View:

May 07, 2024

Indonesia Q4 GDP Preview: Robust Start to 2024

May 7, 2024 1:22 PM UTC

Bottom line: Indonesia's Q1 GDP — released on May 6 — saw growth rebound to 5.1% yr/yr from 4.90% yr/yr in Q4 2023. While private consumption continued its ascent, government expenditure emerged as the key driver of Indonesia's growth narrative. Private consumption was supported by festive deman

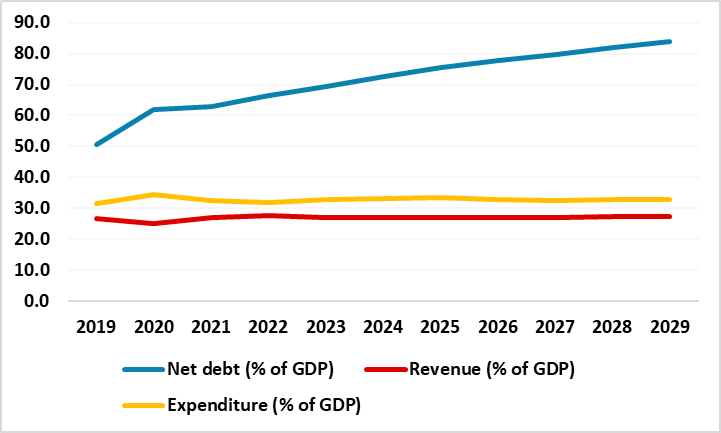

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

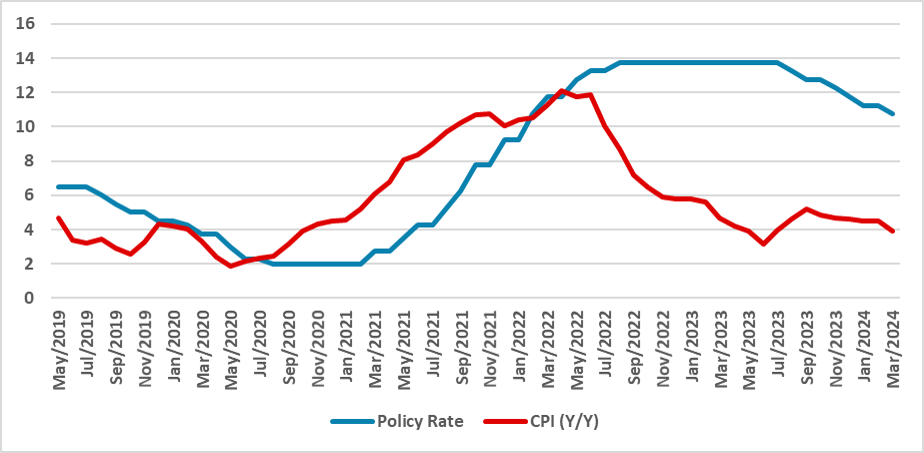

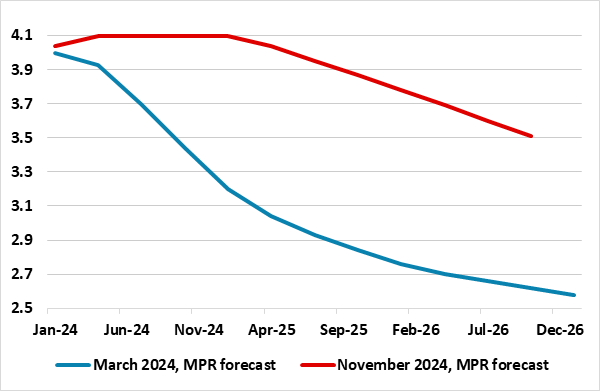

Banxico Preview: Continuing at 25bps

