South African Reserve Bank

View:

April 24, 2024

Sticky Inflation Causes Concerns over the Horizon

April 24, 2024 9:26 AM UTC

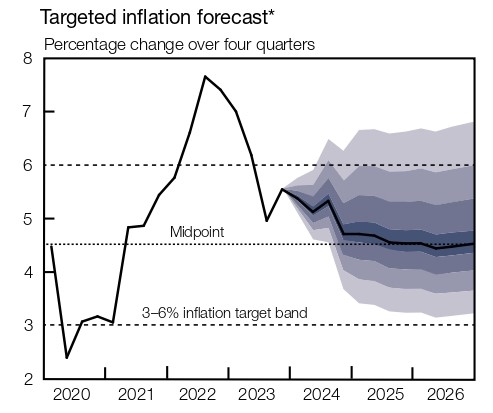

Bottom line: According to the Monetary Policy Review Report by the South African Reserve Bank (SARB) on April 23, the risk of higher inflation still remains and inflation returning to the midpoint of the target band is only expected in the last quarter of 2025. SARB highlighted in its report that ma

March 27, 2024

Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

March 27, 2024 3:26 PM UTC

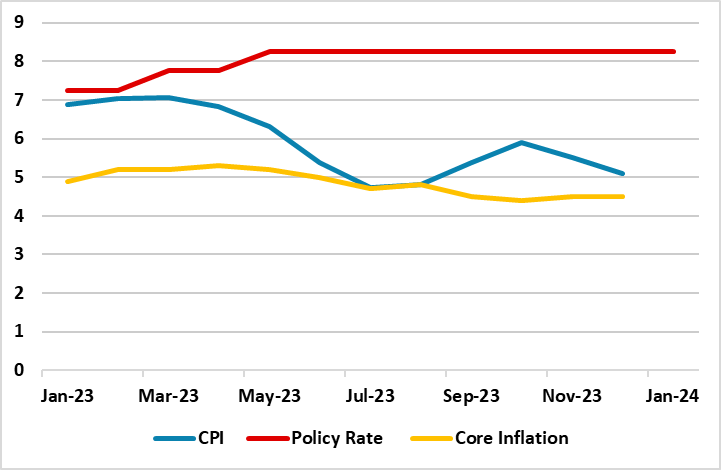

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

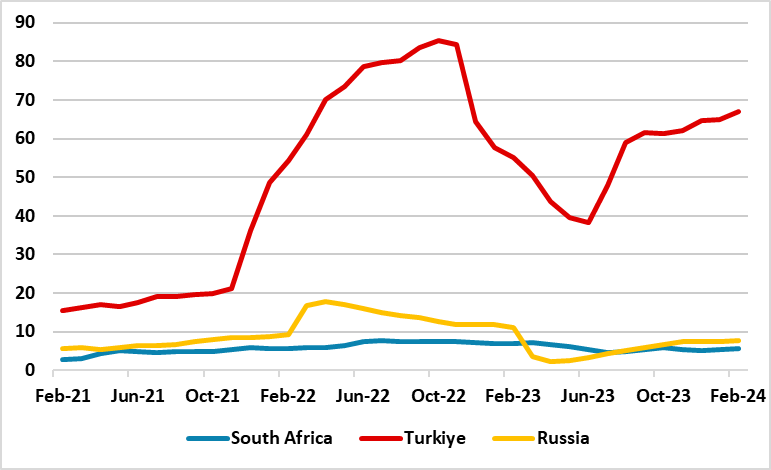

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

January 29, 2024

South Africa: Structural Issues to Dominate Long Term Growth

January 29, 2024 9:00 AM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,

January 25, 2024

SARB Held the Key Rate Stable at 8.25% on January 25

January 25, 2024 2:02 PM UTC

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate at 8.25% on January 25, given recent fall in inflation, coupled with relatively less power cuts (loadshedding), a stable Rand (ZAR) and softer global oil prices since December. It appears the decision targeted to a

January 18, 2024

SARB to Hold the Key Rate Stable on January 25

January 18, 2024 1:57 PM UTC

Bottom line: South African Reserve Bank (SARB) is likely to keep the key rate at 8.25% at the upcoming meeting on January 25, given recent fall in inflation, relatively less power cuts (loadshedding) and a stable Rand (ZAR) since December.

