Bank of England

View:

May 14, 2024

UK Labor Market: Further Signs of Resilient Wage Pressure But Soggier Activity More Notable

May 14, 2024 8:40 AM UTC

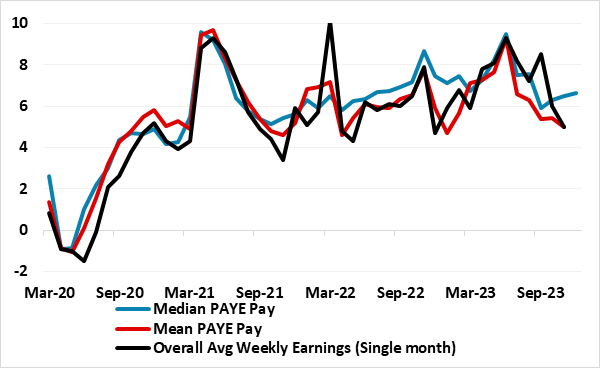

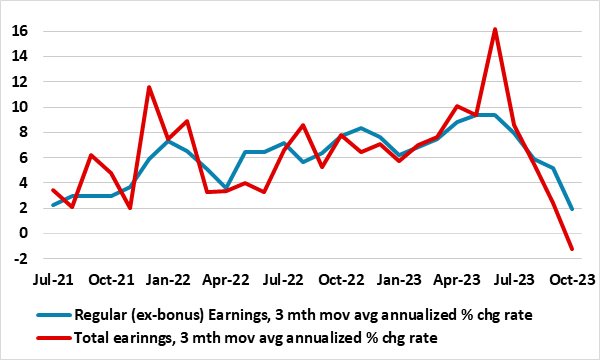

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more author

May 13, 2024

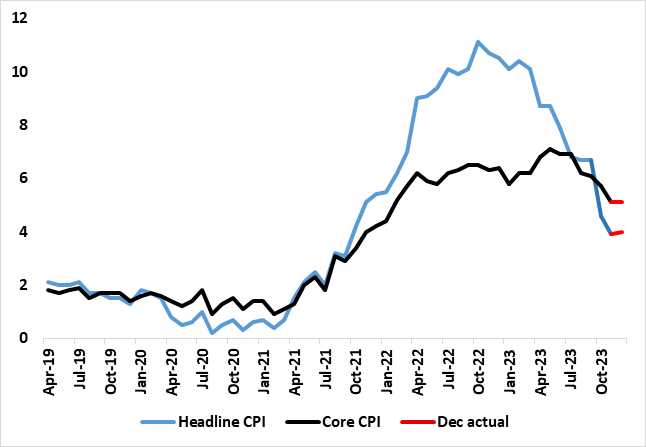

UK CPI Inflation Preview (May 22): Inflation to Fall Further and More Broadly

May 13, 2024 12:10 PM UTC

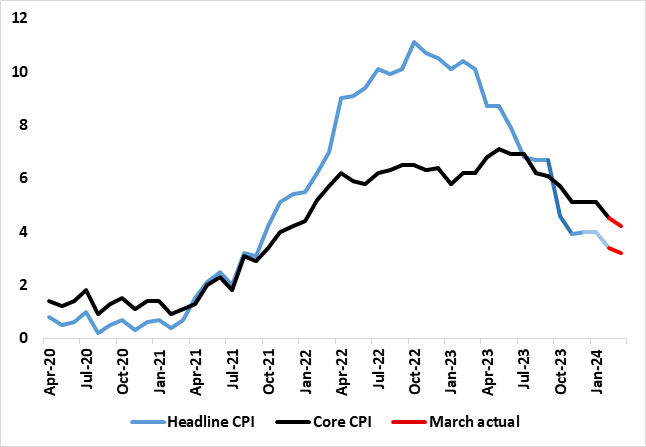

It is very clear that labor market and CPI data are crucial to BoE thinking about the timing and even existence if any start to an easing cycle. But perhaps the CPI data is the most crucial making the looming April data all the more important for markets as they weigh the chances of an initial rat

May 10, 2024

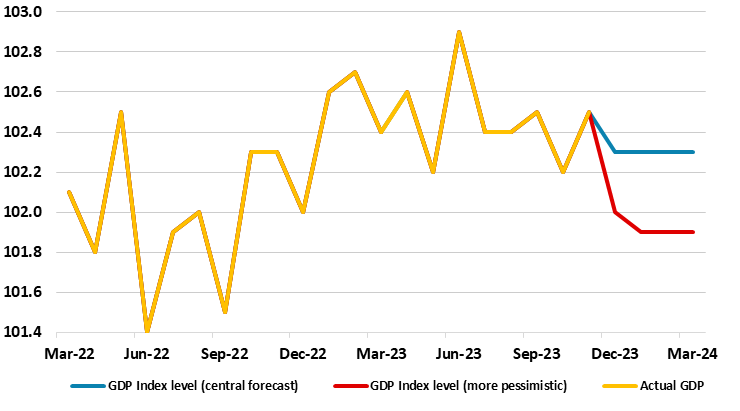

UK GDP Review: Clearer Growth Momentum But Mainly Import Led?

