Free Thematic

View:

May 10, 2024

U.S. May Michigan CSI - Lowest since November, inflation expectations highest since November

May 10, 2024 2:12 PM UTC

May’s preliminary Michigan CSI of 67.4 from 77.2 is the weakest since November 2023 and hints at a loss of momentum in the economy, but with higher inflation expectations, the 1-year view up significantly to 3.5% from 3.2% and the 5-10 year view up marginally to 3.1% from 3.0%.

May 09, 2024

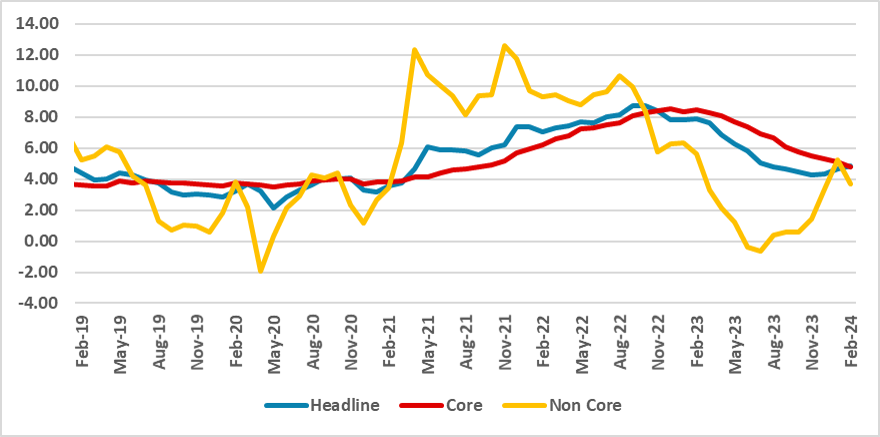

Mexico CPI Review: 0.2% Growth in April

May 9, 2024 6:11 PM UTC

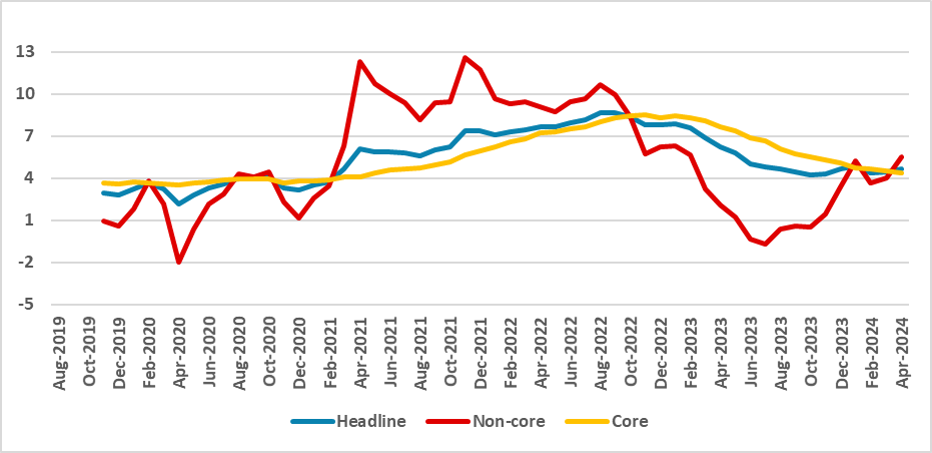

April's CPI data, despite a 0.2% m/m growth, reveals a significant y/y uptick to 4.6% from March's 4.4%, challenging norms due to electricity tariff adjustments. Core CPI maintained stability with a 0.2% increase, while Core Goods CPI rose by 0.3% and Services CPI by 0.1%, accumulating a 5.2% y/y gr

