EM-EMEA Central Banks

View:

April 29, 2024

Indonesia: MPC Review: Bank Indonesia Surprises With A Rate Hike

April 29, 2024 11:26 AM UTC

In a pre-emptive move to both curb inflationary pressures and safeguard the Indonesia Rupiah (IDR) against furhter depreciation, Bank Indonesia, in a surprise move, increased its main policy rate by 25 bps to 6.25%. However, further rate hikes are not expected as the central bank remains wary of hur

April 26, 2024

CBR Kept the Key Rate Stable at 16%

April 26, 2024 1:12 PM UTC

Bottom Line: As widely expected, Central Bank of Russia (CBR) announced on April 26 that it decided to keep the policy rate unchanged at 16% for the third meeting in a row. CBR made critical changes in its key rate and inflation forecasts as it lifted its 2024 inflation forecast to 4.3-4.8% from 4-4

April 25, 2024

CBRT Kept Key Rate Unchanged at 50%

April 25, 2024 3:25 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on April 25 despite galloping inflation, and pressure on FX lately. According to the CBRT statement, monetary policy stance will be tightened in case a significant and persist

April 23, 2024

Indonesia: MPC Preview: Bank Indonesia to Hold Rate Despite Currency Volatility

April 23, 2024 11:12 AM UTC

With inflation within target range and the need to defend the currency amid global uncertainties and US dollar strength, Bank Indonesia (BI) is likely to extend its pause on rate adjustments in the upcoming monetary policy meeting on April 24. BI remains committed to stabilising the Indonesian rupia

April 01, 2024

Indonesia CPI Review: Ramadan Demand Drives Up Inflation

April 1, 2024 1:33 PM UTC

Indonesia's latest Consumer Price Index (CPI) data has revealed a notable acceleration in inflation, surpassing expectations and marking the highest rate since August 2023. The surge, driven primarily by heightened demand during the fasting month of Ramadan, highlights significant price pressures ac