May 10, 2024 6:26 AM UTC

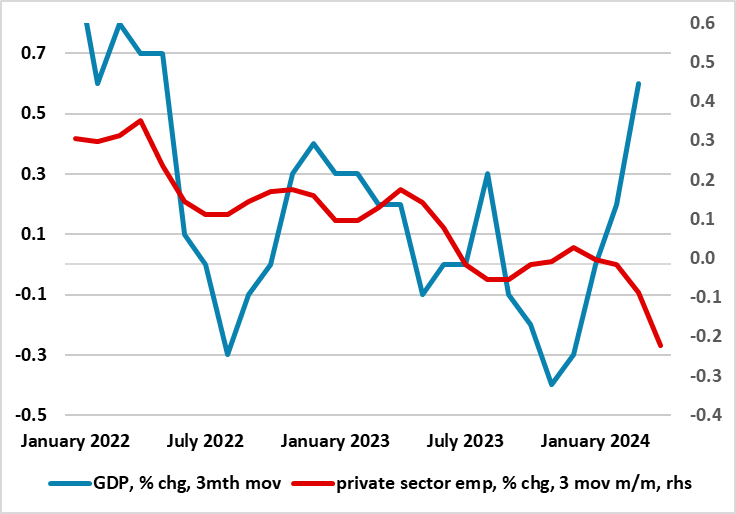

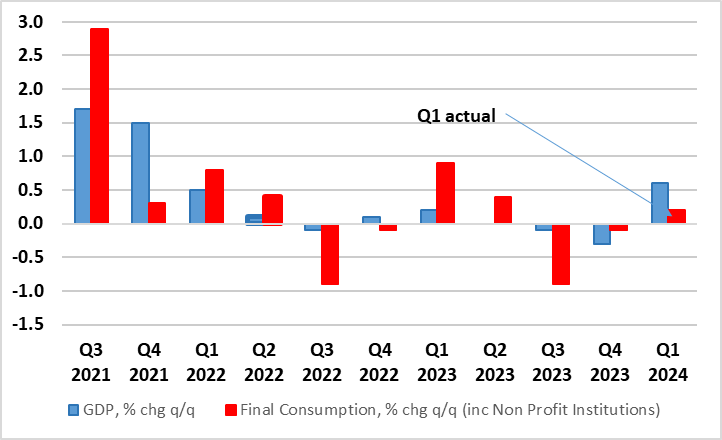

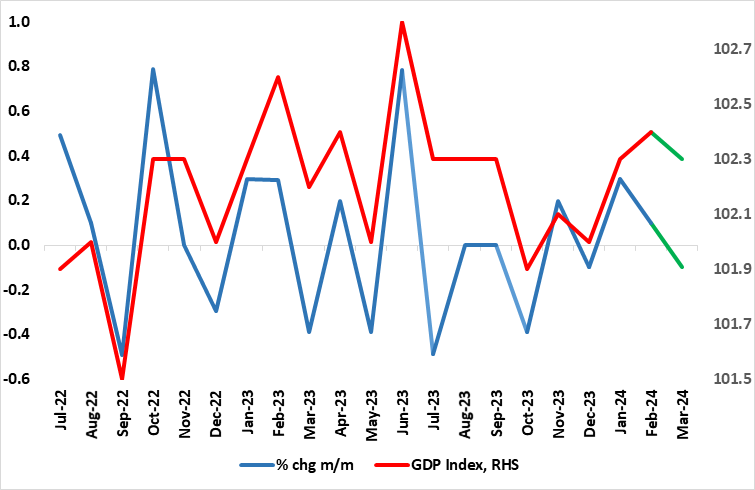

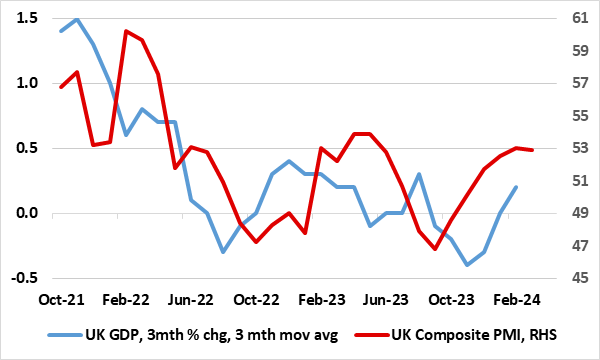

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded boun

May 09, 2024

BoE Review: Data Dependent Easing Bias Clearer?

May 9, 2024 12:52 PM UTC

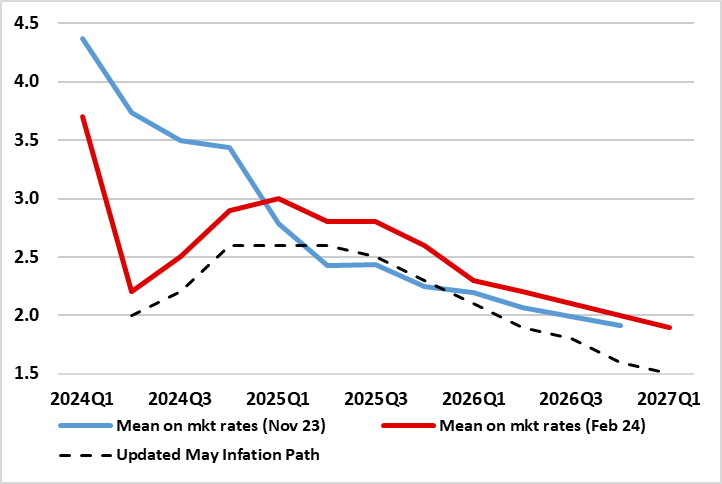

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted

May 02, 2024

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

April 30, 2024

UK GDP Preview (May 10): Fragile Sideways-Moving Activity Continues?

