Federal Reserve

View:

May 10, 2024

May 06, 2024

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

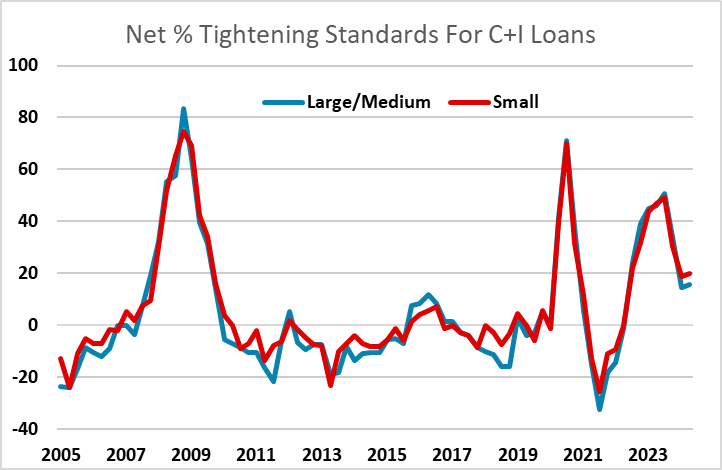

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

May 01, 2024

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

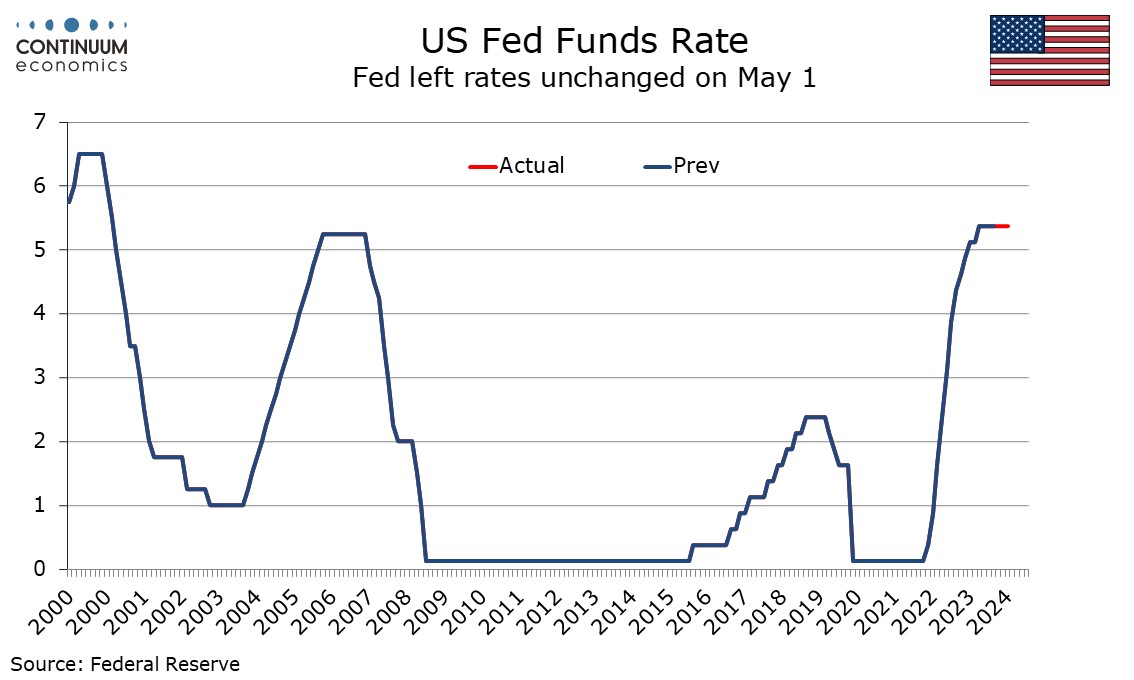

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

April 25, 2024

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

April 22, 2024

Short-end European Government Bonds Following U.S. But June Decoupling

April 22, 2024 1:15 PM UTC

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a Jun

April 19, 2024

April 18, 2024

April 17, 2024

April 16, 2024

April 12, 2024

April 11, 2024

April 10, 2024

Tone of FOMC Minutes From March 20 is Not Hawkish

April 10, 2024 6:54 PM UTC

FOMC minutes from March show little sign of disagreement and the tone is not hawkish, with participants expecting both inflation and the economy to slow, and there being a clear majority view that the pace of balance sheet reduction should soon be trimmed. Optimism on inflation is however cautious

April 05, 2024

April 04, 2024

Could FOMC Minutes From March 20 Appear More Hawkish Than Powell?

