Data

View:

May 10, 2024

Preview: Due May 21 - Canada April CPI - Headline stable but BoC core rates falling

May 10, 2024 2:44 PM UTC

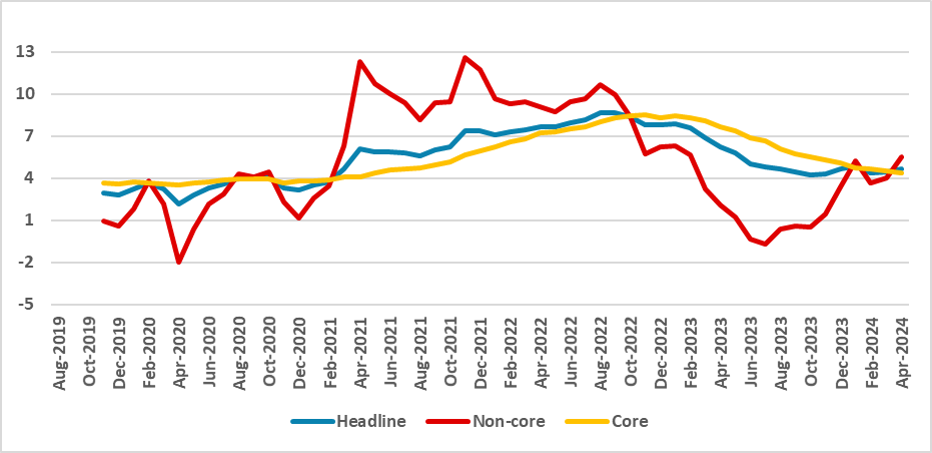

April CPI will be closely watched as the last CPI release before the June 5 Bank of Canada meeting. We expect the yr/yr pace to be unchanged from January at 2.9% which was also the pace in January before February saw a brief dip to 2.8%. However we expect continued steady downward progress in the Bo

U.S. May Michigan CSI - Lowest since November, inflation expectations highest since November

May 10, 2024 2:12 PM UTC

May’s preliminary Michigan CSI of 67.4 from 77.2 is the weakest since November 2023 and hints at a loss of momentum in the economy, but with higher inflation expectations, the 1-year view up significantly to 3.5% from 3.2% and the 5-10 year view up marginally to 3.1% from 3.0%.

Canada April Employment - Trend still solid, suggesting no urgency for BoC easing

May 10, 2024 12:58 PM UTC

Canada’s 90.4k increase in April employment is well above expectations and raises doubt over the case for a June rate cut, this being the last employment report the Bank of Canada will see before its June 5 meeting. Unemployment was unchanged at 6.1% but wage growth (hourly wage fir permanent empl

May 09, 2024

Mexico CPI Review: 0.2% Growth in April

May 9, 2024 6:11 PM UTC

April's CPI data, despite a 0.2% m/m growth, reveals a significant y/y uptick to 4.6% from March's 4.4%, challenging norms due to electricity tariff adjustments. Core CPI maintained stability with a 0.2% increase, while Core Goods CPI rose by 0.3% and Services CPI by 0.1%, accumulating a 5.2% y/y gr