April 30, 2024 2:19 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

April 29, 2024

UK Consumers: Rent the Growing Hit to Spending Power

April 29, 2024 2:02 PM UTC

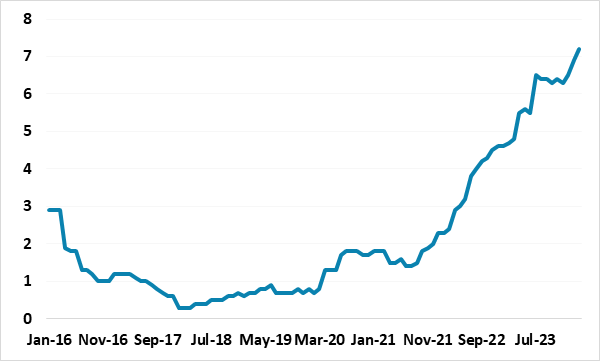

The UK has faced a series of cost-of-living shocks in the last few years. Some such as the surge in food prices may even be reversing, while it now looks likely the BoE hiking cycle may also start to reverse, although rising market rates may mean little further fall in effective mortgage rates in

April 22, 2024

Short-end European Government Bonds Following U.S. But June Decoupling

April 22, 2024 1:15 PM UTC

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a Jun

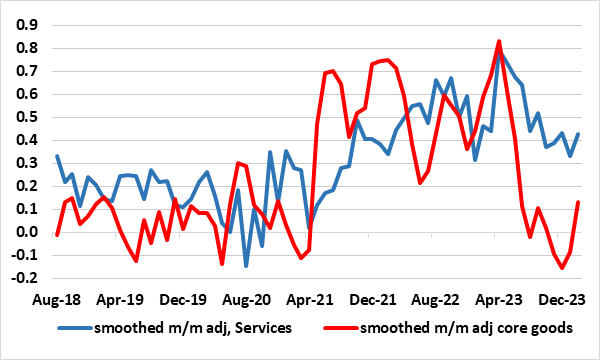

UK: Services Inflation Resilience – An Alternative Perspective?

April 22, 2024 10:03 AM UTC

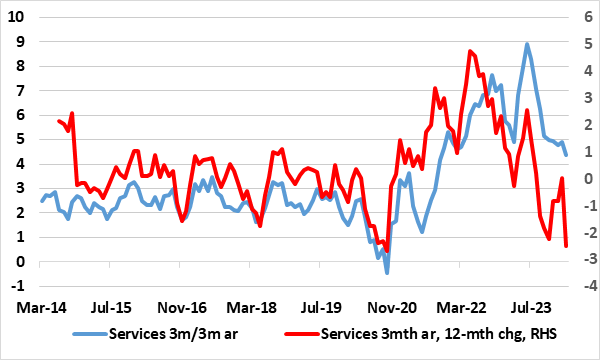

Although still with three members openly resistant to cutting Bank Rate, it does seem as if an MPC majority is nevertheless edging toward easing policy conventionally. This reflects a view among the less hawkish and more pliable MPC members that risks to persistence in domestic inflation pressures