May 08, 2024

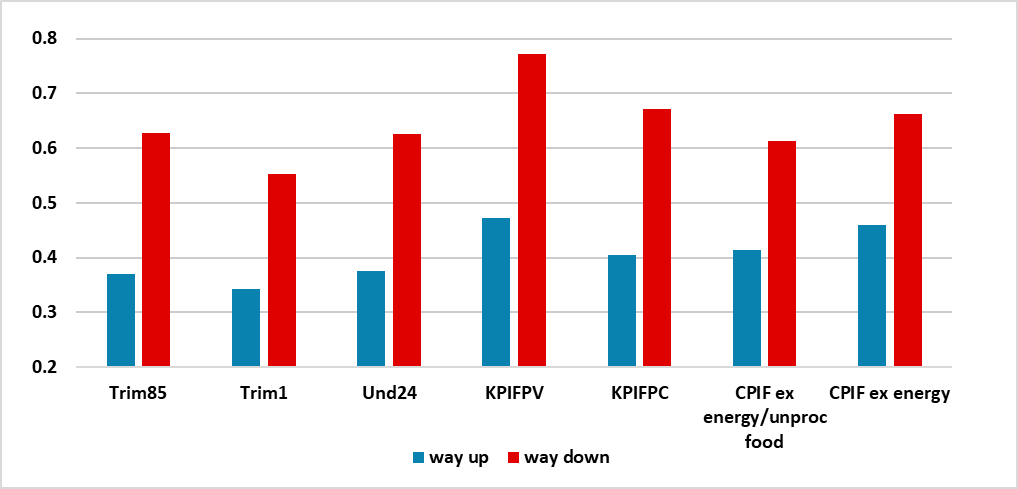

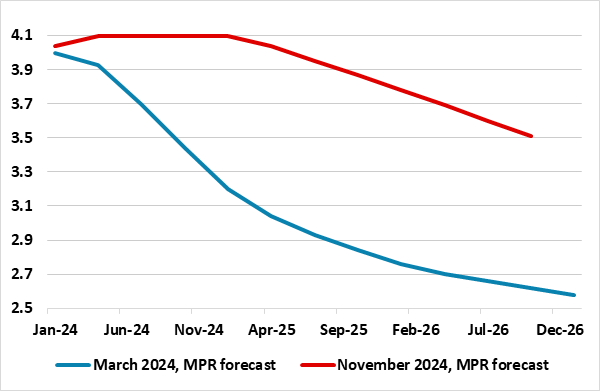

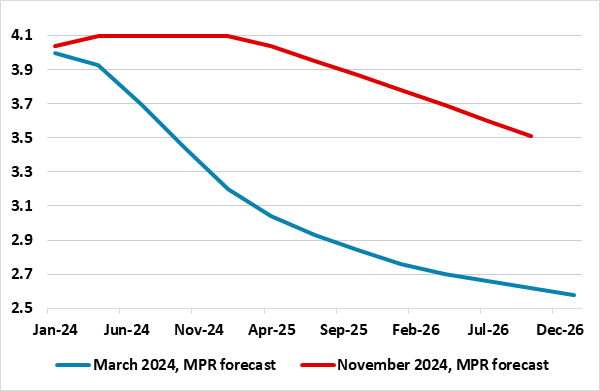

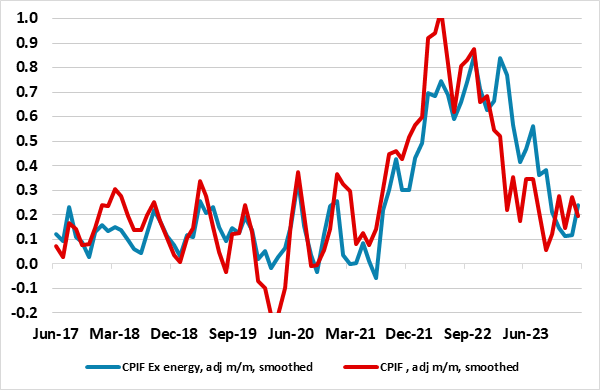

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 01, 2024

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 30, 2024

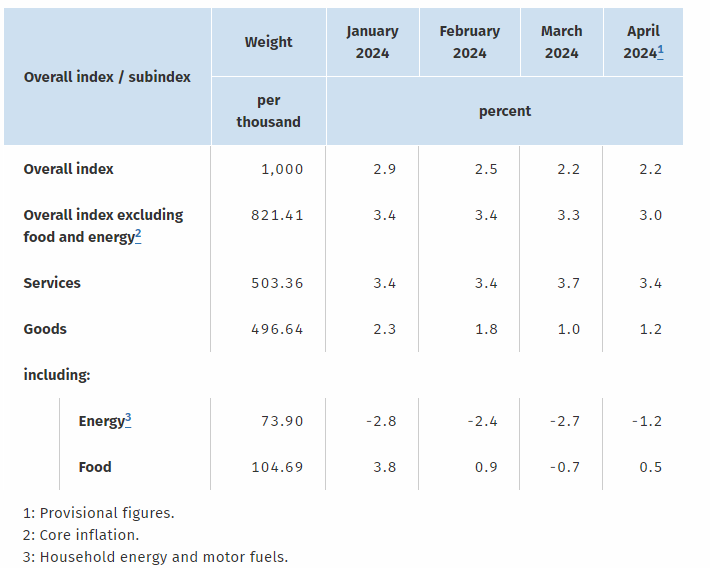

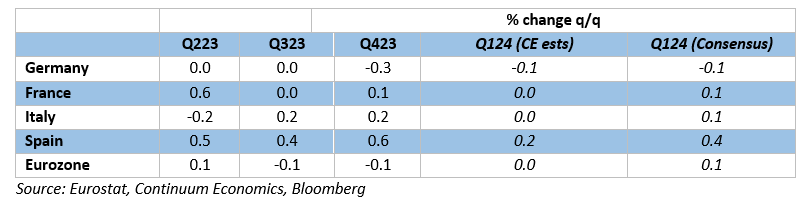

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

April 29, 2024

German Data Review: Inflation Edges up Amid Less Resilient Services and Core Rate?