May 08, 2024

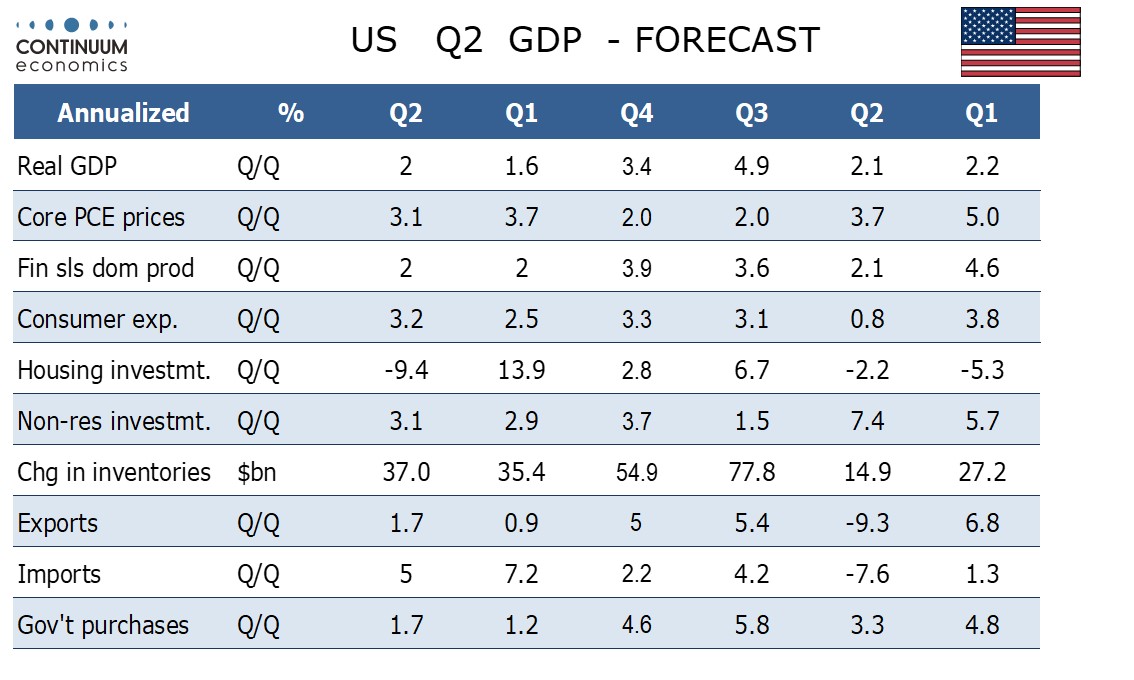

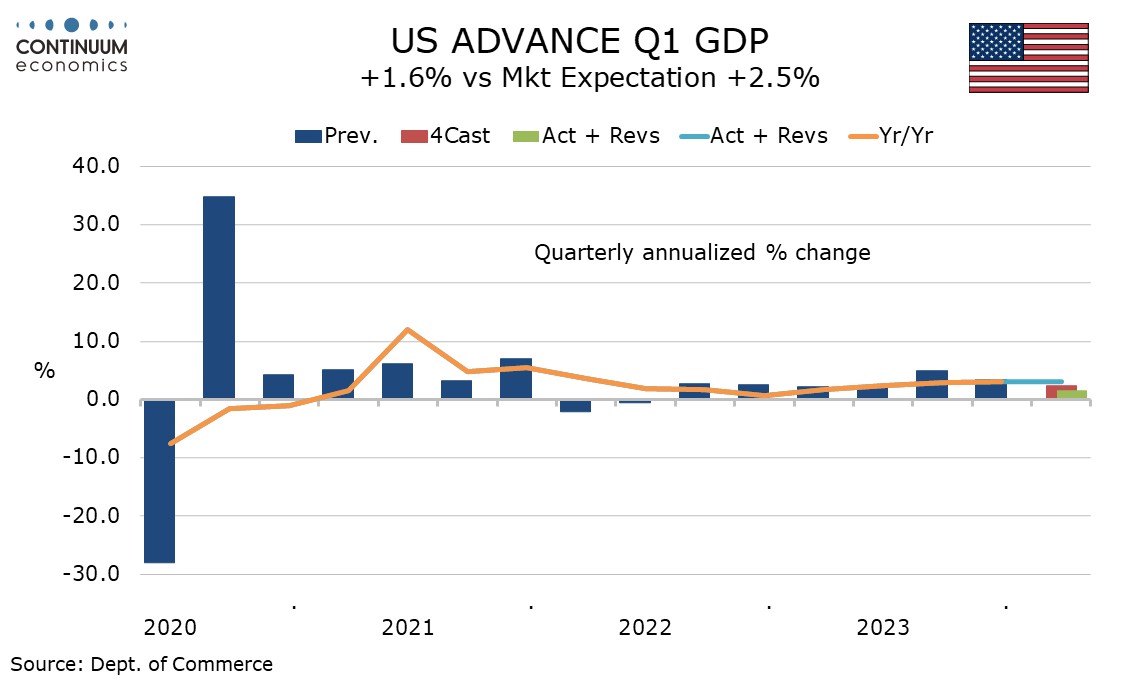

U.S. Q2 GDP to Increase by 2.0% Annualized Before Slowing In the Second Half

May 8, 2024 1:36 PM UTC

In our quarterly outlook on March 22 we looked for Q1 US GDP to rise by 2.4% annualized followed by growth of near 1.0% in the remaining three quarters. While Q1 at 1.6% came in weaker than expected details were constructive for Q2 for which we now expect a 2.0% annualized gain. We continue to expec

May 07, 2024

May 06, 2024

Preview: Due May 16 - U.S. Apr Housing Starts and Permits - Housing sector losing momentum

May 6, 2024 1:10 PM UTC

We expect April housing starts to rise by 4.5% to 1380k after a 14.7% March decline while permits fall by 1.2% to 1450k after a 3.7% March decline. This would be consistent with the housing sector losing some momentum entering Q2 in response to rising mortgage rates in Q1.