May 7, 2024 12:43 PM UTC

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to co

May 06, 2024

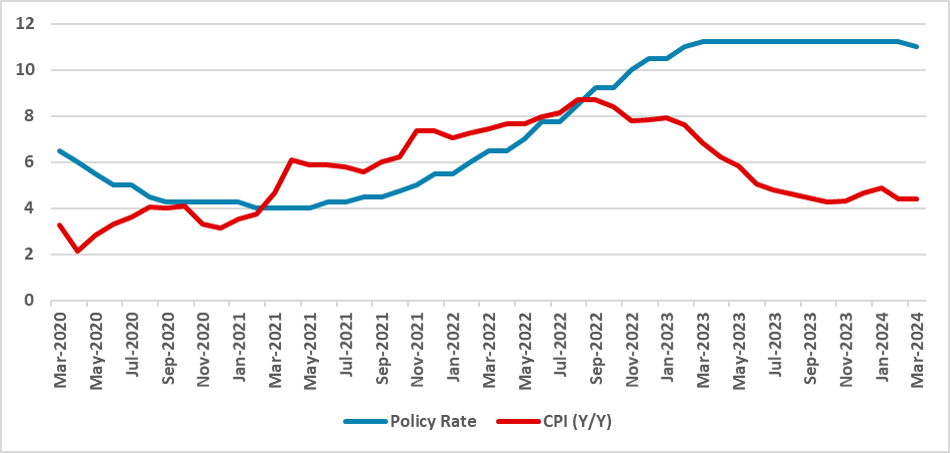

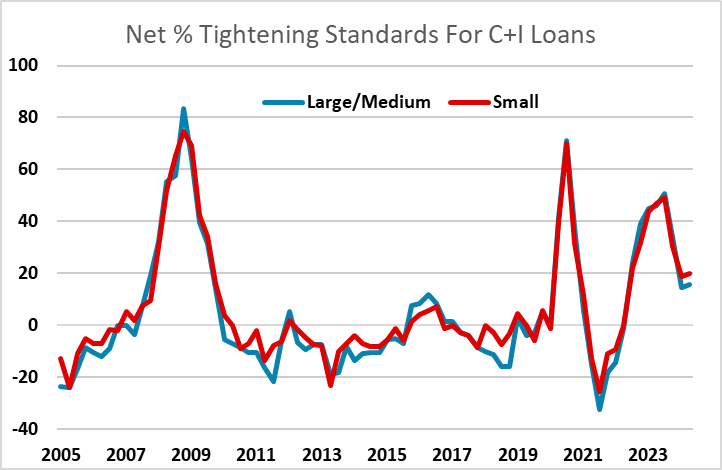

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

BCB Preview: 25bps or 50bps cut?

May 6, 2024 1:02 PM UTC

The Brazilian Central Bank (BCB) convenes on May 8 to set the policy rate. Previous forward guidance hinted at a 50bps cut in May, but recent statements from BCB President Roberto and some weakness in the BRL have shifted expectations to a 25bps cut. However, we anticipate the BCB maintaining a 50bp

