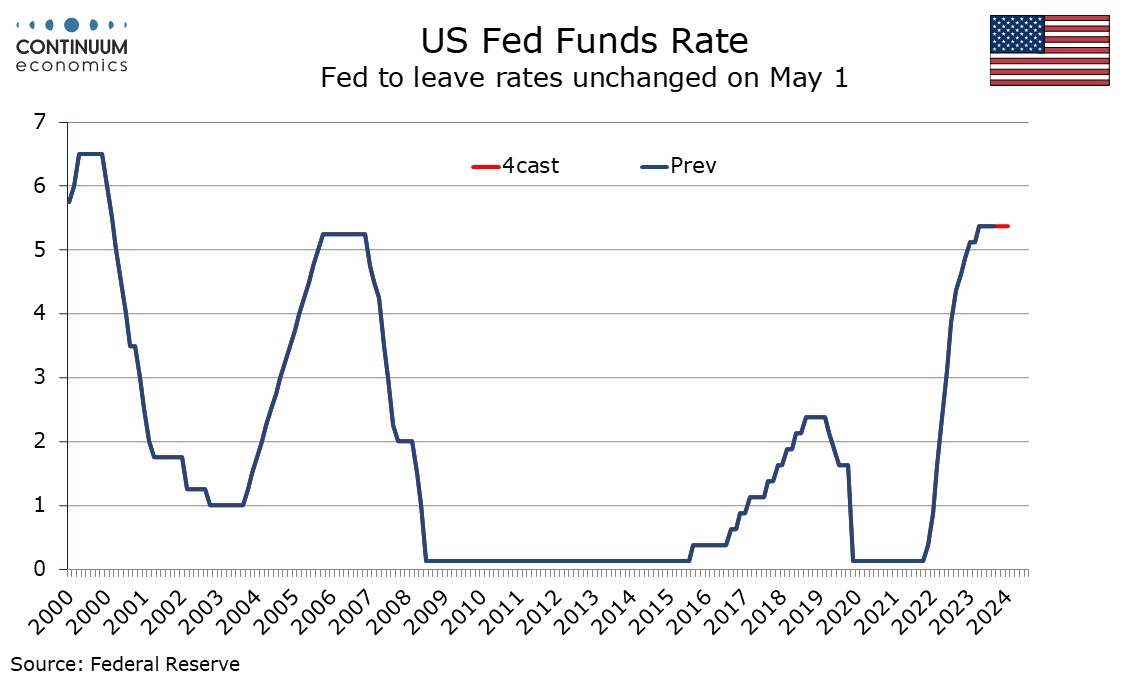

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

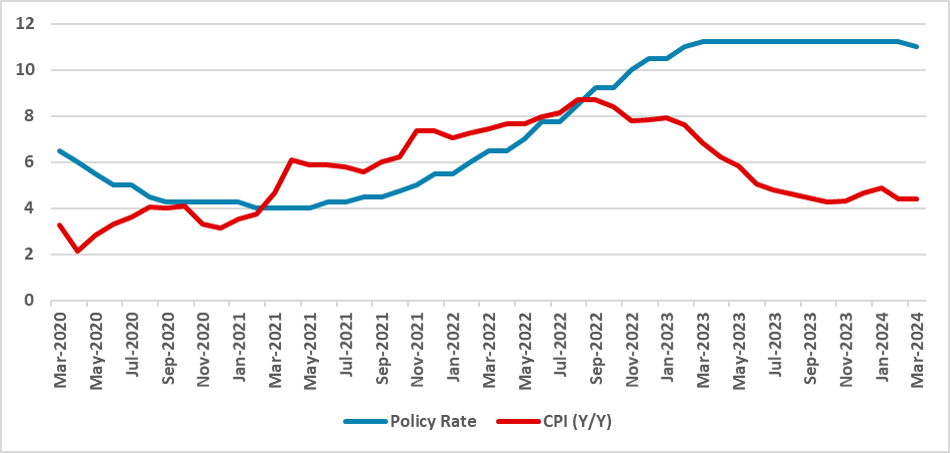

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

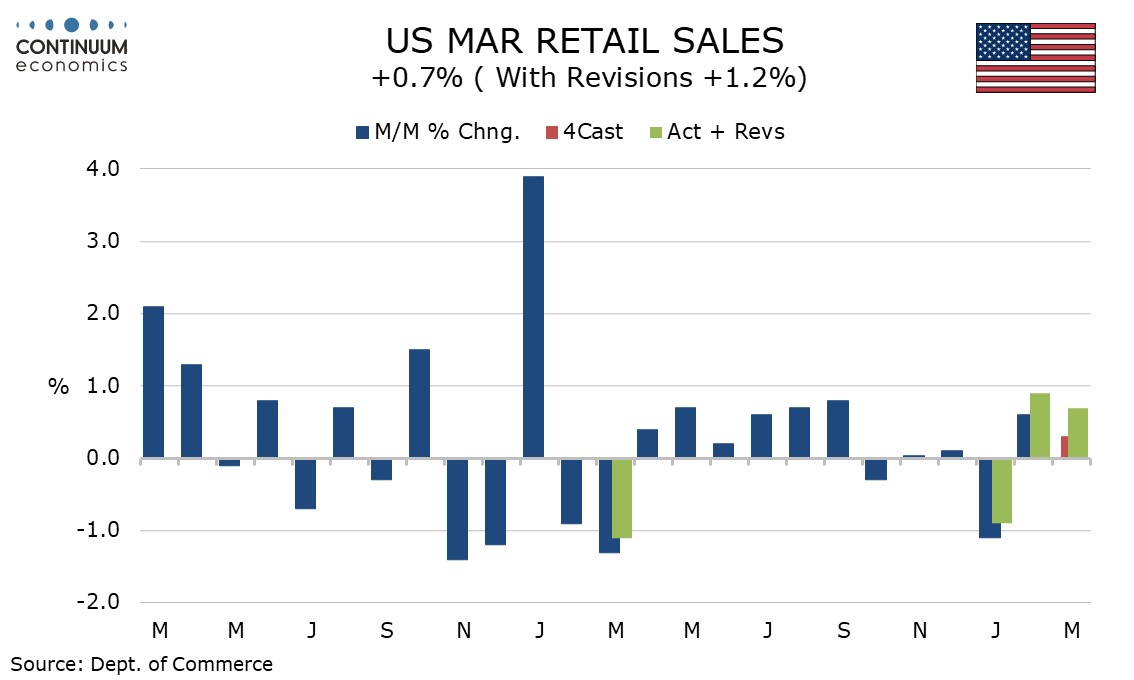

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

Preview: Due April 16 - Canada March CPI - Correction after two soft months

April 15, 2024 1:22 PM UTC

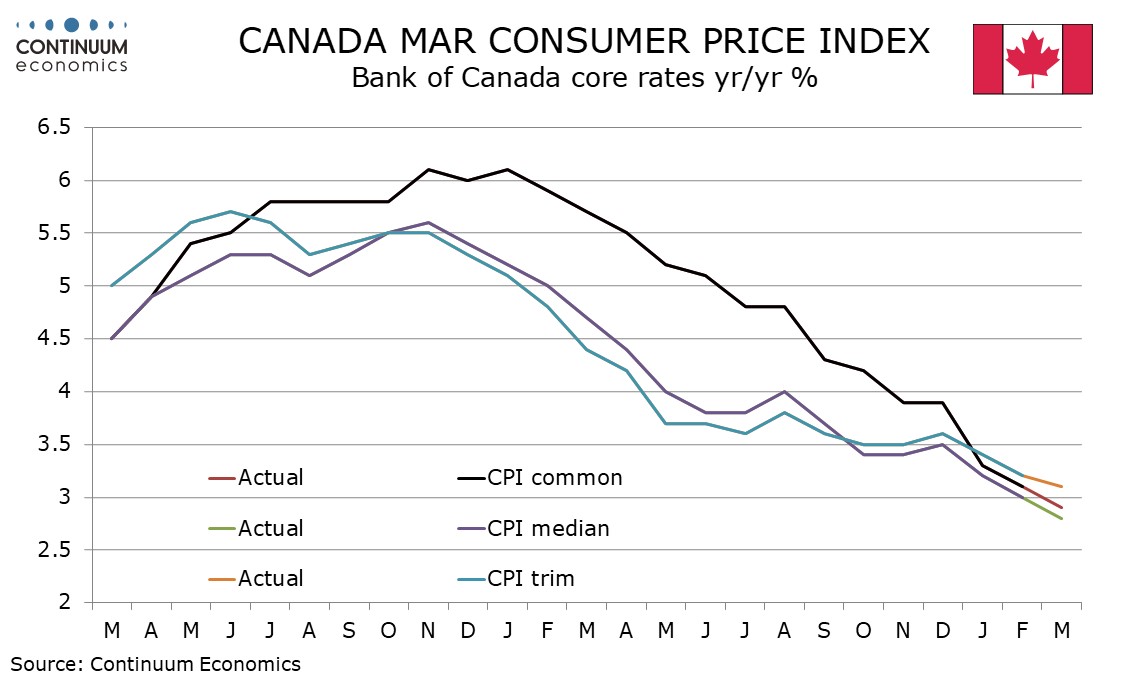

We expect March Canadian CPI to move higher to 3.0% yr/yr from 2.8% in February and 2.9% in January, with the monthly data likely to look quite firm after two soft months. However we do expect some modest progress lower in two of the three BoC’s core rates.

Asia Open - Overnight Highlights

May 8, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform mostly weaker against the USD as the greenback stays solid after some modest volatility. THB saw the largest losses of 0.30%, followed by SGD 0.24%, CNH and IDR 0.15%, CNY 0.14%, TWD 0.06%, HKD 0.04%, INR and PHP 0.02%; the only winners are KRW 0.22% and MYR 0.01%.

Indonesia Q4 GDP Preview: Robust Start to 2024

May 7, 2024 1:22 PM UTC

Bottom line: Indonesia's Q1 GDP — released on May 6 — saw growth rebound to 5.1% yr/yr from 4.90% yr/yr in Q4 2023. While private consumption continued its ascent, government expenditure emerged as the key driver of Indonesia's growth narrative. Private consumption was supported by festive deman

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

Banxico Preview: Continuing at 25bps

May 7, 2024 12:43 PM UTC

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to co