April 17, 2024

UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

April 17, 2024 6:52 AM UTC

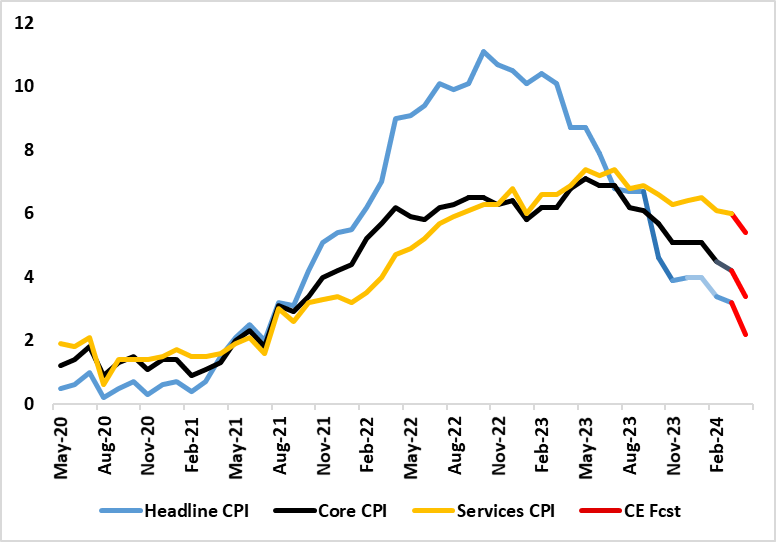

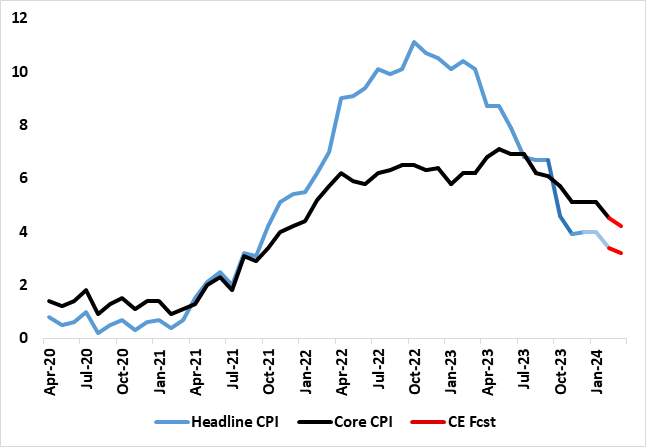

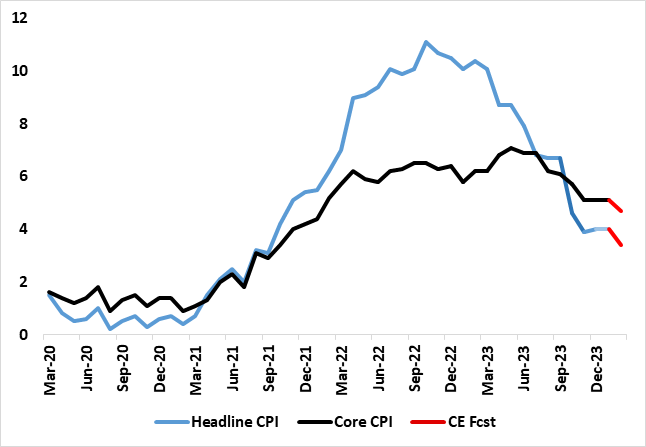

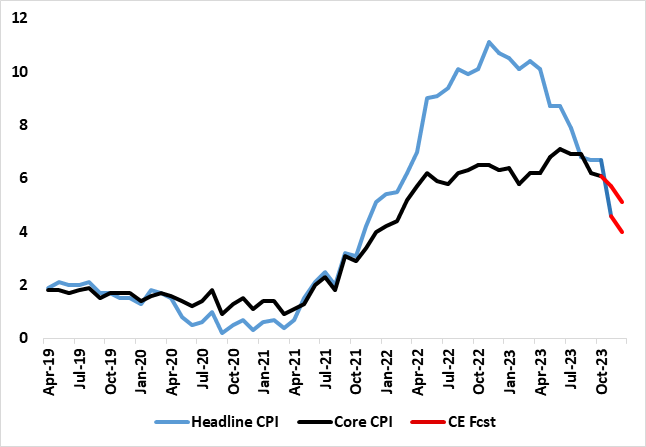

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearl

April 12, 2024

UK GDP Review: Less Fragile Recovery to Fuel BoE Hawks?

April 12, 2024 6:50 AM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

April 11, 2024

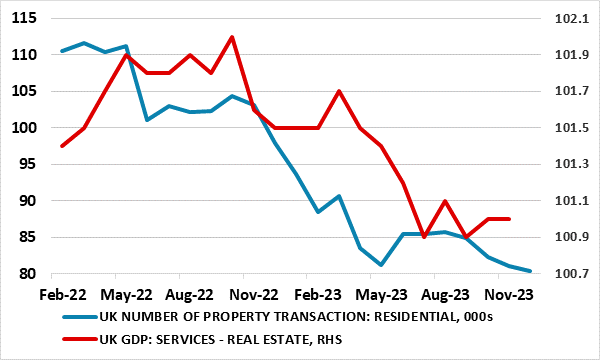

How Durable are Better UK Housing Market Signs?

April 11, 2024 9:45 AM UTC

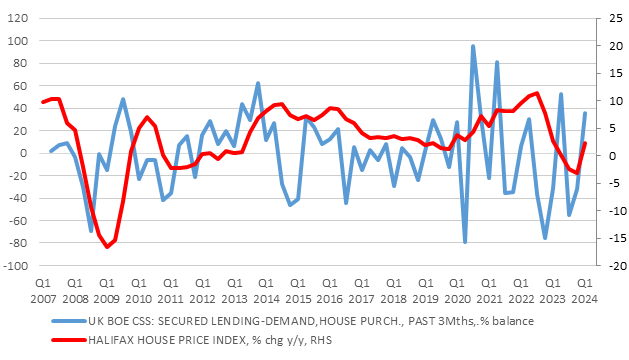

Amid some mixed remarks from one the MPC hawks, the BoE will be noting more positive housing market signs. The latest RICS survey very much points to a clear pic-up in housing demand, something that chimes with the results in the just-published BoE Credit Conditions Survey (CCS), which also sugges

April 08, 2024

UK CPI Inflation Preview (Apr 17): Inflation to Fall Broadly Further, But Momentum Still Evident

April 8, 2024 2:12 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expUK headline and core inflation have been on a clear downward trajectory in the last few mont

April 05, 2024

BoE Forecast Report: Uncertain How to Assess Uncertainty?