May 03, 2024

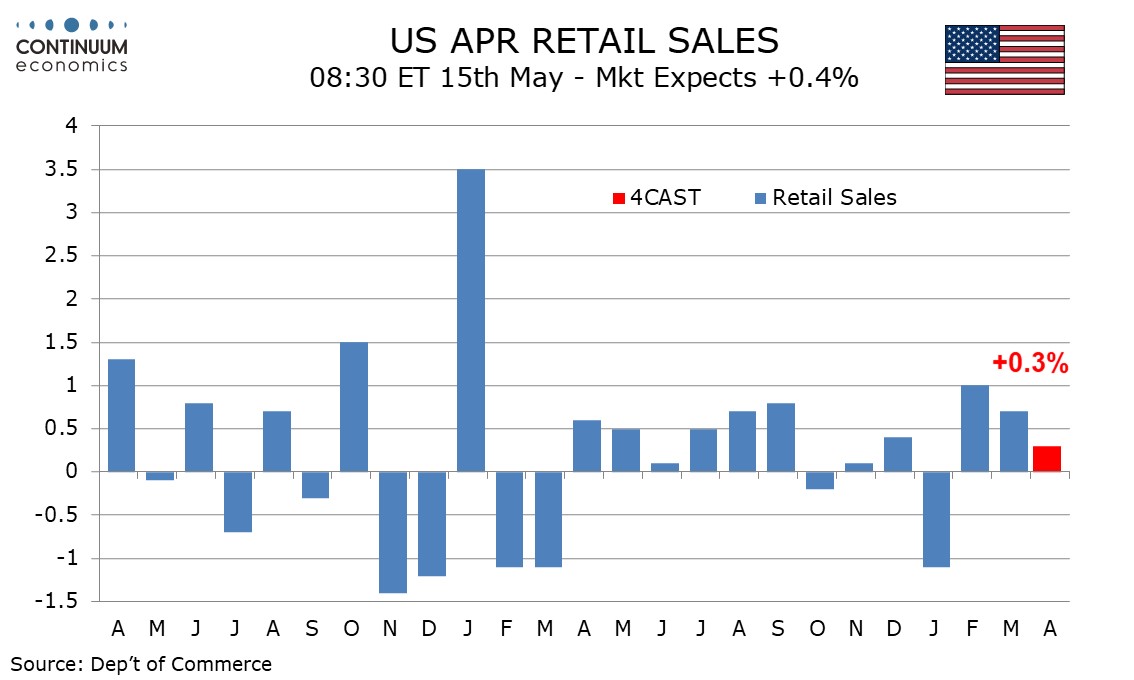

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 3, 2024 5:00 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

U.S. April ISM Services - Weakness may be overstated

May 3, 2024 2:24 PM UTC

April’s ISM services index of 49.4 from 51.4 has fallen below neutral for the first time since December 2022. That dip was explained by bad weather. There is no obvious erratic factor here to explain the weakness, but the details suggests that weakness may be overstated.

