View:

August 29, 2025

Preview: Due September 16 - Canada August CPI - Higher as year ago weakness drops out

August 29, 2025 7:15 PM UTC

Weakness a year ago is likely to see August Canadian CPI picking up on a yr/yr basis, we expect to 2.0% from 1.7%. The Bank of Canada’s core rates are likely to remain fairly stable, and above the 2.0% target.

Preview: Due September 4 - U.S. July Trade Balance - Deficit to rise as imports from China rebound

August 29, 2025 4:24 PM UTC

We expect a July goods trade deficit of $79.2bn, up from $60.2bn in June. The deficit will compare to a Q2 average of $64.0bn but remain well below Q1’s pre-tariff average of $130.2bn. It will be similar to where trend was before the November election result signaled higher tariffs were coming.

Preview: Due September 2 - U.S. August ISM Manufacturing - Back to neutral with firmer prices

August 29, 2025 1:52 PM UTC

We expect August’s ISM manufacturing index to rise to a neutral 50.0 more than fully reversing a dip to 48.0 in July from 49.0 in June. This would be the strongest reading since January and February edged above neutral for the first time since October 2022.

August 28, 2025

Preview: Due September 10 - U.S. August PPI - A moderate gain after a surge in July

August 28, 2025 6:13 PM UTC

We expect August PPI to rise by 0.3% overall and 0.2% ex food and energy, moderate gains after shocking surges of 0.9% in each series in July, which broke a string of mostly subdued outcomes from February through June. Ex food, energy and trade, we expect a 0.3% increase to follow a 0.6% rise in Jul

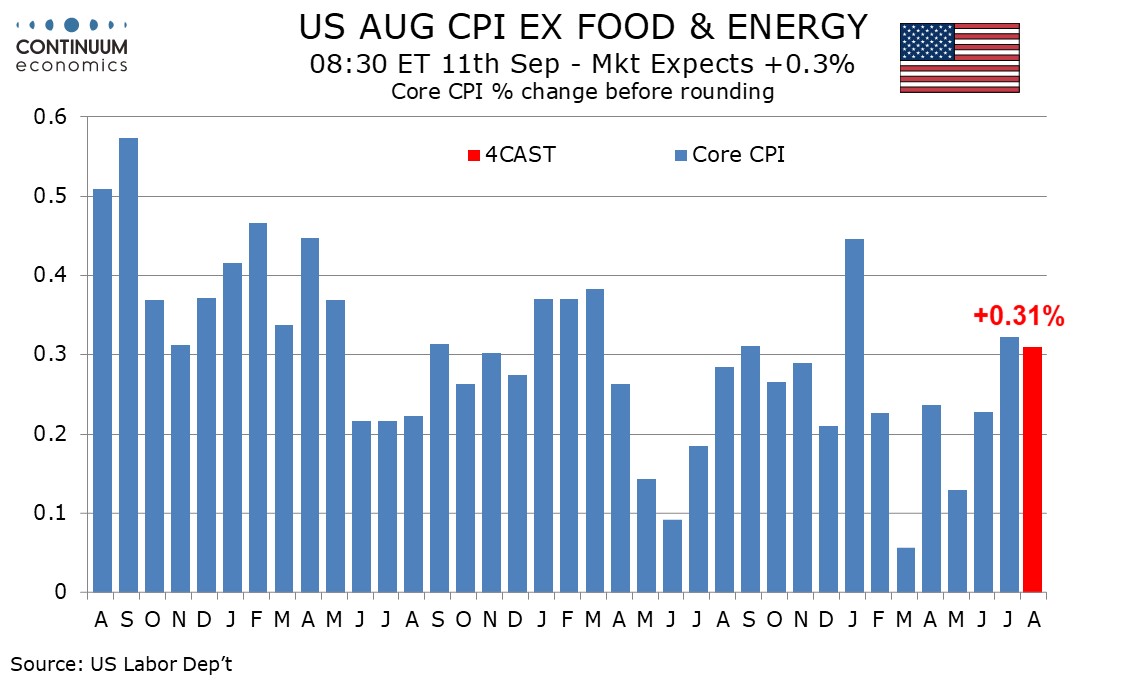

Preview: Due September 11 - U.S. August CPI - Tariff impact slowly building

August 28, 2025 5:19 PM UTC

We expect August CPI to increase by 0.4% overall and by 0.3% ex food and energy, with the respective gains before rounding being 0.37% and 0.31%. This would be the second straight gains slightly above 0.3% in the core rate with the impact of tariffs starting to escalate.