May 03, 2024

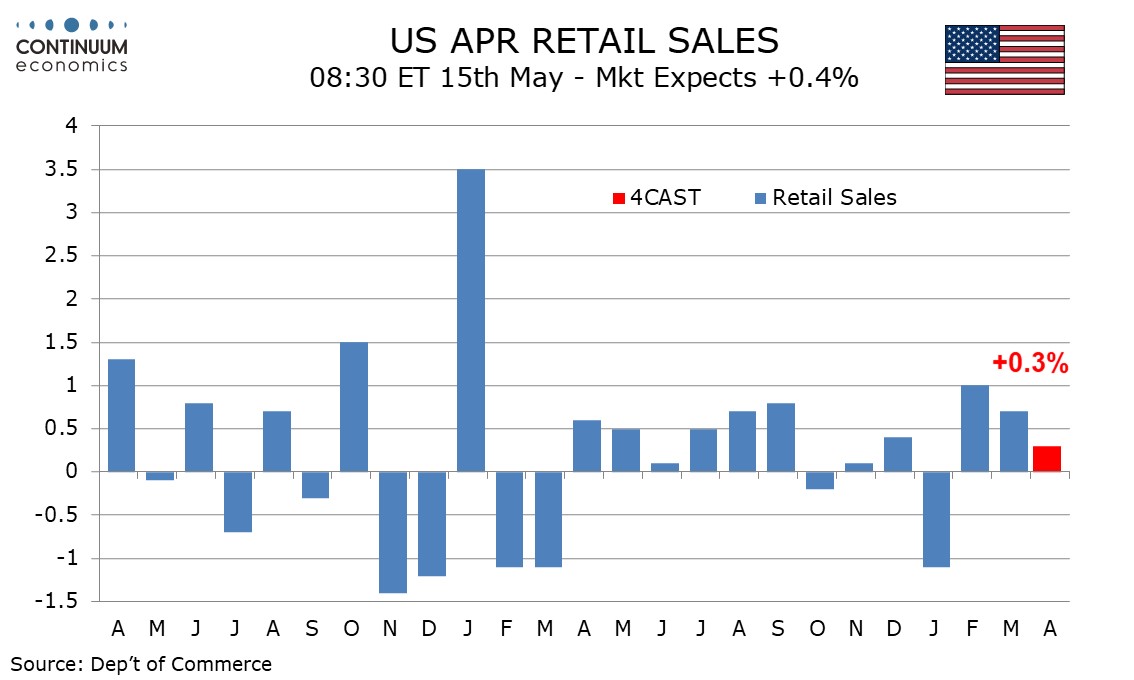

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 3, 2024 5:00 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

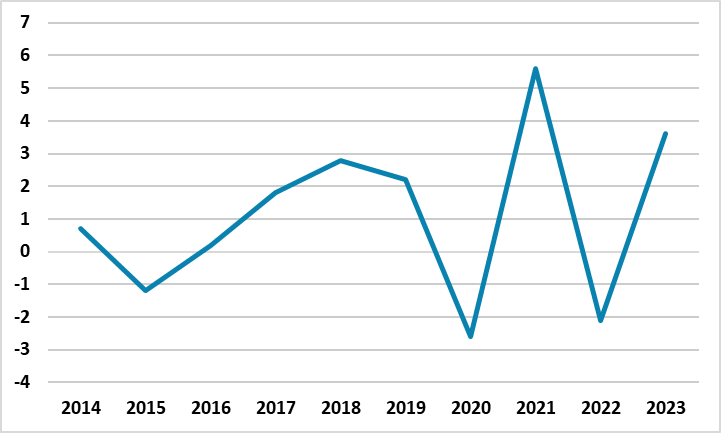

Russian Economy Expands by 4.2% YoY in March, and 5.4% in Q1

May 3, 2024 2:14 PM UTC

Bottom Line: According to the figures announced by the Russian Ministry of Economic Development, Russia's GDP grew by 4.2% YoY in March owing to strong fiscal stimulus, high military spending, invigorating consumer demand and investments. We now foresee Russian economy will expand by 2.6% in 2024