April 29, 2024 12:38 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

April 26, 2024

April 25, 2024

BoJ's Intervention and its impact

April 25, 2024 6:24 AM UTC

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is ke

April 24, 2024

Eurozone GDP Preview (Apr 30): Less Weak?

April 24, 2024 11:06 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation is likely to have continued into Q1 (Figure 1) where we see a flat o

April 23, 2024

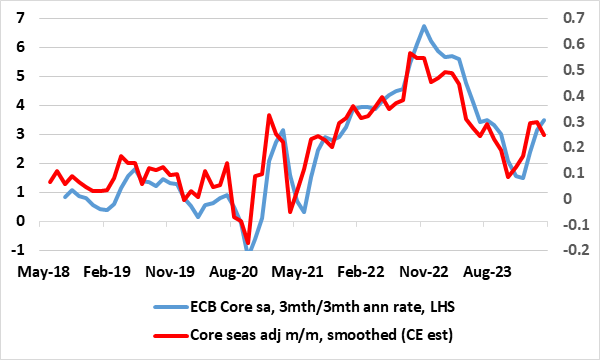

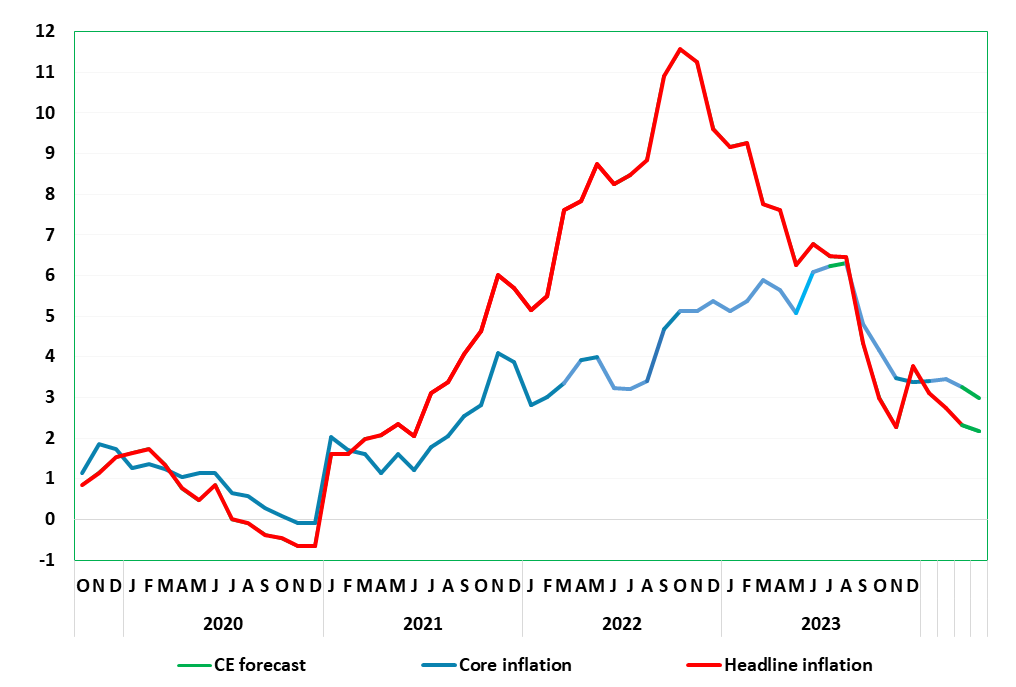

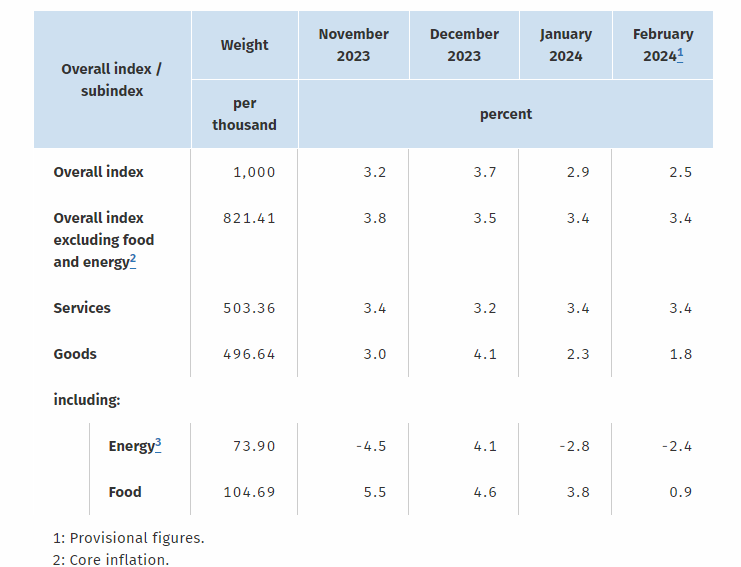

EZ HICP Preview (Apr 30): Core Disinflation Signs to Flatten Out Further?