Preview: Due August 29 - Canada Q2/June GDP - Exports plunge to send GDP lower

August 28, 2025 2:17 PM UTC

We expect Q2 Canadian GDP to fall by 1.0% annualized after five straight gains marginally above 2.0%. This would be slightly stronger than a Bank of Canada forecast of -1.5% but weaker than what monthly GDP data is likely to imply for the quarter, with June seen rising by 0.1%.

Preview: Due August 29 - U.S. July Advance Goods Trade Balance - Deficit to rise as imports from China rebound

August 28, 2025 1:50 PM UTC

We expect an advance July goods trade deficit of $99.8bn, up from $84.9bn in June but still closer to the Q2 average of $89.0bn than the Q1 average of $155.0bn when imports surged ahead of tariffs.

Preview: Due August 29 - U.S. July Personal Income and Spending - Core PCE Prices to match Core CPI

August 28, 2025 1:35 PM UTC

We expect PCE price data to match the July CPI, with a 0.3% rise in the core rate and a 0.2% increase overall. We expect both personal income and spending to rise by 0.5%, ahead of prices.

August 27, 2025

Preview: Due September 4 - U.S. August ADP Employment - Slower than July which corrected a June decline

August 27, 2025 3:39 PM UTC

We expect a rise of 60k in August’s ADP estimate for private sector employment growth. This would be a slowing from 104k in July which outperformed the non-farm payroll, with July’s improved data looking in part corrective from a 23k decline in June.

South Africa GDP Growth Preview: Moderate Growth Will Resume in Q2

August 27, 2025 3:22 PM UTC

Bottom line: Department of Statistics of South Africa (Stats SA) will announce Q2 GDP growth on September 3, and we expect that South African economy will likely grow by around 1.0%-1.2% YoY in Q2 2025. We think that the growth momentum will continue to be supported by low inflation and interest rat

Preview: Due August 28 - U.S. Preliminary (Second) Estimate Q2 GDP - Upward revision on retail and construction

August 27, 2025 2:33 PM UTC

We expect the second (preliminary) estimate of Q2 GDP to be revised up to 3.2% from the first (advance) estimate of 3.0%. The rise should be seen alongside a 0.5% decline in Q1 given recent extreme volatility in net exports.