April 5, 2024 8:14 AM UTC

A long-awaited review of BoE forecasting techniques and goals is due on Apr 12 with a report commissioned by the BoE but authored by ex-Fed Chair Ben Bernanke. It is set to offer alternatives to the way the MPC currently produces and communicates its outlook and has been prompted by marked forecas

April 03, 2024

UK GDP Preview (Apr 12): Fragile Recovery?

April 3, 2024 1:26 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January more than reversing th

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

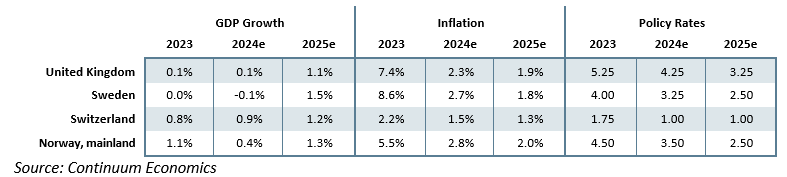

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

March 21, 2024

BoE Review: Easing Bias Continues

March 21, 2024 1:12 PM UTC

Although no shock that the BoE vote to keep policy on hold this month, there was some surprise that all hawkish dissents ended, with the one MPC member instead still again calling for a cut. But despite recent CPI underlying falls, the majority continue to focus on assessing how ‘persistent’ a

March 20, 2024

UK CPI Inflation Review: Headline and Core Fall More Broadly, But Momentum Still Evident

March 20, 2024 7:44 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%,

March 14, 2024

BoE Preview: Easing Bias to be Made Clearer?

March 14, 2024 10:23 AM UTC

It would be something of a shock if the BoE was to vote to do anything but keep policy on hold when the MPC gives its next verdict on Mar 21. More likely than not there will be no further dissents in favor of a further hike, merely one again calling for a cut. But despite recent CPI underlying f

March 13, 2024

UK GDP Review: Recovery Emerging but Fragility Persists?

March 13, 2024 7:59 AM UTC

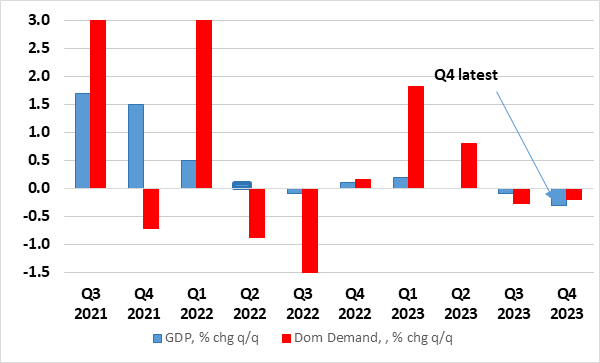

Coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January more than reversing the 0.1% drop in December data, a result that reflected the bounce in retail sales and recovery in construction. The data does look as if the economy is recovering, albeit with the pic

March 11, 2024

UK CPI Inflation Preview (Mar 20): Headline and Core to Fall More Clearly?

March 11, 2024 10:59 AM UTC

UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch to 4.0%, up from a 27-month low of 3.9%,

March 06, 2024

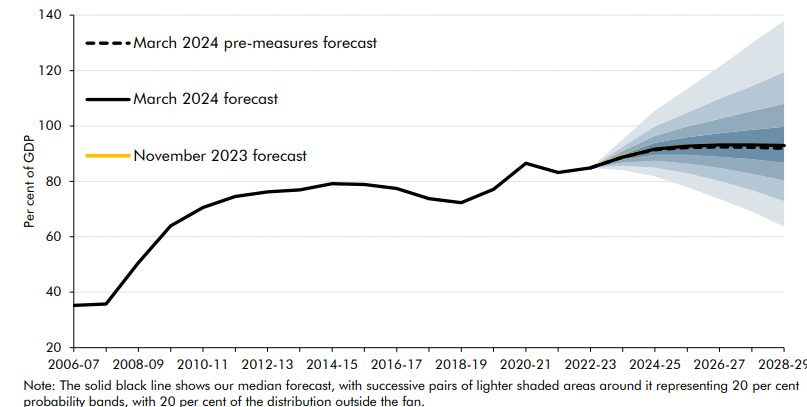

UK Budget Review: Demographics Fail to Prevent Ever Smaller Fiscal Headroom?

March 6, 2024 2:53 PM UTC

Chancellor Hunt’s Budget today was an even clearer politically driven affair. Hence the focus on offering alleged tax cuts, all framed as helping boost growth potential but where the tax as a share of GDP is forecast to rise to a post-war record 37.1% of GDP in 2028-29. The political question

March 05, 2024

UK GDP Preview (Mar 13): Fragility to Continue

March 5, 2024 11:34 AM UTC

Coming in lower than expected after taking account of downward revisions, and probably hit by industrial action, GDP shrank by 0.1% m/m in December data, a result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer spending. We see stagnation in