March 27, 2024

Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

March 27, 2024 3:26 PM UTC

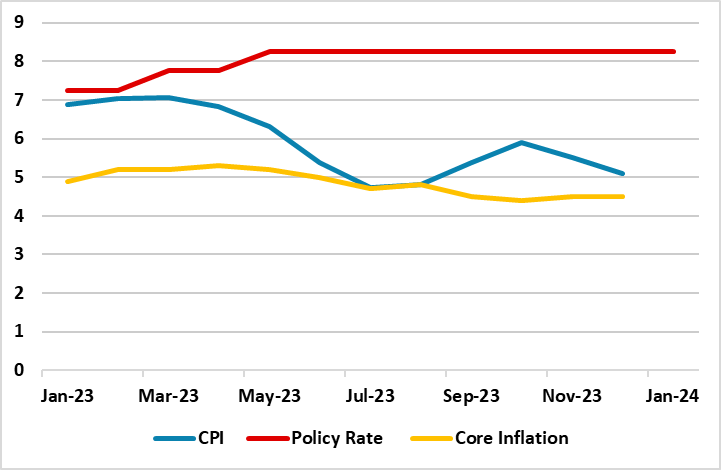

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

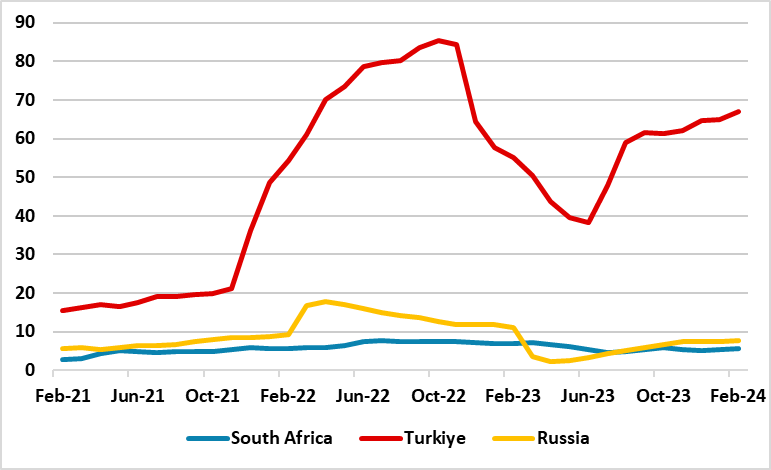

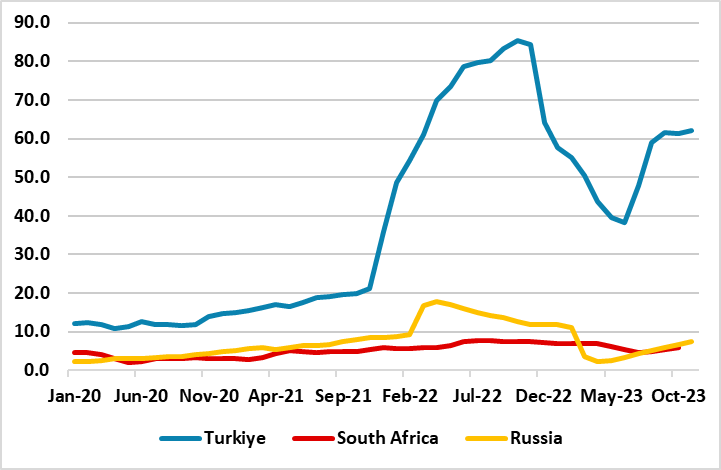

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

March 22, 2024

CBR Keeps the Key Rate Constant at 16%

March 22, 2024 10:55 AM UTC

Bottom Line: As we envisaged, Central Bank of Russia (CBR) announced on March 22 that it decided to keep the policy rate unchanged at 16% for the second meeting in a row, despite inflationary pressures remaining elevated, and currency weakening continued. We expect the CBR to hold the key rate stab

March 21, 2024

Inflationary Pressures Caused CBRT to Restart Tightening Cycle and Hike Key Rate to 50%

March 21, 2024 4:26 PM UTC

Bottom Line: Despite predictions were centred around no change, Central Bank of Turkiye (CBRT) increased the policy rate by 500 bps to 50% on March 21 due to strong inflation, and pressure on FX and reserves lately. According to the CBRT statement, the current level of the policy rate will be mainta

March 18, 2024

Bank Indonesia to Retain Policy Rate

March 18, 2024 5:40 AM UTC

Bank Indonesia (BI) will likely maintain the key 7-day reverse repo rate unchanged in March at 6%, in line with recent trends. The stability of the rupiah remains a crucial consideration for BI, alongside CPI inflation, which has moderated within the new target band of 2.5+/-1%.

March 07, 2024

Bank Indonesia to Look Beyond Recent Uptick in Consumer Price Index

March 7, 2024 4:06 AM UTC

Indonesia's Consumer Price Index (CPI) data released by the Central Statistics Agency (BPS) indicates a notable uptick in inflation, reaching 2.75% y/y in February compared to 2.57% y/y in January. The three-month high inflation rate was primarily propelled by surging food prices, aligning with expe

February 22, 2024

CBRT Left the Key Rate Constant at 45%

February 22, 2024 12:53 PM UTC

Bottom Line: As we predicted, Central Bank of Turkiye (CBRT) ended monetary hiking cycle under new governor, and kept the key rate stable at 45% after eighth straight rate hikes since presidential elections last May. According to the CBRT statement, the current level of the policy rate will be maint

February 16, 2024

As Expected, CBR Keeps the Key Rate at 16%

February 16, 2024 1:49 PM UTC

Bottom Line: As we predicted, Central Bank of Russia (CBR) announced on February 16 that it decided to keep the policy rate unchanged at 16% after lifting the rate in the last five consecutive MPC meetings, despite inflationary pressures and expectations remaining elevated, domestic demand still out