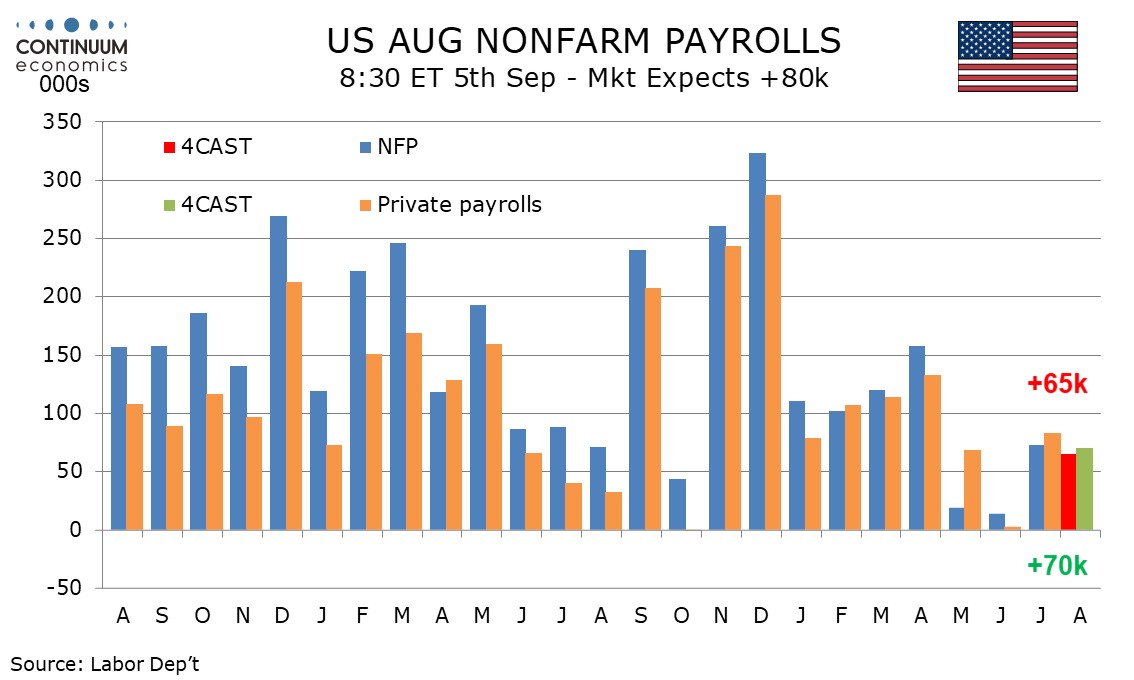

Preview: Due September 5 - U.S. August Employment (Non-Farm Payrolls) - Similar to July's, still not recessionary

August 27, 2025 2:20 PM UTC

We expect August’s non-farm payroll to look similar to July’s, with a rise of 65k versus 73k in July, above the 14k rise of June and the 19k rise of May but well below the trend that was running above 100k through April. We also expect unemployment to remain at July’s 4.2% rate and a second st

August 26, 2025

Turkiye GDP Growth Preview: Slowdown Will Continue in Q2

August 26, 2025 5:14 PM UTC

Bottom Line: Turkish Statistical Institute (TUIK) will announce Q2 GDP growth on September 1 and we expect that Turkish economy will expand around 1.7% -2.0% YoY backed by private consumption despite early indicators demonstrate a lower acceleration rate in domestic demand amid tightening financial

Preview: Due September 2 - U.S. August ISM Manufacturing - Back to neutral with firmer prices

August 26, 2025 4:59 PM UTC

We expect August’s ISM manufacturing index to rise to a neutral 50.0 more than fully reversing a dip to 48.0 in July from 49.0 in June. This would be the strongest reading since January and February edged above neutral for the first time since October 2022.

August 25, 2025

Preview: Due August 26 - U.S. July Durable Goods Orders - Aircraft to return to normal, trend marginally positive

August 25, 2025 12:33 PM UTC

We expect July durable goods orders to fall by 4.5%, extending a 9.4% decline in June, but still not quite fully reversing a 16.5% surge in May. Aircraft will continue to lead the moves. Ex transport we expect a 0.1% increase, in line with a trend that is now marginally positive.

August 22, 2025

Preview: Due August 25 - U.S. July New Home Sales - Increased weakness

August 22, 2025 1:24 PM UTC

We expect a July new home sales level of 615k, which would be a 1.9% decline if June’s 0.6% increase to 627k is unrevised. The level would be the lowest since November 2023. We may be near a base but significant gains in new home sales are likely to require the start of Fed easing.

August 20, 2025

Preview: Due August 21 - U.S. July Existing Home Sales - Maintaining a slowly declining trend

August 20, 2025 2:25 PM UTC

We expect July existing home sales to maintain a modestly negative trend with a 0.8% decline to 3.90m. which would be the lowest level since a matching September of 2024. Trends in the housing sector are modestly negative and probably need Fed easing to find a base.