February 26, 2024

24 Rate Easing Reduced and 2025 the Same

February 26, 2024 11:00 AM UTC

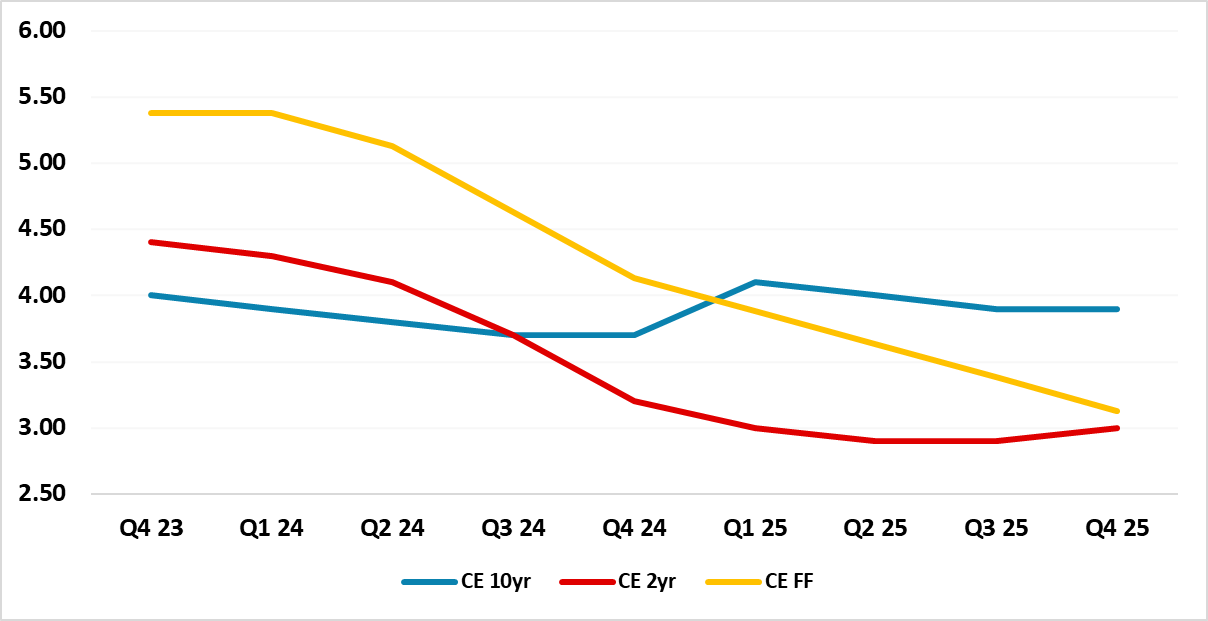

Bottom Line: 2024 official interest rate easing expectations in financial markets now look better aligned to baseline prospects from leading DM central banks due to good big picture progress towards inflation targets. The start of ECB/BOE easing in Q2 and Fed easing in Q3 will likely see markets

February 21, 2024

UK Budget Preview: Demographics to Boost Fiscal Headroom?

February 21, 2024 10:25 AM UTC

It will be no surprise that with a general election looming almost certainly later this year or so and with the government so far behind in the opinion polls, Chancellor Hunt’s Budget on Mar 6 will be yet another very politically driven affair. It should see gloomier GDP projections but with som

February 15, 2024

UK GDP Review: Recession Confirmed

February 15, 2024 7:56 AM UTC

Coming in lower than expected after taking account of downward revisions, and probably hit by industrial action, GDP shrank by 0.1% m/m in December data, a result that reflected the plunge in retail sales and abnormal weather that meant a Q4 drop in GDP and consumer sending (Figure 1). Admittedly

February 14, 2024

Markets: ECB/BOE/SNB Before the Fed?

February 14, 2024 11:35 AM UTC

Bottom Line: We do see 25bps cuts arriving from the ECB/BOE and SNB and most likely these will all be in June. Whether this is before the Fed will likely be a function of the Fed, as we see these interest rate moves as being driven by domestic fundamentals rather than the Fed being an influence.

UK CPI Inflation Review: Headline and Core Steady But Softer Underlying Pressures Evident

February 14, 2024 8:01 AM UTC

Superimposed over both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate

February 13, 2024

UK Labor Market: Further Signs of Clearly Softer Wage Pressure

February 13, 2024 8:57 AM UTC

As we have underscored repeatedly, the BoE has come to regard the official average earnings data with some suspicion; after all, they have implied wage growth being well above other official and survey sources. But even though they were higher than consensus thinking, the latest data are showing s

February 07, 2024

UK Housing – Cracks Still Evident, as Transactions Sink

February 7, 2024 2:17 PM UTC

As mortgage rates have started to fall and recent house price data show somewhat unexpected resilience if not gains, there is increasing speculation that the worst is over the for UK housing market. Regardless, with over half of mortgage holders yet to feel the hits from BoE hikes we feel this vie

February 06, 2024

UK GDP Preview (Feb 15): Recession to be Confirmed?

February 6, 2024 2:00 PM UTC

Coming in higher than expected, and probably boosted by less poor weather and a correction back in imports, GDP rose by 0.3% m/m in the November data, a result that meant that the surprise drop of the previous month was exactly reversed. We think this will have been a short-lived reprieve, with a

February 05, 2024

UK CPI Inflation Preview (Feb 14): Headline and Core to Fail to Fall Again?

February 5, 2024 2:13 PM UTC

With both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate rose a notch

February 01, 2024

BoE Review: Persistent Price Pressures or Persistent Policy Errors?