April 4, 2024 6:55 PM UTC

FOMC minutes from March 20 are due on April 10. Powell’s press conference at that meeting and his subsequent comments have been relatively dovish, downplaying recent strong data though he has also sounded in no hurry to ease. The minutes may show a significant minority expressing greater concern

April 03, 2024

April 02, 2024

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

March 29, 2024

March 27, 2024

March 26, 2024

EM FX Outlook: Domestic Drivers Key

March 26, 2024 9:01 AM UTC

In terms of spot EM FX projections domestic drivers remain critical, with a desire to avoid appreciation versus the USD for some countries. Fed easing in H2 2024 should however help EMFX more broadly and allow some recovery in spot rates (e.g. Indonesian Rupiah (IDR), South African Rand (ZAR)

March 22, 2024

March 20, 2024

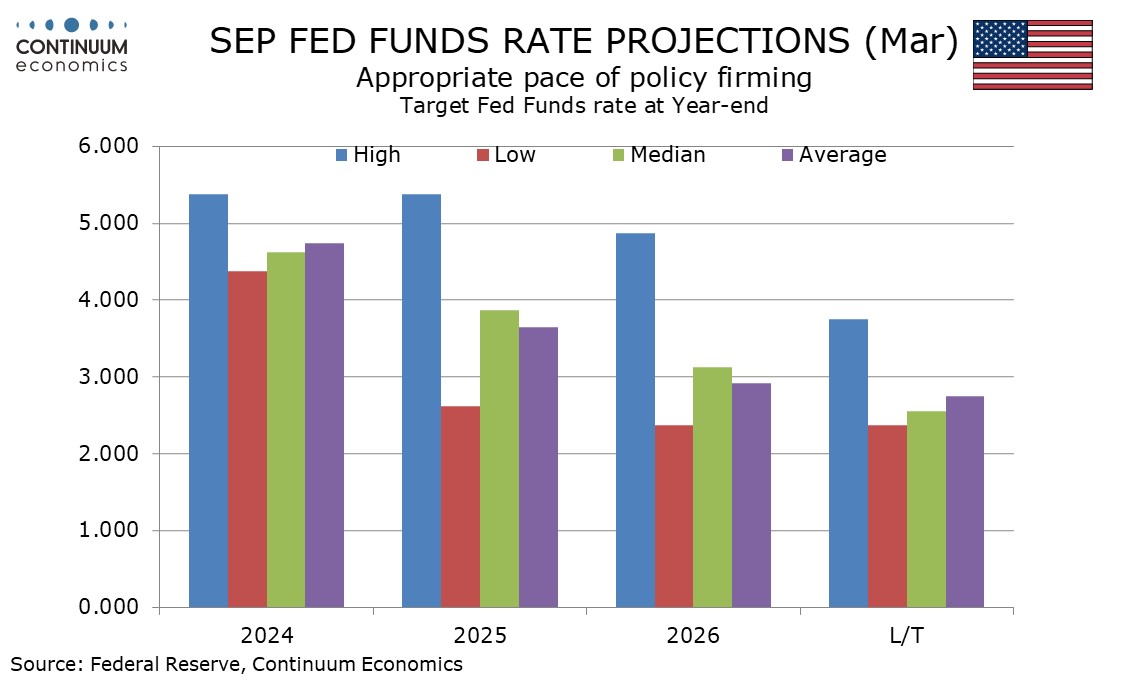

Fed: 2024 Easing To Reduce Degree of Restriction

March 20, 2024 7:51 PM UTC

The March FOMC leaves the impression that the Fed still feels that they will reduce the scale of restrictive monetary policy and the upward revision to 2024 GDP and core PCE medians are not significant. On balance, July is the most likely meeting, followed by two further cuts in Q4. We see a fur