January 29, 2024

South Africa: Structural Issues to Dominate Long Term Growth

January 29, 2024 9:00 AM UTC

Bottom line: We expect 1.3-1.5% GDP growth in South Africa in the 2025-2030 period. We are concerned with the structural problems affecting economic dynamics negatively, including loadshedding, transportation bottlenecks, and shrinking trade surplus. Despite structural problems; growing population,

January 26, 2024

Climate Change: 2025-30 Rather than Long-Term Impacts

January 26, 2024 4:15 PM UTC

Bottom Line: In the 2half of the 2020’s GDP in DM economies will benefit from climate change investment, though the net positive impact will likely be modest on an annual basis. The impact on EM economies will be more mixed, as lack of fiscal space restrains the scale of green investment and some

January 25, 2024

SARB Held the Key Rate Stable at 8.25% on January 25

January 25, 2024 2:02 PM UTC

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate at 8.25% on January 25, given recent fall in inflation, coupled with relatively less power cuts (loadshedding), a stable Rand (ZAR) and softer global oil prices since December. It appears the decision targeted to a

January 18, 2024

SARB to Hold the Key Rate Stable on January 25

January 18, 2024 1:57 PM UTC

Bottom line: South African Reserve Bank (SARB) is likely to keep the key rate at 8.25% at the upcoming meeting on January 25, given recent fall in inflation, relatively less power cuts (loadshedding) and a stable Rand (ZAR) since December.

January 09, 2024

Shipping Freight Cost Jump and Inflation – Some Perspectives

January 9, 2024 2:24 PM UTC

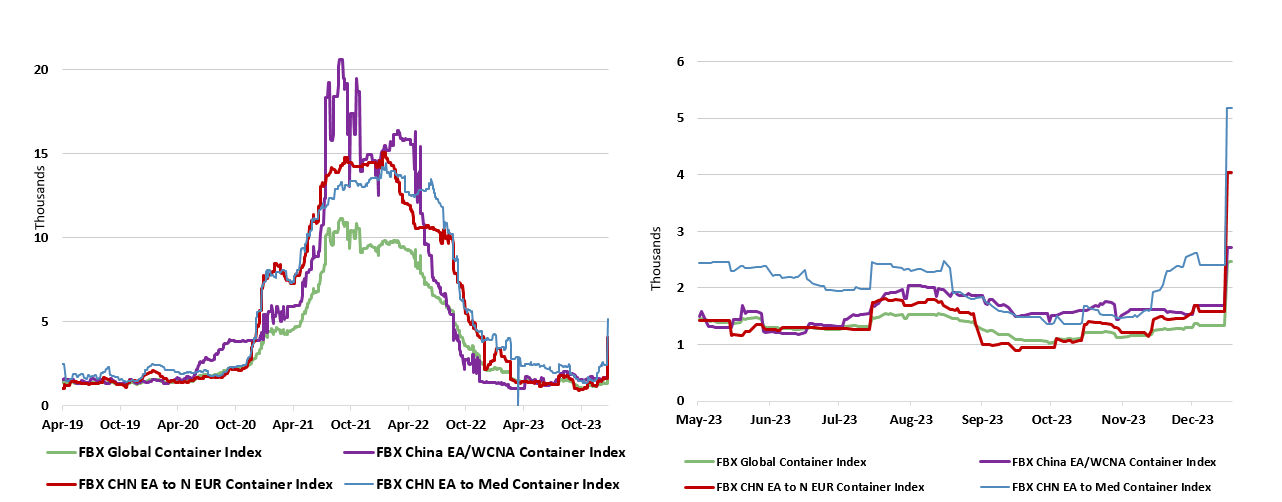

Figure 1: Freight Cost Surge in Perspective

Source: DataStream

How Long?