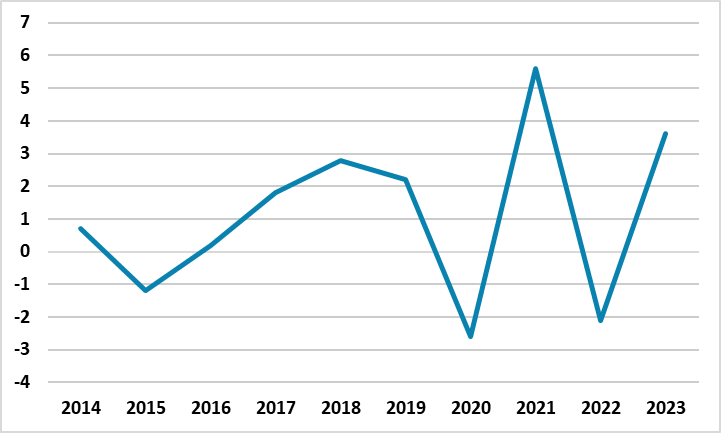

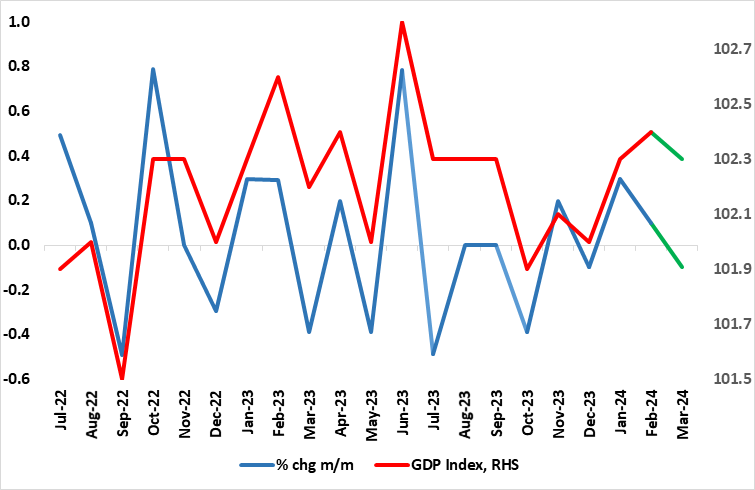

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

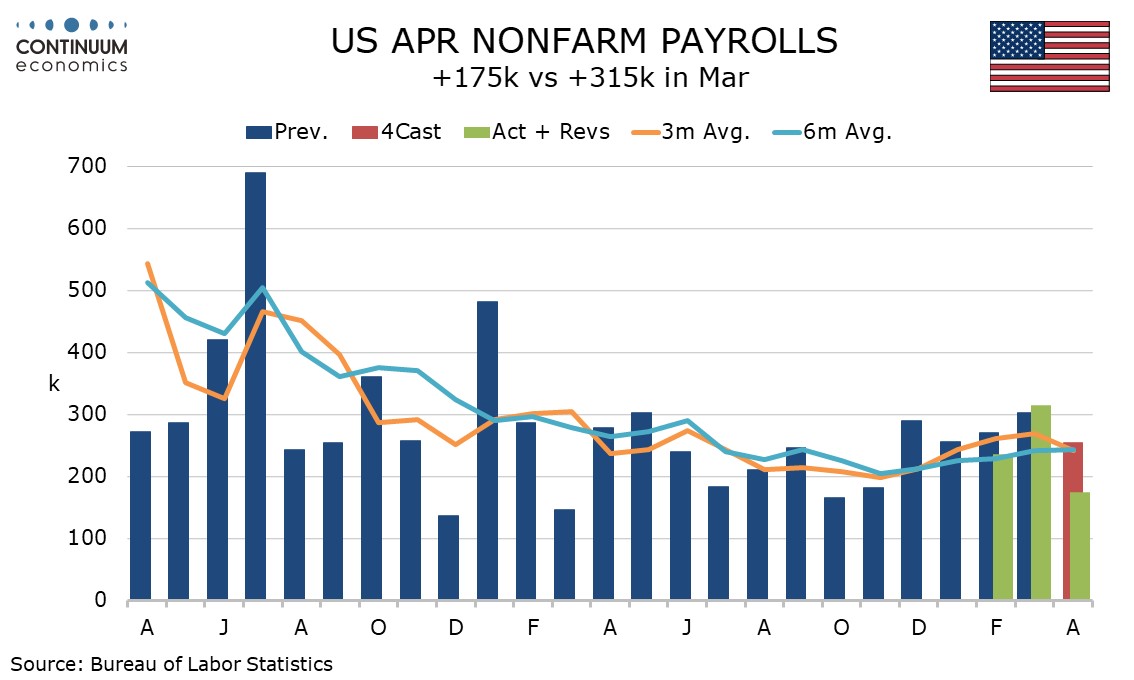

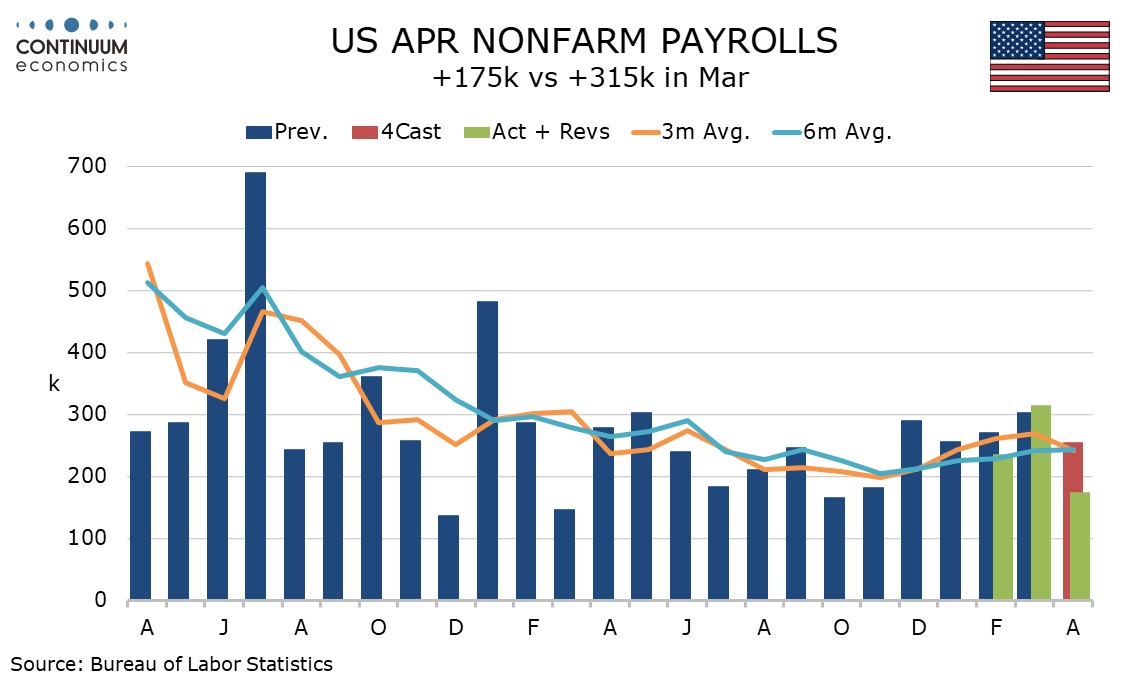

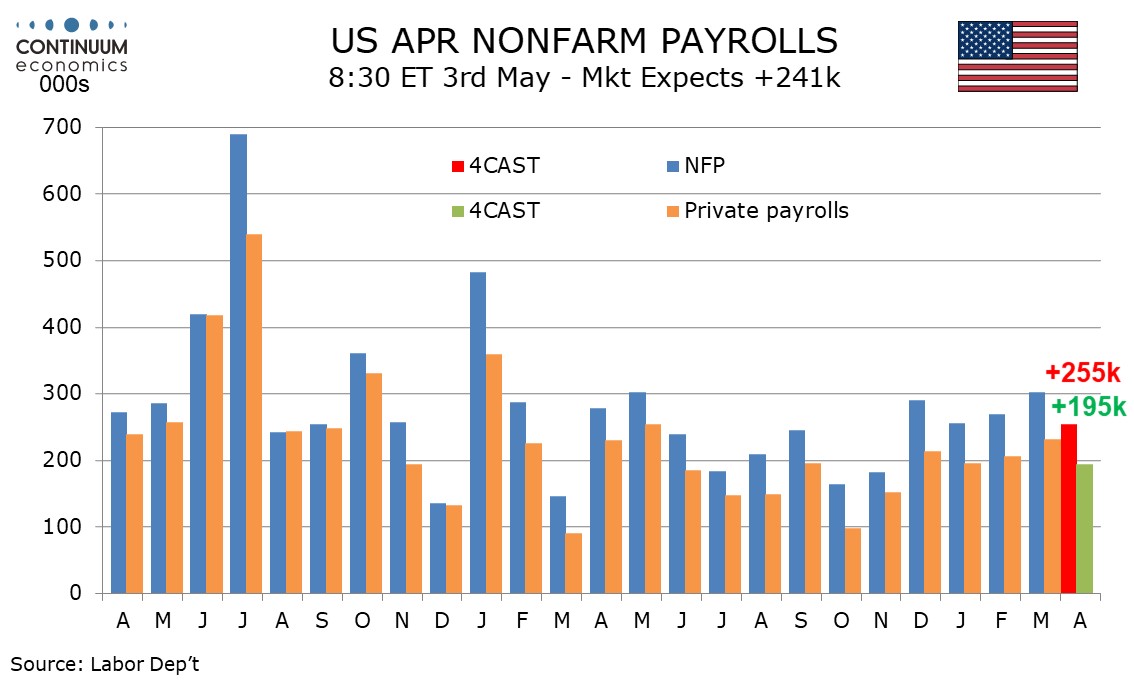

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

Indonesia CPI Review: Inflation Inches Down but BI on Alert

May 3, 2024 10:33 AM UTC

Indonesia’s consumer price inflation eased marginally to 3% yr/yr in April on the back of declining food prices. Despite the easing, food price remain the key inflationary factor. Additionally, imported inflation as the IDR comes under pressure could keep inflation elevated in the near term. Bank

Norges Bank Review: Even More Caution?