April 23, 2024 9:43 AM UTC

Very much having affected ECB thinking, there has been repeated positive EZ news in the form of falling EZ HICP inflation and somewhat broadly so. This continued in the March HICP numbers, with the 0.2 ppt drops in both headline and core being a notch more sizeable than most anticipated. Regardless,

April 22, 2024

German Data Preview (Apr 29): Inflation Drop to Continue Amid Less Resilient Services?

April 22, 2024 12:58 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

April 17, 2024

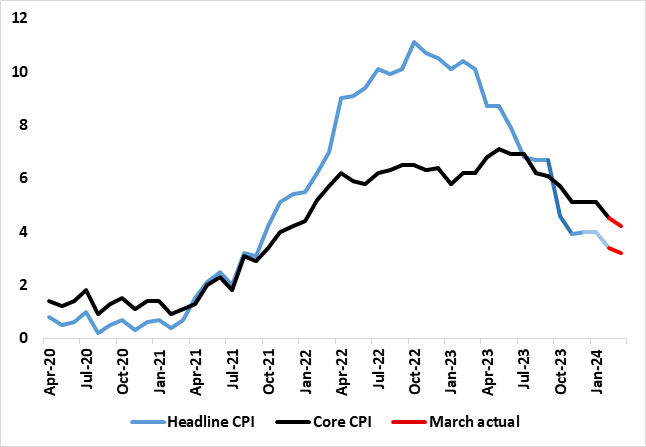

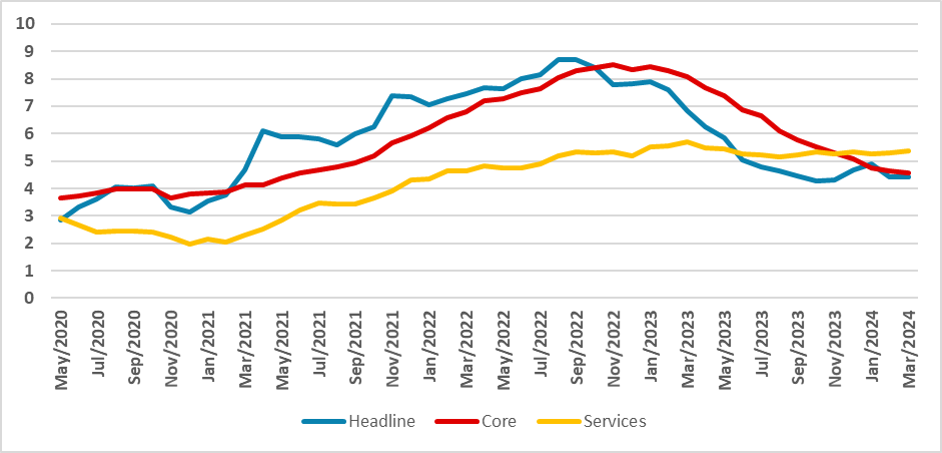

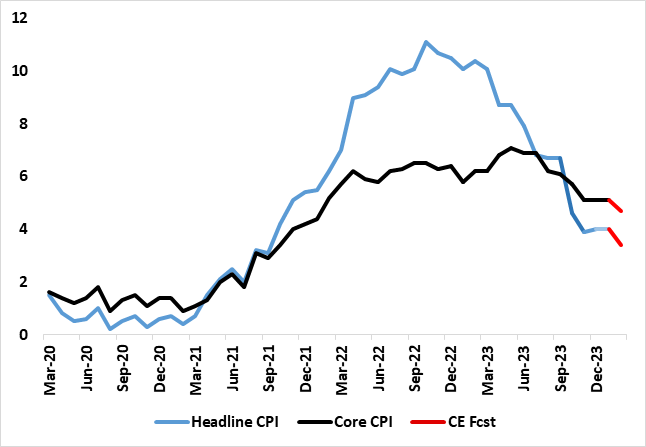

UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

April 17, 2024 6:52 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearl

April 16, 2024

U.S. March Industrial Production - Manufacturing backing improved ISM signal

April 16, 2024 1:34 PM UTC

March industrial production with a 0.4% increase was in line with expectations though manufacturing with a rise of 0.5% exceeded expectations and there appears to be some underlying improvement there.

April 15, 2024

India Inflation: Risks Tilted to the Upside

April 15, 2024 12:35 PM UTC

India's inflation trajectory in March 2024 showcased divergent trends in both consumer and wholesale price indices. While consumer inflation dipped to its lowest in ten months at 4.9% y/y, wholesale inflation rose to 0.5% y/y, driven by surging food prices. The outlook suggests gradual WPI escalatio

April 12, 2024

U.S. April Michigan CSI - Lower but inflation expectations rise

April 12, 2024 2:13 PM UTC

April’s preliminary Michigan CSI of 77.9 is down from March’s 79.4 but still above February’s 76.5 and generally healthy. Inflation expectations moved higher, the 1-year view to 3.1% from 2.9% and the 5-10 year view to 3.0% from 2.8%, its highest since November.