Houthi rebels have been attacking some ships in the Red Sea in recent weeks. The key question is how long this will last? One line of thinking is that the Houthi attacks are part of Iran axis of resistance alongside attacks

January 03, 2024

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

December 21, 2023

CBRT Continued Monetary Tightening Cycle on December 21, but with a Lesser Pace

December 21, 2023 12:19 PM UTC

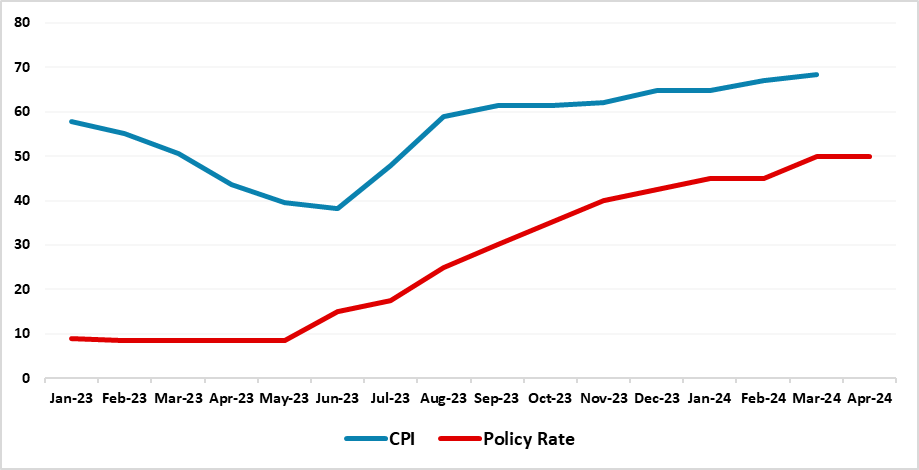

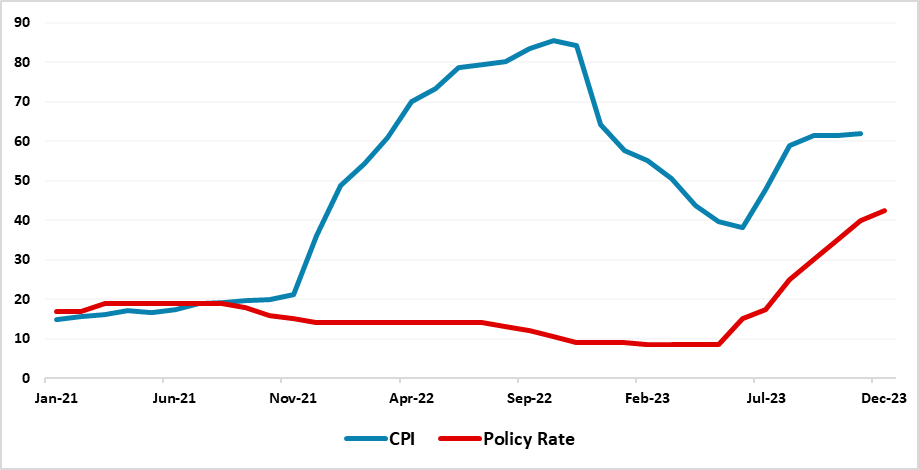

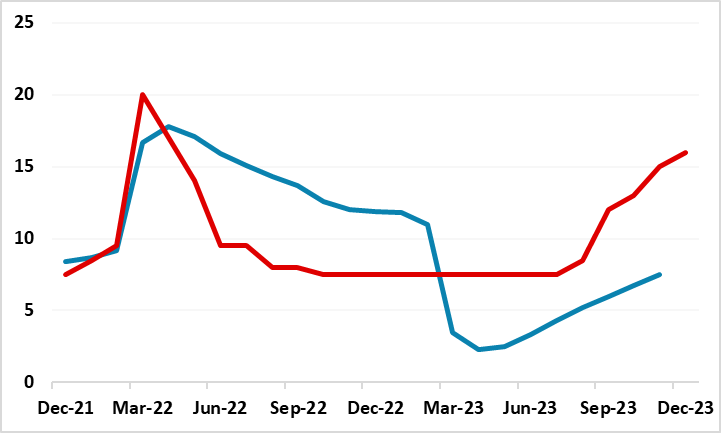

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2021 – December 2023

Source: Turkish Statistical Institute, Datastream, Continuum Economics

The CBRT raised the policy rate from 40% to 42.5% on December 21 MPC meeting to establish the disinflation course as soon as possible, to anchor infl

December 18, 2023

EMEA Outlook: Inflationary Pressures Remain Strong

December 18, 2023 10:01 AM UTC

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflationary Concerns Remain High