December 18, 2023

EMEA Outlook: Inflationary Pressures Remain Strong

December 18, 2023 10:01 AM UTC

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflationary Concerns Remain High

EMEA economies continue to be squeezed by macroeconomic problems such as elevated inflation and financial pressures. We think country specific factors, geopolitics,

December 13, 2023

Softer Fuel and Transportation Prices Helped South Africa’s Inflation Decelerate in November

December 13, 2023 1:43 PM UTC

Figure 1: CPI Inflation Rate (%, YoY), November 2021 – November 2023

Source: Datastream

South African inflation fell to 5.5% in November Yr/Yr partly driven by a monthly decrease of 5.5% in the fuel price index leading to the annual rate for fuel lower to 1.8% in November from 11.2% in October. In a

November 24, 2023

SARB Holds Key Rate at 8.25% at Third Straight MPC

November 24, 2023 10:11 AM UTC

Figure 1: CPI Inflation Rate, October 2021 – October 2023

Source: Datastream

Under surging inflationary concerns, SARB decided to keep the repo rate at 8.25% on November 23 MPC. While the hold was widely expected, high inflation numbers on November 22 did raise some eyebrows. Despite this, it appe

November 22, 2023

The Bells Are Tolling as the Spiking Cycle Continues: South Africa’s Inflation Jumped to 5.9% in October

November 22, 2023 3:48 PM UTC

Figure 1: CPI Inflation Rate, October 2021 – October 2023

Source: Datastream

Price increases in food and fuel were remarkable last month, which directly hit the consumers purchasing power. Inflation for food and non-alcoholic beverages accelerated for a second consecutive month, rising to 8.7% in O

November 14, 2023

South Africa: Structural Issues to Dominate Long Term Growth

November 14, 2023 1:07 PM UTC

Figure 1: South Africa GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics

Figure 2: Population Forecasts to 2030 (Thousand)

Source: Continuum Economics

Technology is also one positive driver of productivity in the 2020's alongside increased climate change investments but the impacts of Tec

October 18, 2023

South Africa’s Inflation Spiked to 5.4% in September

October 18, 2023 12:10 PM UTC

Figure 1: CPI Inflation Rate, October 2021 – September 2023

Source: Datastream

Annual CPI amounted to 5.4% in September 2023, up from 4.8% in August. The food and non-alcoholic beverages contributed to the 5.4% annual inflation rate by 1.4 percentage points; housing and utilities by 1.3 percentage

October 10, 2023

South Africa’s Inflation is Expected to Increase in September

October 10, 2023 1:15 PM UTC

Figure 1: CPI Inflation Rate, October 2018 – August 2023

Source: Datastream

First, the weakening currency remained as one of the major risks against the inflation outlook. USD to Rand rate fell to a four-month low to 19.57 as of October 5 and the lagged feedthrough of previous declines is still fe

October 04, 2023

South Africa’s Current Account Deficit Remains Cloudy in 2023

October 4, 2023 1:38 PM UTC

Figure 1: Current Account Balance (Million Rand), November, 2018 – May, 2023

Source: Datastream, Continuum Economics

Figure 2: Foreign Trade (Million Rand), November, 2018 – May, 2023

Source: Datastream, Continuum Economics

After experiencing current account deficits (CAD) every year for nearly tw

September 28, 2023

EMEA Outlook: Domestic Factors and Geopolitics Dominate Heading to 2024 Election Year

September 28, 2023 7:45 AM UTC

EMEA Dynamics: Domestic Factors and Geopolitics Continue to Dominate the Outlook during 2024 Election Year

EMEA economies continue to be squeezed by the elevated DM interest rates, high oil and certain food prices, EU and China slowdown. However, country specific factors and geopolitics will continue

September 21, 2023

South Africa’s Inflation Slightly Rose in August

September 21, 2023 6:18 AM UTC

Figure 1: USD Rand Rate, September 2021 – July 2023

Source: Datastream

Despite the fall in headline inflation accelerated in June and July as inflation for food and non-alcoholic beverages (NAB) slowed, and fuel prices and transportation costs partly eased, the inflation outlook worsened in Augu

September 06, 2023

Exceeding Expectations: South Africa’s GDP Expanded by 0.6% in Q2

September 6, 2023 6:32 AM UTC

Figure 1:GDP (% YoY)

Source: Department of Statistics of South Africa

According to Department of Statistics of South Africa, 6 of 10 industries recorded growth in Q2, as agriculture (4.2%), manufacturing (2.2%), and finance (+0.7%), lead the way. We foresaw the growth in manufacturing in Q2 as recent

August 30, 2023

South Africa’s Inflation is Expected to Rise from August

August 30, 2023 6:49 PM UTC

Figure 1: Inflation and Core Inflation (%), August 2022 – July 2023

Source: Datastream

Despite the fall in headline inflation accelerated in June and July as inflation for food and non-alcoholic beverages (NAB) slowed for the fourth successive month in July, and fuel prices and transportation c

August 28, 2023

South Africa’s Government Debt Darkens Financial Outlook

August 28, 2023 9:24 AM UTC

Figure 1: General Government Overall Balance and Primary Balance, 2014-2028 (% GDP)