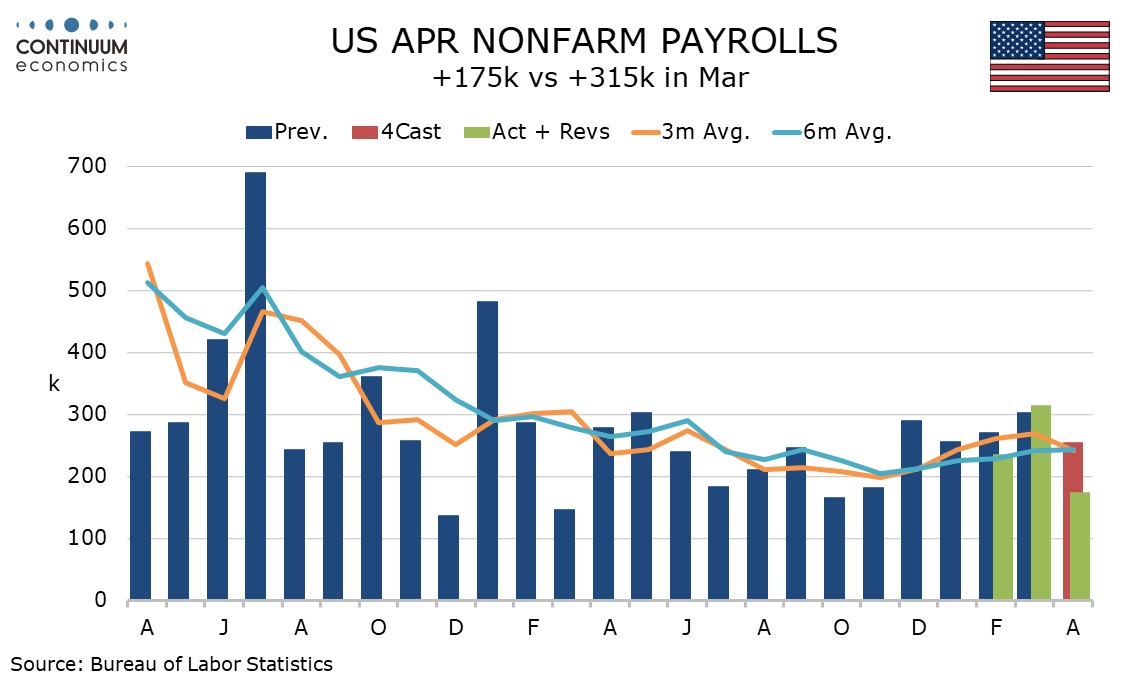

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

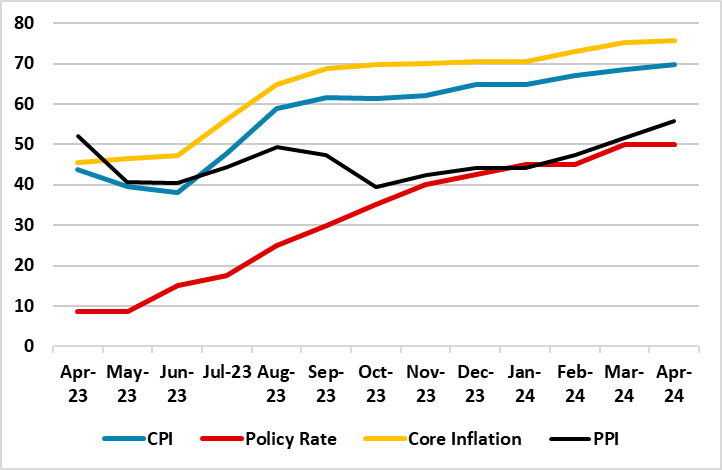

Turkiye’s Inflation Continues to Jump in April with 69.8%

May 3, 2024 7:40 AM UTC

Bottom Line: Turkish Statistical Institute (TUIK) announced on May 3 that Turkish CPI ticked up 69.8% annually and 3.2% monthly in April due to increases in transportation, restaurant & hotel and education prices, coupled with the lingering impacts of the wage hikes on the services sector. We feel u

May 02, 2024

Preview: Due May 3 - U.S. April ISM Services - A correction after two straight slowings

May 2, 2024 2:14 PM UTC

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion.

U.S. March trade balance little changed, Canada's moves into deficit

May 2, 2024 1:33 PM UTC

March’s US trade deficit of $69.4bn was marginally down from $69.5bn in February as a deterioration on the goods deficit was offset by a correction higher in the services surplus. Canada’s trade data was more surprising, a C$2.23bn deficit, and the largest deficit since June 2023.