EMEA economies continue to be squeezed by macroeconomic problems such as elevated inflation and financial pressures. We think country specific factors, geopolitics,

December 15, 2023

Concerned with Accelerating Inflation, CBR Lifted the Key Rate by 100bps to 16%

December 15, 2023 3:47 PM UTC

Figure 1: Policy Rate (%) and CPI (YoY, % Change), December 2021 – December 2023

Source: Datastream, Continuum Economics

In order to reduce inflation and inflation expectations, and to anchor inflation at the target level, CBR continued its tightening cycle in the fifth consecutive MPC meeting, and

December 13, 2023

Softer Fuel and Transportation Prices Helped South Africa’s Inflation Decelerate in November

December 13, 2023 1:43 PM UTC

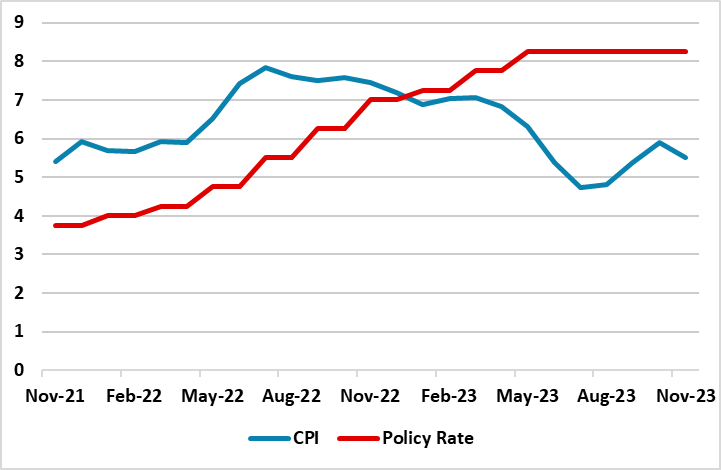

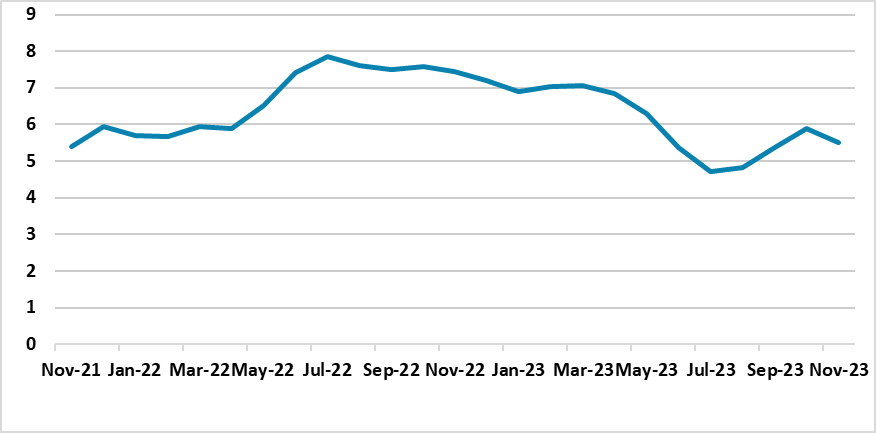

Figure 1: CPI Inflation Rate (%, YoY), November 2021 – November 2023

Source: Datastream

South African inflation fell to 5.5% in November Yr/Yr partly driven by a monthly decrease of 5.5% in the fuel price index leading to the annual rate for fuel lower to 1.8% in November from 11.2% in October. In a