May 3, 2024 8:46 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a third successive meeting at its latest Board meeting. It also retained the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what wer

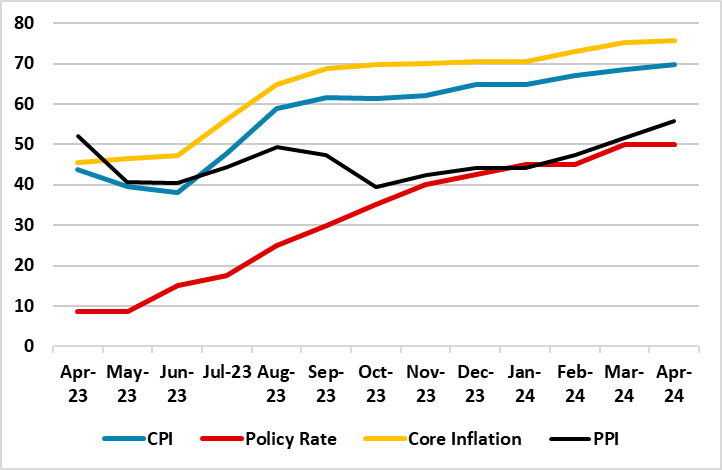

Turkiye’s Inflation Continues to Jump in April with 69.8%

May 3, 2024 7:40 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel u

May 02, 2024

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

Preview: Due May 3 - U.S. April ISM Services - A correction after two straight slowings

May 2, 2024 2:14 PM UTC

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion.

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

U.S. March trade balance little changed, Canada's moves into deficit

May 2, 2024 1:33 PM UTC

March’s US trade deficit of $69.4bn was marginally down from $69.5bn in February as a deterioration on the goods deficit was offset by a correction higher in the services surplus. Canada’s trade data was more surprising, a C$2.23bn deficit, and the largest deficit since June 2023.

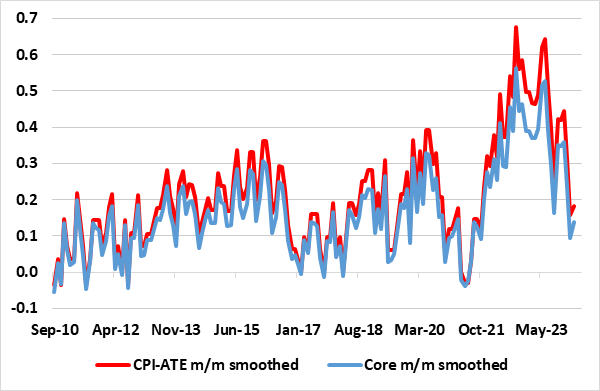

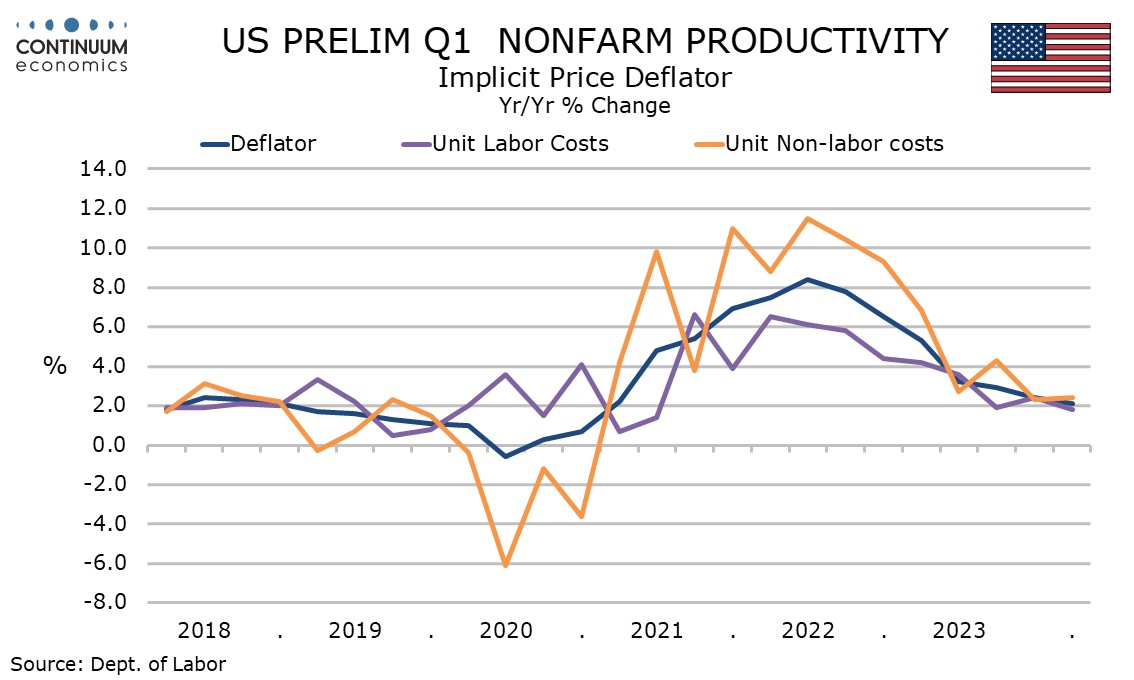

U.S. Unit Labor Costs and Initial Claims suggest inflationary risk from labor market strength