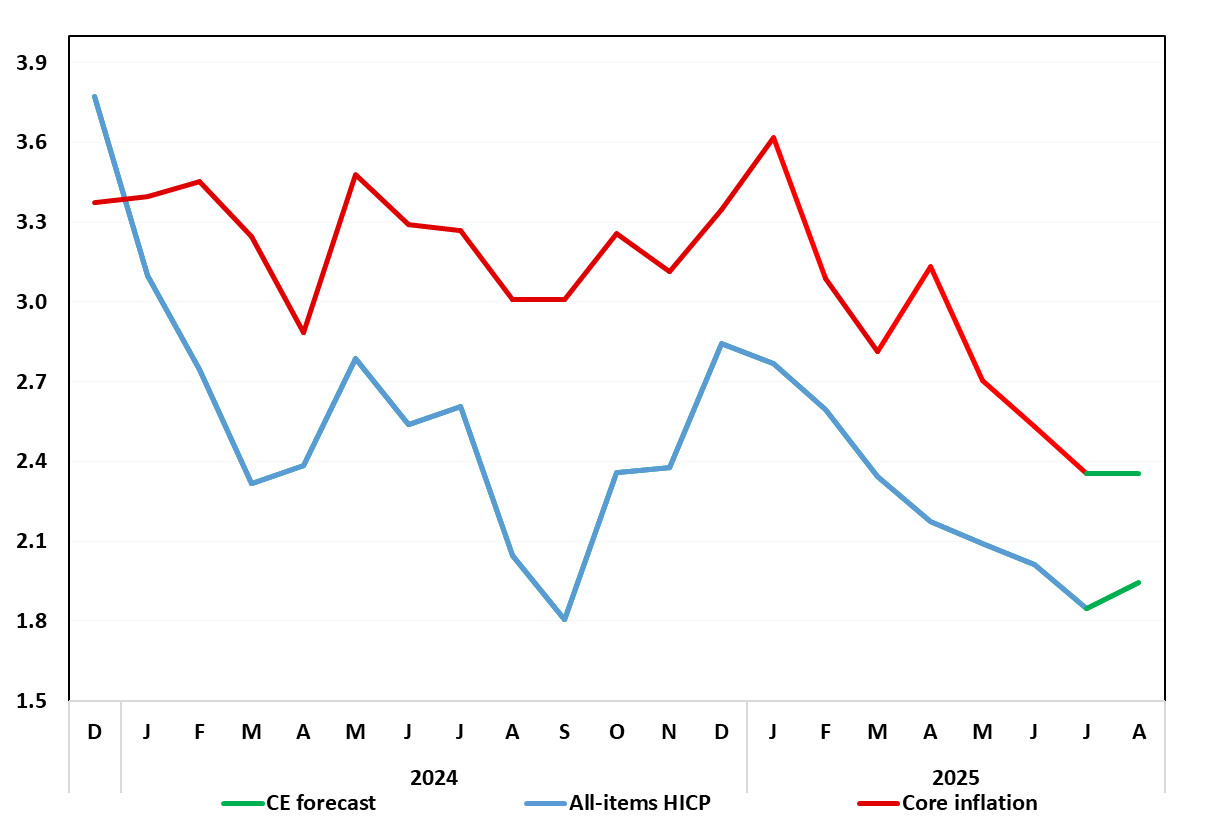

German Data Preview (Aug 29): Base Effects to Pull Headline Back Up - Temporarily?

August 20, 2025 1:39 PM UTC

Germany’s disinflation process continued, with the lower-than-expected July HICP numbers refreshing and reinforcing this pattern, with a 0.2 ppt drop to 1.8% y/y, a 10-mth low (Figure 1). This occurred in spite of adverse energy base effects albeit these likely to feature even more strongly in t

August 18, 2025

Preview: Due August 19 - U.S. July Housing Starts and Permits - Negative underlying trend

August 18, 2025 2:05 PM UTC

We expect July housing starts to fall by 4.6% to 1260k, reversing a similar rise in June which corrected a 9.7% decline in May. We expect permits to confirm a slipping trend with a fourth straight decline, by 3.1% to 1350k. A soft trend is likely to persist unless Fed easing commences.

Preview: Due August 19 - Canada July CPI - Lower on gasoline but core rates to remain firm

August 18, 2025 1:46 PM UTC

We expect July Canadian CPI to fall to 1.6% yr/yr from 1.9%, taking the pace to the slowest since September 2024, though April’s abolition of the carbon tariff is still depressing yr/yr growth by around 0.6%. July’s dip will be largely on gasoline and we expect little change in the BoC’s core

August 15, 2025

Preview: Due August 29 - U.S. July Advance Goods Trade Balance - Deficit to rise as imports from China rebound

August 15, 2025 3:27 PM UTC

We expect an advance July goods trade deficit of $99.8bn, up from $84.9bn in June but still closer to the Q2 average of $89.0bn than the Q1 average of $155.0bn when imports surged ahead of tariffs.

Preview: Due August 28 - U.S. Preliminary (Second) Estimate Q2 GDP - Upward revision on retail and construction

August 15, 2025 2:59 PM UTC

We expect the second (preliminary) estimate of Q2 GDP to be revised up to 3.2% from the first (advance) estimate of 3.0%. The rise should be seen alongside a 0.5% decline in Q1 given recent extreme volatility in net exports.