May 01, 2024

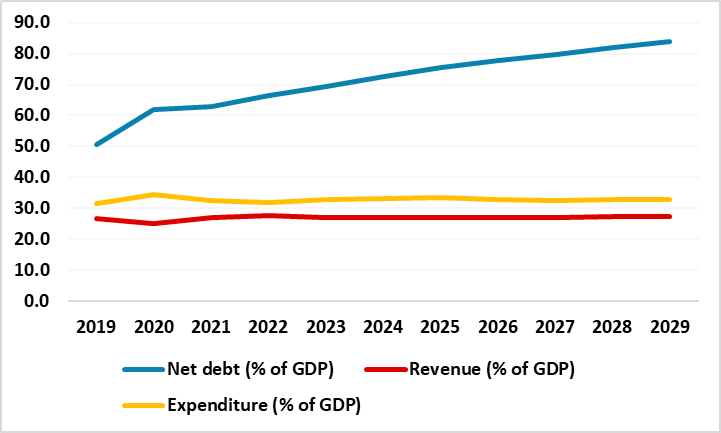

South Africa’s Fiscal Outlook Under Spotlights as the Elections Are Approaching

May 1, 2024 6:45 PM UTC

Bottom line: South Africa policy makers remain concerned about government debt trajectory, large domestic and international financing needs and elevated country risk premium before fast-approaching elections on May 29. We think South Africa’s general government fiscal balance and debt trajectory w

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

May 1, 2024 12:59 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

U.S. April ADP Employment - Trend looking stronger, payroll implications unclear

May 1, 2024 12:39 PM UTC

ADP’s April estimate for private sector employment growth of 192k is on the high side of expectations though not quite as strong as the revised March gain of 208k (revised from 184k). ADP trend has picked up in the last three months but this may be catch up with strength in non-farm payrolls.

April 30, 2024

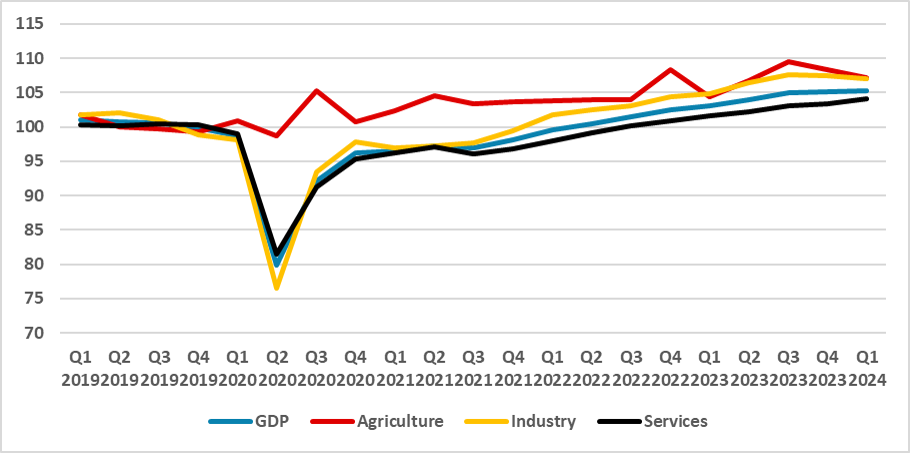

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service

U.S. April Consumer Confidence - Labor markets seen as less strong

April 30, 2024 2:23 PM UTC

April consumer confidence with a fall to 97.0 from 103.1 is weaker than expected and the lowest since July 2022. The easiest explanation for this is rising bond yields and fading expectations for rate cuts, though there are hints that the labor market is losing momentum too.

Canada February GDP - Q1 looking less positive than previously projected

April 30, 2024 1:20 PM UTC

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1.

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

April 30, 2024 12:10 PM UTC

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.

April 29, 2024

Preview: Due May 14 - U.S. April PPI - New Year strength fading

April 29, 2024 6:08 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

Preview: Due April 30 - Canada February GDP - Another rise, but a slower one

April 29, 2024 12:20 PM UTC

We expect Canadian GDP to increase by 0.3% in February, slightly below a 0.4% estimate that was made with January’s report, where a strong 0.6% monthly increase was seen, flattered by the end of public sector strikes. We expect preliminary indications for March to be near flat.