May 2, 2024 12:56 PM UTC

Initial claims at 208k are unchanged at a very low level while continued claims at 1774k are also unchanged, the preceding data revised from 207k and 1781k respectively. The labor market remains tight while unit labor costs saw a significant bounce to 4.7% annualized in Q1.

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

May 1, 2024 6:45 PM UTC

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory w

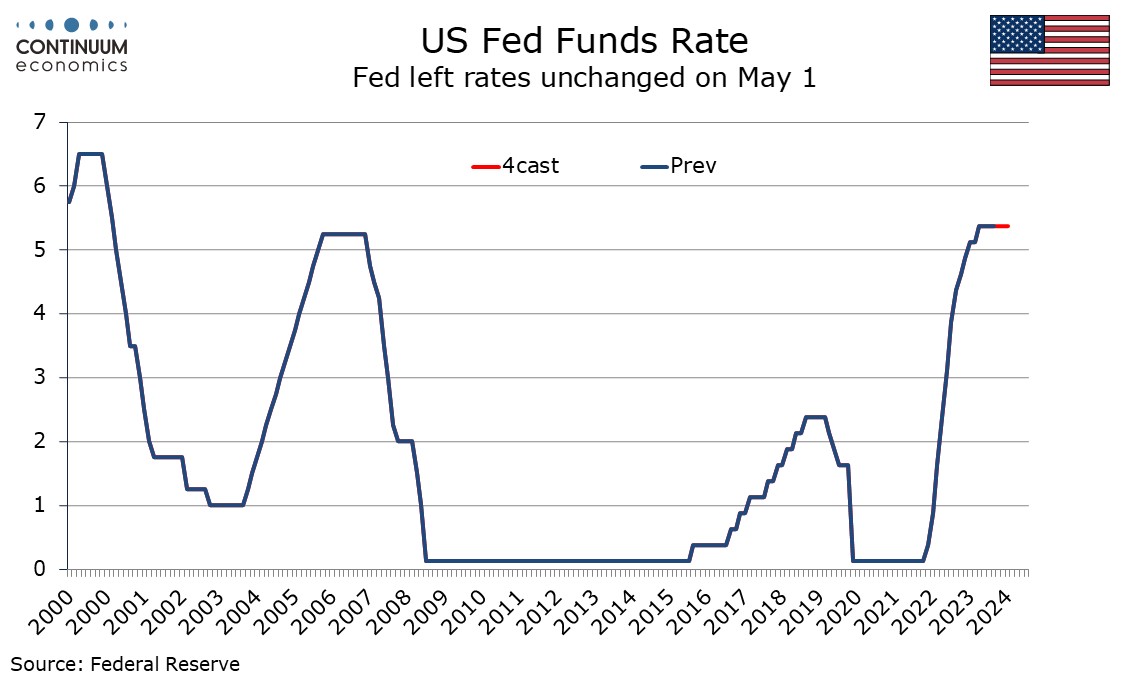

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

U.S. March JOLTS report weaker, as is April ISM Manufacturing, but Prices Paid rise

May 1, 2024 2:30 PM UTC

March’s JOLTS report has seen a sharp decline in job openings, to 8488k from 8813k (the latter a modest upward revision from 8756k). This with a slightly slower ISM manufacturing index if 49.2 from 50.3, hints at slowing activity in early Q2, though ISM prices paid at 60.9 from 55.8 are worryingly

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

May 1, 2024 12:59 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

U.S. April ADP Employment - Trend looking stronger, payroll implications unclear

May 1, 2024 12:39 PM UTC

ADP’s April estimate for private sector employment growth of 192k is on the high side of expectations though not quite as strong as the revised March gain of 208k (revised from 184k). ADP trend has picked up in the last three months but this may be catch up with strength in non-farm payrolls.