April 11, 2024

ECB Review: ECB Hums Easing Tune for June

April 11, 2024 1:58 PM UTC

Surprising hardly anyone, the ECB is preparing to cut official rates, after what are now five successive stable policy decisions. It explicitly suggested that it could be appropriate to reduce the current level of monetary policy restriction, a policy hint backed up by dropping its previous rhetoric

April 09, 2024

Mexico CPI Review: Slightly Below Expectations, with Concerns in Service

April 9, 2024 6:43 PM UTC

Mexico's March CPI data, released by the National Statistics Institute, shows a slight increase of 0.29%, below the 0.36% expectation. Year-on-year CPI remains stable at 4.4%, above Banxico's 3.0% target. While fruit and vegetable prices dropped, transport costs rose. Concerns arise with Services CP

April 04, 2024

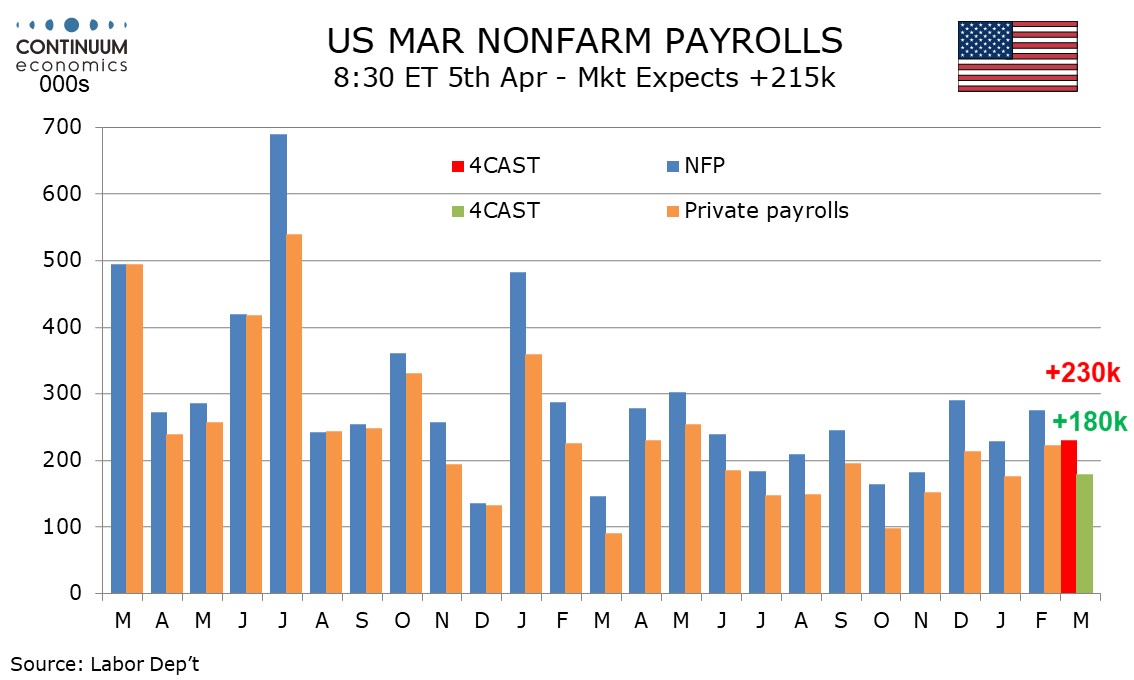

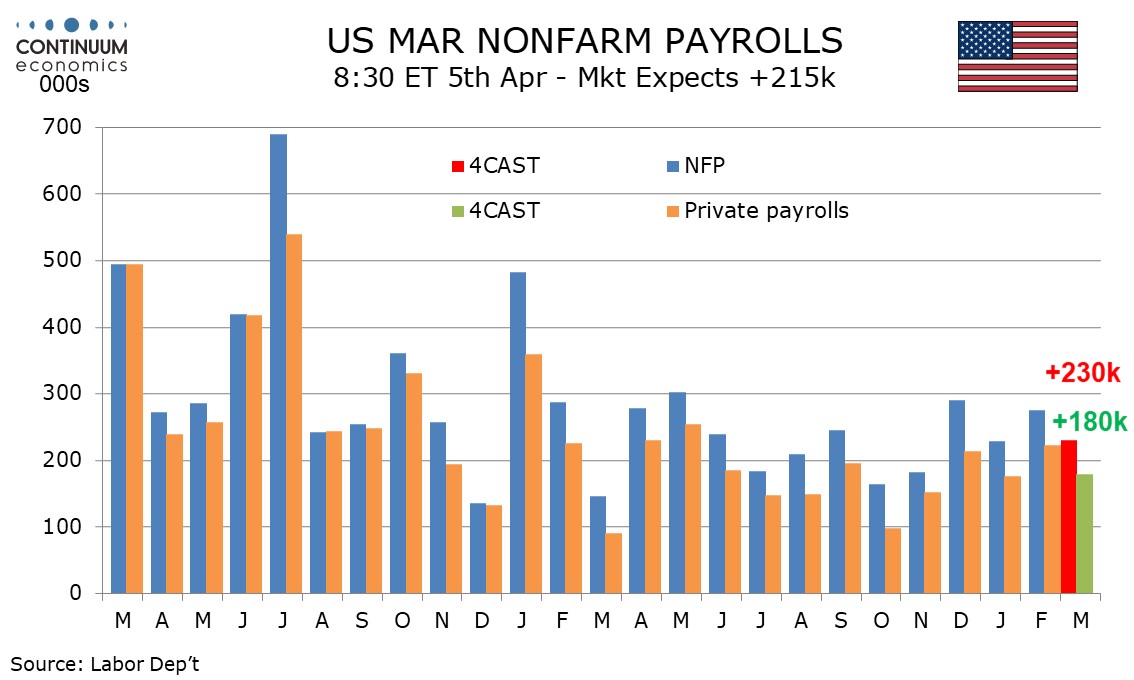

Preview: Due April 5 - U.S. March Employment (Non-Farm Payrolls) - Slightly Slower but Labor Market Remains Strong

April 4, 2024 1:18 PM UTC

We expect a 230k increase in March’s non-farm payroll, which would be in line with the 6-month average but slightly below the 3-month. We expect a correction lower in unemployment to 3.8% from 3.9% and a moderate 0.3% increase in average hourly earnings.

April 03, 2024

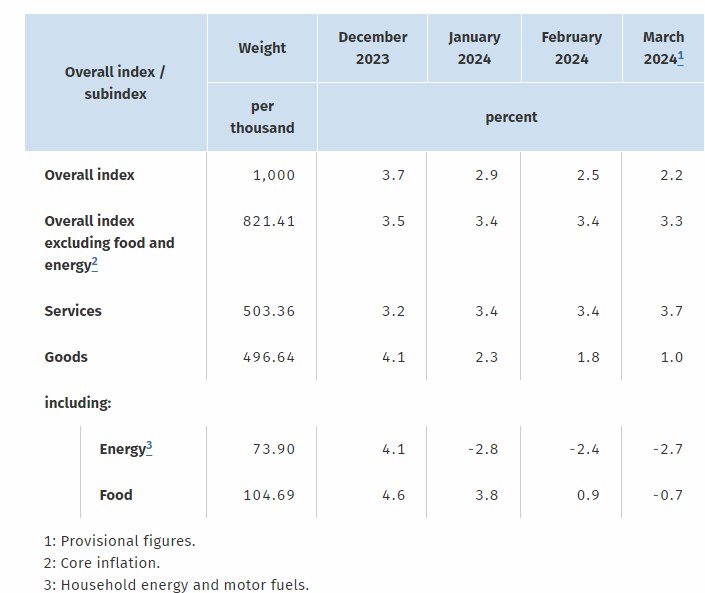

EZ HICP Review: Core Disinflation Flattening Out?

April 3, 2024 9:34 AM UTC

Very much having affected ECB thinking, there has been repeated positive EZ news in the form of falling inflation and somewhat broadly so. This continued in the March HICP numbers, with the 0.2 ppt drops in both headline and core being a notch more sizeable than most anticipated. Regardless, the hea