Preview: Due April 30 - U.S. Q1 Employment Cost Index - Trend slowing, but still quite firm

April 29, 2024 12:12 PM UTC

We look for the Q1 employment cost index (ECI) to increase by 0.9%, matching the Q4 increase that was the slowest since Q1 2021. Yr/yr growth will continue to slow, to 3.9% from 4.2%, reaching its slowest since Q3 2021, but will remain well above the pre-pandemic trend.

Indonesia: MPC Review: Bank Indonesia Surprises With A Rate Hike

April 29, 2024 11:26 AM UTC

In a pre-emptive move to both curb inflationary pressures and safeguard the Indonesia Rupiah (IDR) against furhter depreciation, Bank Indonesia, in a surprise move, increased its main policy rate by 25 bps to 6.25%. However, further rate hikes are not expected as the central bank remains wary of hur

April 26, 2024

U.S. March Trimmed Mean PCE Price Index Slower at 2.9% Annualized

April 26, 2024 3:32 PM UTC

While March’s 0.3% Core PCE Price Index was a little firmer before rounding, and stronger than February data that was rounded up to 0.3%, the Dallas Fed’s Trimmed Mean PCE Price Index slowed to a 2.9% annualized pace from 3.4% in February.

April 25, 2024

Preview: Due May 2 - U.S. March Trade Balance - Deficit to increase on weaker goods exports

April 25, 2024 4:57 PM UTC

We expect March’s trade deficit to see a marginal increase to $69.2bn from $68.9bn, with a 2.0% decline in exports and a 1.5% decline in imports. This would be the fourth straight increase in the deficit to its highest level since April 2023.

Preview: Due April 26 - U.S. March Personal Income and Spending - Upside risk in Core PCE prices given Q1 outcome

April 25, 2024 3:41 PM UTC

March personal income and spending data will be largely old news as we have already seen Q1 totals in the GDP report. The GDP details are consistent with gains of 0.6% in personal income, 0.8% in personal spending and 0.4% in core PCE prices, all 0.1% above our pre-GDP forecasts of 0.5%, 0.7% and 0.

U.S. March Pending Home Sales bounce follows sharp February rise in Existing Home Sales

April 25, 2024 2:14 PM UTC

March has seen a stronger than expected 3.4% increase in pending home sales. Normally pending home sales lead existing home sales but in this case we appear to be seeing a catch up with strength in February existing home sales.

Q1 U.S. GDP Slows on Imports and Inventories, Core PCE Prices Stronger on the Quarter

April 25, 2024 1:14 PM UTC

Q4 GDP has come in weaker than expected at 1.6% annualized but with a stronger than expected 3.7% annualized increase in the core PCE price index. Weaker inventories and stronger imports are the main reason for the GDP slowing so the data is not a clear signal of underlying weakness. Lower initial (

April 24, 2024

Preview: Due April 30 - Canada February GDP - Another rise, but a slower one

April 24, 2024 3:07 PM UTC

We expect Canadian GDP to increase by 0.3% in February, slightly below a 0.4% estimate that was made with January’s report, where a strong 0.6% monthly increase was seen, flattered by the end of public sector strikes. We expect preliminary indications for March to be near flat.

Preview: Due April 25 - U.S. March Advance Goods Trade Balance - Exports, imports and deficit to increase

April 24, 2024 1:14 PM UTC

We expect March’s advance goods trade deficit to rise to $91.2bn from $90.3bn, reaching an 11-month high. We expect exports and imports to both increase by 1.0%, though imports would then see the larger increase in USD terms.

U.S. March Durable Goods Orders - Underlying trend still near flat

April 24, 2024 12:51 PM UTC

March durable goods orders are in line with expectations with a 2.6% increase overall, 0.2% ex transport, keeping trend near flat, with non-defense capital ex aircraft seeing similarly modest 0.2% increases in both orders and shipments.

April 23, 2024

Preview: Due May 3 - U.S. April ISM Services - A correction after two straight slowings

April 23, 2024 5:36 PM UTC

We expect April’s ISM services index to see a modest increase to 52.0 from 51.6, pausing after two straight declines, leaving the index with no clear trend, and continuing to imply modest expansion.

U.S. March New Home Sales - Gain may not be sustained in Q2

April 23, 2024 2:16 PM UTC

March new home sales at 693k are stronger than expected, up 8.8% from a downwardly revised February to their highest level since September, though still moving in quite a narrow range with Q2 sales vulnerable to higher mortgage rates.