View:

February 02, 2026

U.S. January ISM Manufacturing - Broad based improvement

February 2, 2026 3:18 PM UTC

January’s ISM manufacturing index of 52.6 is up significantly from 47.9 in December and the highest since August 2022. While caution should be seen on one month’s data, the improvement is broad based and backed by several reginal surveys.

USD flows: Shutdown politics and economic data

February 2, 2026 1:39 PM UTC

The US government is now in a partial shutdown which is expected to be resolved fairly soon, but probably only for two weeks. The December JOLTS report on labor turnover due on Tuesday February 3 may be delayed, but initial claims on Thursday February 5 and the key January non-farm payroll on Friday

EZ HICP Preview (Feb 4): Services Inflation Less Resilient as Headline to Slip Further

February 2, 2026 12:07 PM UTC

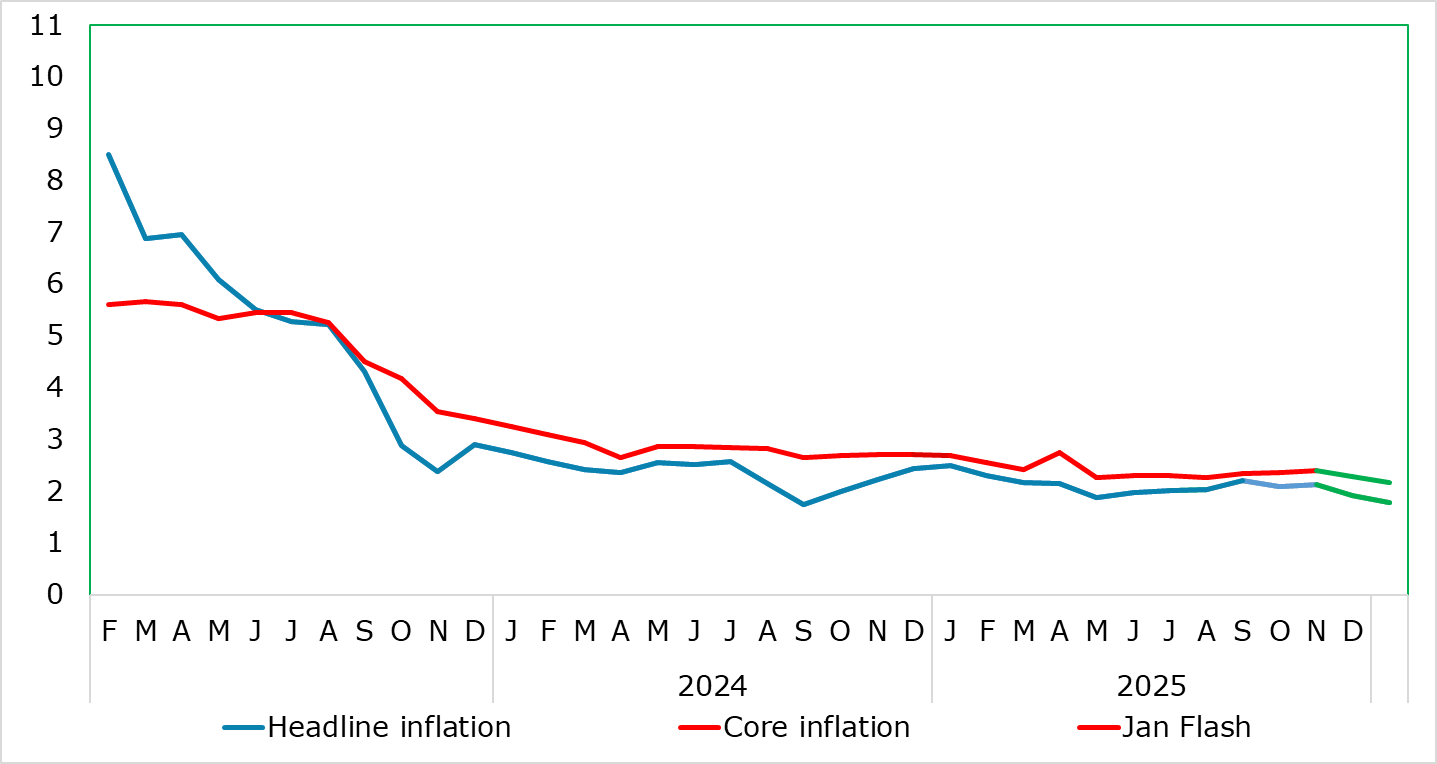

HICP inflation had been range bound for some 5-6 months between 2.0% and 2.2% with the November and October numbers in the middle of that range. And it seemingly stayed in that range falling to 2.0% in the December flash numbers, only to be revised down a further notch to 1.9% in the final HICP figu

Markets: Profit-Taking or More?

February 2, 2026 9:22 AM UTC

• For now we see some further profit-taking on risky positions in gold/silver/copper/equities and short USD positions. However, a bigger macro catalyst is required to produce a deep correction in equities and major risk off. The nomination of Kevin Warsh for Fed chair is unlikely to be