February 1, 2024 1:47 PM UTC

As was widely expected, the BoE kept policy on hold for a fourth successive meeting and abandoned its previous tightening bias. It even hinted that policy could be eased but more evidence was needed before this could happen. But clearly the BoE is uncertain, if not confused. The MPC vote was t

January 24, 2024

BoE Preview (Feb 1): Inflation Risks Shift From the Upside to More Balanced?

January 24, 2024 2:48 PM UTC

Bottom Line: As is widely expected, the BoE is likely to keep policy on hold for a fourth successive meeting when it delivers its next verdict on Feb 1. But as with other DM central banks the interest is less on what is done, but more on what is said, especially given the manner in which market inte

January 17, 2024

UK CPI Inflation Review: Headline and Core Fail to Fall?

January 17, 2024 7:53 AM UTC

Superimposed over both upside and downside surprises, UK headline and core inflation have been on a clear downward trajectory in the last few months the former having peaked above 10% in February and the latter at 7.1% In May. However, this trend surprisingly stalled in December as the headline rate

January 16, 2024

UK Labor Market: More Signs of Clearly Softer Wage Pressure

January 16, 2024 8:10 AM UTC

There are increasingly clear signs of slowing wage pressures, most discernibly in terms of the manner flagged by weaker bonus growth. The latter is something the BoE will be paying ever clearer attention to and drawing reassurance from as it assesses that signs of more persistent inflation pressures

January 12, 2024

UK GDP Review: GDP Still Moving Sideways?

January 12, 2024 7:46 AM UTC

As for the economic outlook, the backdrop is looking softer still. Recent GDP sectorial updates suggest a much weaker growth picture for Q2 and Q3 last year, meaning that the 2023 average rate may be no higher than 0.2%, less than half the now out-of-date consensus and with this downgrade threatenin

January 08, 2024

UK CPI Inflation Preview (Jan17): Headline and Core Are Adjusting?

January 8, 2024 11:58 AM UTC

Nevertheless, we note these anticipated outcomes are well below BoE projections unveiled in November, which reflects in a) the short-term; softer food and non-industrial good inflation and b) in the medium-term; less of the upgraded price risk the BoE added to its November MPR. Moreover, our estim

January 03, 2024

UK: Much Softer Wage Signs May Already be (Increasingly) Evident?

January 3, 2024 9:24 AM UTC

Figure 1: A Stark Contrast - Adjusted m/m Earnings vs y/y Data

Source: ONS, all seasonally adjusted

Assessing Persistent Price and Cost PressuresThere have been inflation signs of late to reassure the BoE. The Bank may be calmed as various alternative y/y measures of core and underlying inflation ha

January 02, 2024

2024 and 2025 DM Rate Cuts

January 2, 2024 11:34 AM UTC

Figure 1: Aggressive DM Rate Expectations Source: Bloomberg/Continuum Economics

December optimism over a Fed pivot has left financial markets starting 2024 with aggressive rate cut expectations. 150bps of cuts are now discounted by money markets from the Fed/ECB and BOE for example and then

December 15, 2023

Western Europe Outlook: Inflation Succumbing?

December 15, 2023 2:44 PM UTC

Our Forecasts

Risks to Our Views

Common Themes

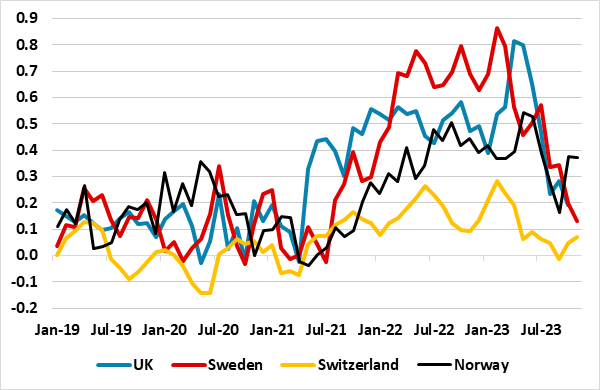

There continue to be clear cross currents across Western Europe’s economies that may continue into 2024 and possibly beyond, all inter-related. Firstly, while we have made little alteration to the 2024 outlooks for all four countries, they remain very

DM Rates Outlook: Front End Favored

December 15, 2023 10:19 AM UTC

• EZ debt yields will also see a swing back towards a positive shaped yield curve. Gradual ECB rate cuts will translate into a persistent decline in 2yr yields in 2024, but slower in 2025 as the market will be uncertain about the terminal policy rate and the ECB forward guidance will like