April 02, 2024

German Data Review: Inflation Drop Continues But Amid Still Resilient Services

April 2, 2024 12:19 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

April 01, 2024

Preview: Due April 11 - U.S. March PPI - Early 2024 strength set to fade

April 1, 2024 6:36 PM UTC

We expect a 0.3% increase in March’s PPI, with a 0.2% increase ex food and energy, the latter slowing from above trend increases of 0.3% in February and 0.5% in January, though this would still be stronger than each month from August through December of 2023.

March 27, 2024

EZ HICP Preview (Apr 3): Core Disinflation Signs Start to Flatten Out?

March 27, 2024 1:25 PM UTC

Enough to have affected ECB thinking, there has been repeated positive EZ news in the form of plunging inflation. This continued in the February numbers, albeit with the 0.2 ppt drops in both headline and core being less that most anticipated. Regardless, the headline, at 2.6%, continued its recent

Sweden Riksbank Review: Early Easing to Allow Gradual Moves

March 27, 2024 9:58 AM UTC

Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its latest decision, again keeping the policy rate at 4%, and no change to the pace of bond sales,

March 26, 2024

Preview: Due April 5 - U.S. March Employment (Non-Farm Payrolls) - Slightly Slower but Labor Market Remains Strong

March 26, 2024 7:04 PM UTC

We expect a 230k increase in March’s non-farm payroll, which would be in line with the 6-month average but slightly below the 3-month. We expect a correction lower in unemployment to 3.8% from 3.9% and a moderate 0.3% increase in average hourly earnings.