Source:

IMF

Figure 2: General Government Revenue and Expenditure 2014-2028 (% GDP)

Source:IMF

According to the IMF Fiscal Report in April 2023, South Africa’s general government fiscal balance (% of GDP), which rec

August 23, 2023

South Africa’s Inflation Further Eased in July, Hitting Lowest in Two Years

August 23, 2023 5:28 PM UTC

Figure 1: CPI (%, y/y) January 2019 – July 2023

Source: Datastream

When we check the composition of inflation, the decline in fuel prices was remarkable in July, which weakened the upward push of transport on consumer inflation. According to the Department of Statistics, the annual rate for fuel was

August 21, 2023

South Africa’s GDP Expected to Mildly Contract in Q2 after Expanding by 0.4% in Q1

August 21, 2023 3:40 AM UTC

Figure 1: Real GDP (constant 2015 prices, seasonally adjusted)

Source: Department of Statistics of South Africa

According to Department of Statistics of South Africa, total demand was buoyant in Q1 particularly fuelled by government consumption, household consumption, investment and net exports. As

August 08, 2023

South Africa’s Nightmare is Back: A Temporary Ease in Load Shedding Finished as of July

August 8, 2023 4:09 PM UTC

Figure 1: System Hourly Demand & Available Capacity, July 31 - August 5

Source: Eskom (here)

(Note: When we compare hourly RSA contracted demand against available capacity to check what the amount of surplus/shortfall was in the past week; we see that available capacity could not match with the t

July 20, 2023

SARB Pauses With a Split Vote

July 20, 2023 2:26 PM UTC

Figure 1: SARB CPI Inflation Projection July v May (Yr/Yr %)

Source: SARB

Rate Peak and 2024 Cuts

The SARB decision not to hike the policy rate from 8.25% appears to reflect the marginal downward revision to the inflation trajectory with 6.0% and 5.0%, shaped primarily by fuel, electricity and food

July 19, 2023

South Africa’s Inflation Dips to Lowest in 20 Months with 5.4% in June

July 19, 2023 2:57 PM UTC

Figure 1: CPI (y/y, % change), January 2009 - June 2023

Source: Department of Statistics of South Africa

When we check the composition of the inflation, we see that out of the 12 main categories covered by the consumer price index (CPI), six saw a drop in annual inflation, five recorded increases and

July 14, 2023

SARB Set for Final 25bps Hike

July 14, 2023 9:56 AM UTC

SARB will announce its next interest-rate decision on July 20, and we expect the Bank to increase the policy rate by 25 bps to 8.50%, particularly due to the further pick up in 2024 inflation expectations from 5.8% to 5.9%. The decreasing pattern in CPI inflation continued in May as the inflation st

June 21, 2023

EMEA Outlook: Domestic Factors Dominant

June 21, 2023 8:03 AM UTC

EMEA Dynamics: Deteriorating Macro Picture Cannot Steal the Stage from Politics and Geopolitics

EMEA economies continue to be squeezed by elevated DM interest rates as the growth trajectories decrease for most countries for 2023. Soaring DM interest rates have different effects across the three key c

May 26, 2023

SARB Tightening and Political/Rand and Bond Worries

May 26, 2023 8:32 AM UTC

Figure 1: SARB Projections for CPI Inflation

Source: SARB

SARB increased the policy rate this month by 50bps in line with market expectations from 7.75% to 8.25%.The backdrop to the statement and forecasts appear to be hawkish and a number of points are worth highlighting.

Figure 2. 10yr S Africa v U

May 17, 2023

S Africa Recession/Inflation and High Interest Rates

May 17, 2023 1:46 PM UTC

Market Implications: Although, the currency is undervalued, we would suspect that this will persist until after the 2024 election and we do not see much of a recovery until H2 2024. In the meantime, we forecast USDZAR to 19.50 by end 2023, as the economic and political problems remain an issue.

Figu

September 09, 2022

EM FX: USD Strength but Not Crisis

September 9, 2022 1:01 AM UTC

Figure 1: USD Rises More Slowly against Key EMs and Falls vs. Brazilian Real (Dec. 31, 2021 = 100)

Source: Continuum Economics

The USD surge against G10 currencies has not been replicated so far against bigger EM currencies for a number of reasons. Key points include:

Figure 2: 10yr Nominal Yield Spre

August 10, 2022

EM Relief from Peak Fed Rates?

August 10, 2022 8:20 AM UTC

Figure 1: USD Real Effective Exchange Rate (2010 = 100)

Source: Datastream, Continuum Economics

Fed Peaking and EM FX and Bond Yields

Financial markets are now discounting that the Fed will finish tightening by the December FOMC meeting, and our June Outlook (here) highlighted the view that we will s