December 14, 2023

BoE Review: Table Mountain Still, But Descending Q2 2024

December 14, 2023 12:49 PM UTC

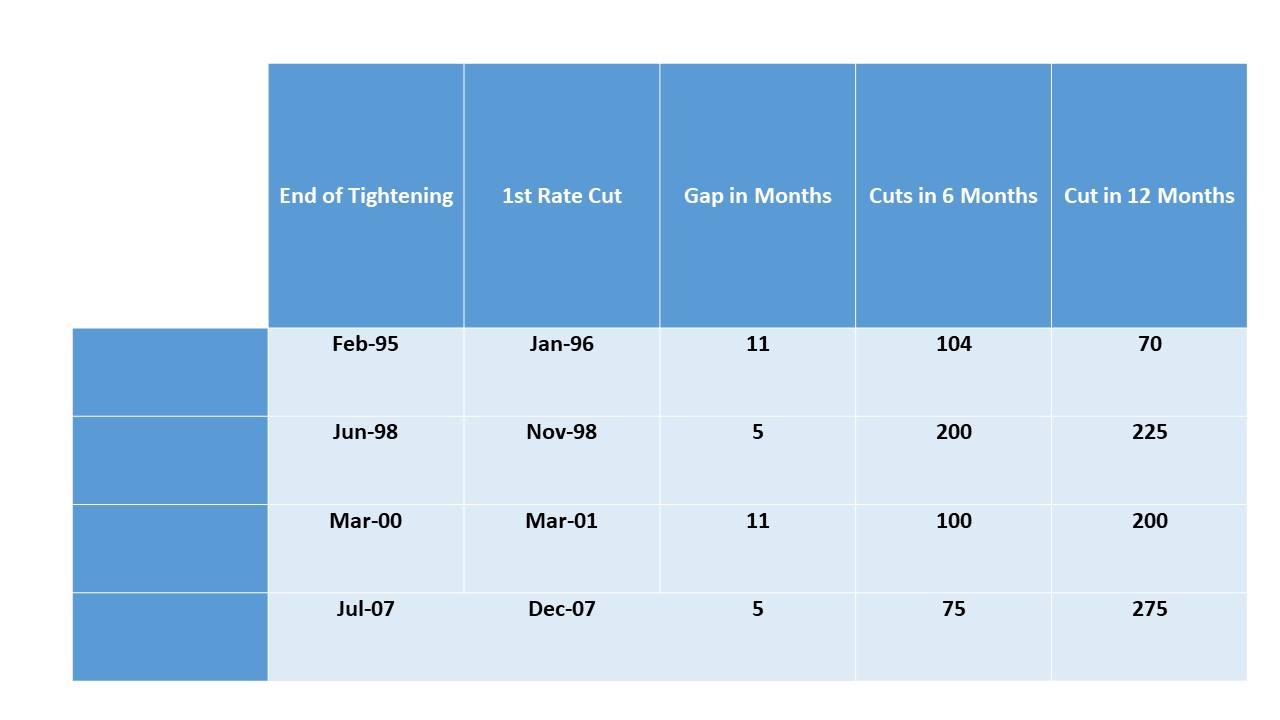

Figure 1: Previous BOE Easing CyclesSource: BOE/Continuum Economics BOE communications from the December MPC statement maintain the broad thrust that the committee foresee that policy will need to be sufficiently restrictive for sufficiently long to return inflation to the 2% target sustainably in

December 07, 2023

BoE Preview: Upside Inflation Risks Diminishing?

December 7, 2023 9:50 AM UTC

Figure 1: BoE Outlook Sees Inflation Falling Below Target

Source: BoE Monetary Policy Report

Admittedly, the BoE is already fairly gloomy with the GDP growth outlook in November having been pared by a full ppt over the forecast horizon, including a 0.5% downgrade to zero for 2024 – similar to our ow

November 15, 2023

UK CPI Inflation Review: Headline Slumps; Core Slides Further

November 15, 2023 7:27 AM UTC

Figure 1: Further Fall in in Headline and Core Inflation Beckons

Source: ONS, Continuum Economics

The government will make much of the fact that CPI inflation slowed to 4.6% y/y in October 2023, down from 6.7% in September and thus has met is goal as it has more than halved from its peak of over 11% a

November 08, 2023

Could the BOE Slow or Stop QT In An Easing Cycle

November 8, 2023 8:35 AM UTC

Figure 1: Stylised BOE Balance Sheet as QT Proceeds

Source: Bank of England

BOE QT has been operating without much disruption to UK financial markets nor impacting money or wider financial market stability, despite the BOE having a more aggressive form of QT that includes outright sale of assets. Th

November 07, 2023

BoE Bending to Market Thinking?

November 7, 2023 2:55 PM UTC

Pill stressed that with interest rates staying at their close levels in the language the MPC used last week in its statement for an extended time, is consistent with cuts from the middle of next year. This seemingly conflicts with an earlier speech from Pill in which he suggested that rates would pl

November 06, 2023

UK CPI Inflation Preview (Nov 15): Headline to Slump; Core to Slide Further?

November 6, 2023 3:30 PM UTC

Figure 1: Further Fall in in Headline and Core Inflation Beckons

Source: ONS, Continuum Economics

CPI inflation stayed at 6.7% y/y in September 2023, a little higher than expected. The largest downward contributions to the change in CPI annual rates came from food and non-alcoholic beverages, where pr

November 02, 2023

BoE Review: Risks Around the Upside Inflation Risks

November 2, 2023 1:47 PM UTC

Figure 1: BoE Inflation Outlook

Source: BoE Monetary Policy Report

A Cup Less Half Full and More Half Empty

The decision this time around was no surprise and with both the decision and the policy arguments put forward by the two ‘camps’ suggesting no major differences. Instead, there were still me