March 22, 2024

March 20, 2024

UK CPI Inflation Review: Headline and Core Fall More Broadly, But Momentum Still Evident

March 20, 2024 7:44 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%,

March 19, 2024

March 18, 2024

Sweden Riksbank Preview: Early Easing Discussion Clearer But Nothing Definitive

March 18, 2024 4:20 PM UTC

It is ever clearer that the Riksbank has accepted that it can and should make its policy stance less contractionary, at least in conventional terms. In its last decision, at the start of February, keeping policy at 4%, albeit increasing the pace of bond sales from SEK 5 billion to 6.5 billion per

March 15, 2024

March 14, 2024

BoE Preview: Easing Bias to be Made Clearer?

March 14, 2024 10:23 AM UTC

It would be something of a shock if the BoE was to vote to do anything but keep policy on hold when the MPC gives its next verdict on Mar 21. More likely than not there will be no further dissents in favor of a further hike, merely one again calling for a cut. But despite recent CPI underlying f

March 13, 2024

Preview: Due March 14 - U.S. February PPI - Strong January core rates unlikely to be repeated

March 13, 2024 1:54 PM UTC

We expect a 0.3% increase in February’s PPI, matching January’s increase, but with 0.2% increases in the core rates ex food and energy and ex food, energy and trade, slowing from above trend January increases of 0.5% and 0.6% respectively as the New Year saw what we expect to be one-time price h

BoJ Preview: 50-50

March 13, 2024 3:17 AM UTC

Our central forecast is for the BoJ to change forward guidance in March, indicating trend inflation will be achieving target and ultra-ease monetary policy is no longer necessary and hike interest rate to 0% in April as wage growth has accelerated and the latest wage negotiation is likely to ensure

March 11, 2024

UK CPI Inflation Preview (Mar 20): Headline and Core to Fall More Clearly?

March 11, 2024 10:59 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%,

March 07, 2024

Mexico CPI Review: CPI Grew 0.1% in February

March 7, 2024 10:16 PM UTC

The February CPI figures released by Mexico's National Institute of Statistics and Geography show a slight 0.1% increase, aligning with expectations. Year-on-year CPI dropped to 4.4%, ending a three-month rise. Food and Beverages notably fell by 1.3%, while Housing and Transports saw positive growth

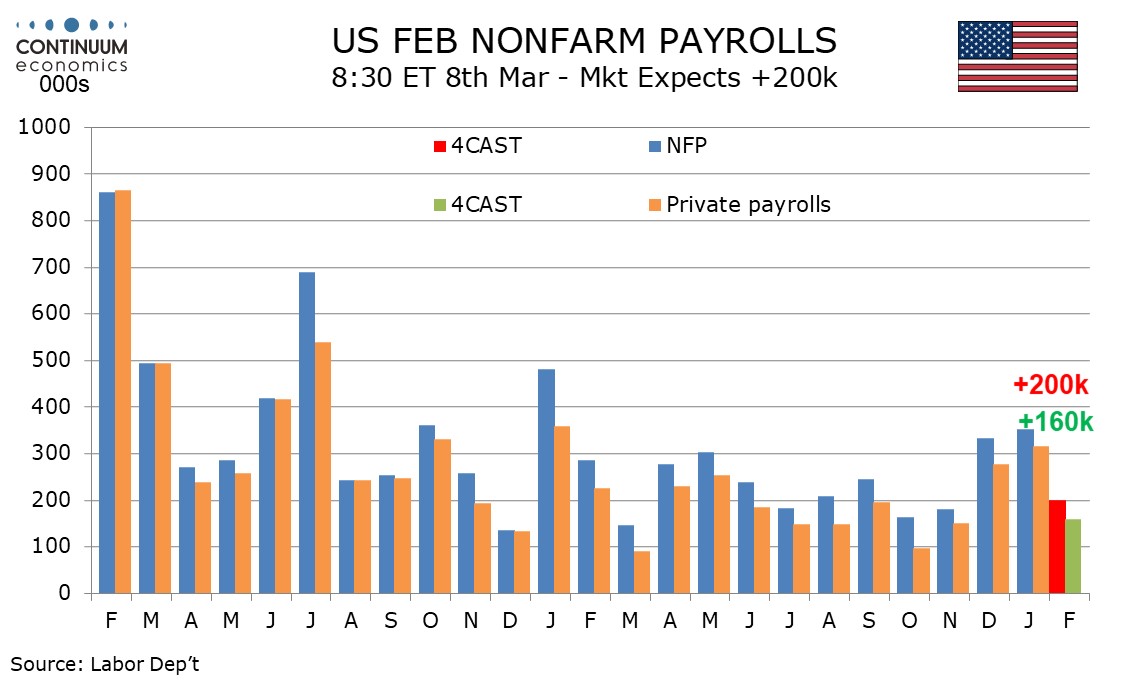

Preview: Due March 8 - U.S. February Employment (Non-Farm Payrolls) - Slower but Labor Market Remains Strong