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 30, 2024

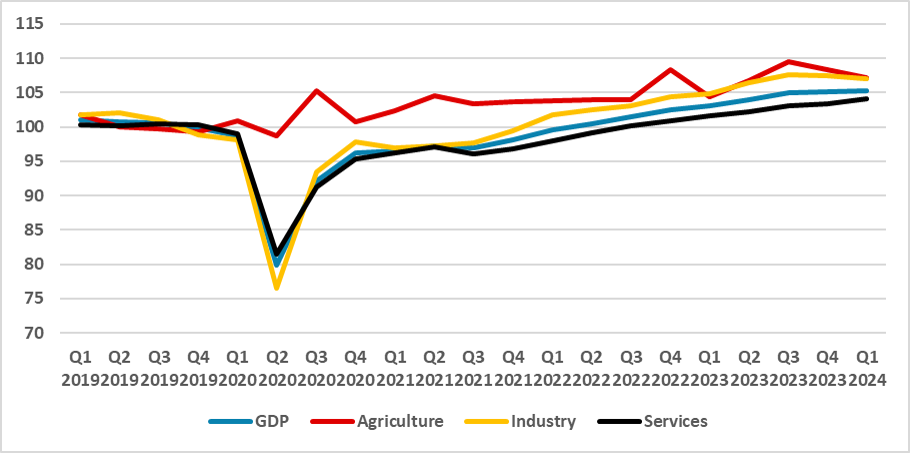

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service

U.S. April Consumer Confidence - Labor markets seen as less strong

April 30, 2024 2:23 PM UTC

April consumer confidence with a fall to 97.0 from 103.1 is weaker than expected and the lowest since July 2022. The easiest explanation for this is rising bond yields and fading expectations for rate cuts, though there are hints that the labor market is losing momentum too.

UK GDP Preview (May 10): Fragile Sideways-Moving Activity Continues?

April 30, 2024 2:19 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

Canada February GDP - Q1 looking less positive than previously projected

April 30, 2024 1:20 PM UTC

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1.

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

April 30, 2024 12:10 PM UTC

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.

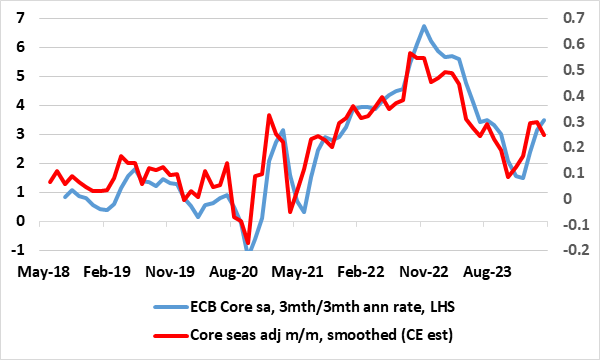

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

April 29, 2024

Preview: Due May 14 - U.S. April PPI - New Year strength fading

April 29, 2024 6:08 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

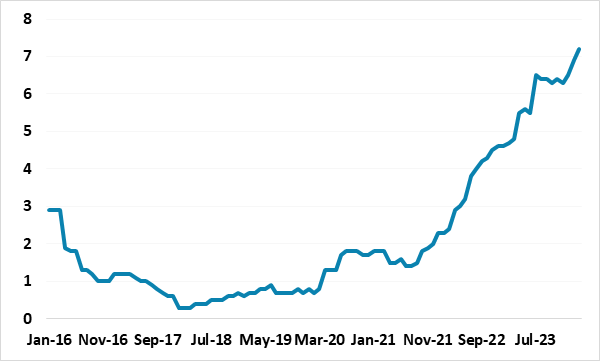

UK Consumers: Rent the Growing Hit to Spending Power

April 29, 2024 2:02 PM UTC

The UK has faced a series of cost-of-living shocks in the last few years. Some such as the surge in food prices may even be reversing, while it now looks likely the BoE hiking cycle may also start to reverse, although rising market rates may mean little further fall in effective mortgage rates in

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a