March 7, 2024 2:35 PM UTC

After two straight very strong non-farm payroll gains exceeding 300k we expect a 200k increase in February’s non-farm payroll, which is where trend was before the recent acceleration. We expect an unchanged unemployment rate of 3.7% to show the labor market remains tight, but average hourly earnin

March 06, 2024

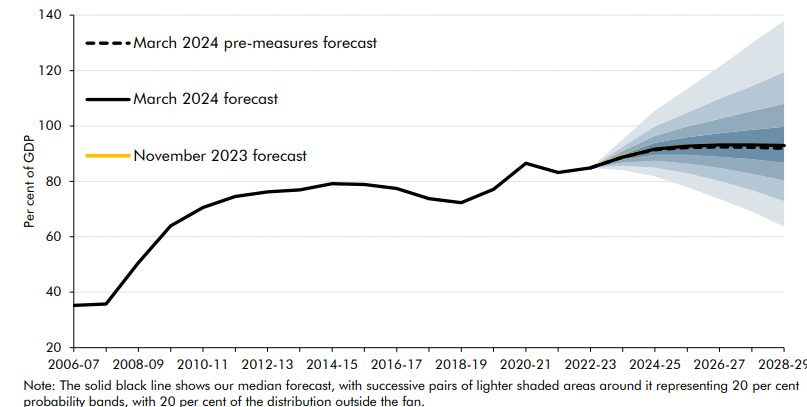

UK Budget Review: Demographics Fail to Prevent Ever Smaller Fiscal Headroom?

March 6, 2024 2:53 PM UTC

Chancellor Hunt’s Budget today was an even clearer politically driven affair. Hence the focus on offering alleged tax cuts, all framed as helping boost growth potential but where the tax as a share of GDP is forecast to rise to a post-war record 37.1% of GDP in 2028-29. The political question

March 05, 2024

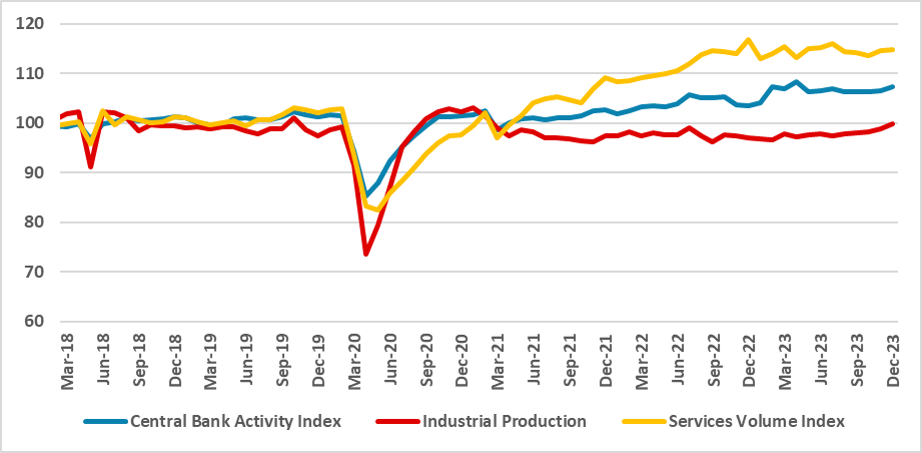

UK GDP Preview (Mar 13): Fragility to Continue

March 5, 2024 11:34 AM UTC

Coming in lower than expected after taking account of downward revisions, and probably hit by industrial action, GDP shrank by 0.1% m/m in December data, a result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer spending. We see stagnation in

March 04, 2024

ECB Preview (Mar 7): Caution Still the Council Watchword

March 4, 2024 10:45 AM UTC

Once again the ECB meeting verdict due next Thursday (Mar 7) will be notable not for what the Council does (save for downward tweaks to its projections (Figure 1)) but rather what is said. A fourth successive stable policy decision is unambiguously expected. This will come alongside a reaffirmat

March 01, 2024

EZ HICP Review: Core Disinflation Signs Start to Flatten Out?

March 1, 2024 10:41 AM UTC

There has been repeated positive EZ news in the form of plunging inflation. This continued in the February numbers, albeit with the 0.2 ppt drops in both headline and core being less that most anticipated and with some hints that core disinflation may be marked. Regardless, the headline, at 2.6%, co

February 29, 2024

German Data Review: Inflation Drop Continues But Still Resilient Services?

February 29, 2024 1:13 PM UTC

Base effects continue to distort the German HICP/CPI readings, but the January data came in a notch below expectations, and reversed half of the surge in the y/y rate seen in December. And February data continued the downtrend, as the HICP rate fell from 3.1% to 2.7%, but with no further drop in t

February 28, 2024

Brazil GDP Preview: Small Contraction in the Last Quarter

February 28, 2024 2:51 PM UTC

The Brazilian GDP is anticipated to have contracted by 0.1% in Q4 2023, yet the annual growth for 2023 is expected at 3.1%, marking the third consecutive year above the 3.0% threshold. Agricultural sector's significant 15% growth, primarily driven by soybean harvest, offsets the deceleration. Tight