December 08, 2023

Russia’s Inflation Accelerates to 7.5% in November

December 8, 2023 7:47 PM UTC

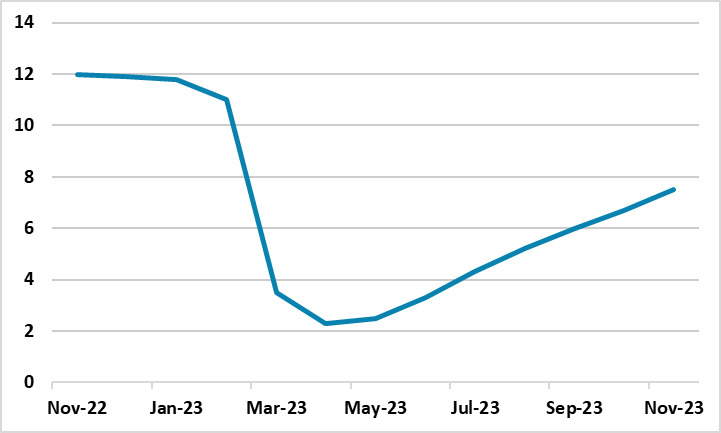

Figure 1: Inflation Rate (%, YoY), November 2022 - November 2023

Source: Datastream, Continuum Economics

According to Rosstat on December 8, prices of food, non-food products and services rose by 1.55%, 0.53% and 1.23% on a monthly basis in November, respectively. The consumer price index (CPI) edged

December 04, 2023

Moderate Increase in Turkiye’s Inflation in November

December 4, 2023 11:28 AM UTC

Figure 1: CPI (YoY, % Change) and Policy Rate (%), January 2021 – November 2023

Source: Turkish Statistical Institute, Datastream, Continuum Economics

When annual rate of changes (%) in the CPI's main groups are examined in November, we see that housing with 37.5% was the main group with the lowest

November 30, 2023

Turkish Economy Expands 5.9% in Q3 2023

November 30, 2023 1:40 PM UTC

Figure 1: GDP (%, YoY), Q3 2019 – Q3 2023

Source: Datastream, Continuum Economics

When the activities which constitute GDP are analyzed in Q3, construction sector made the highest contribution to the economy with an 8.1% YoY rise, followed by 5.7% in the industry sector and 5.1% in the financial and

November 29, 2023

Russian Economy Grows by 5% in October

November 29, 2023 7:11 PM UTC

Figure 1: Industrial Production (%, YoY), October 2020 – October 2023

Source: Datastream, Continuum Economics

The Russian economy continues to grow fast in 2023 so far, after partly relieved from the negative impacts of the war in Ukraine in 2023. The Russian economy grew by a strong 5% YoY in Octob

November 24, 2023

SARB Holds Key Rate at 8.25% at Third Straight MPC

November 24, 2023 10:11 AM UTC

Figure 1: CPI Inflation Rate, October 2021 – October 2023

Source: Datastream

Under surging inflationary concerns, SARB decided to keep the repo rate at 8.25% on November 23 MPC. While the hold was widely expected, high inflation numbers on November 22 did raise some eyebrows. Despite this, it appe

November 23, 2023

Sixth Straight Rate Hike: CBRT Continued Strong Monetary Tightening

November 23, 2023 12:53 PM UTC

Figure 1: Key Rate (%), September 2020 – November 2023

Source: Datastream

The CBRT raised the policy rate from 35% to 40% on November 23 MPC meeting to establish the disinflation course as soon as possible, to anchor inflation expectations, to control the deterioration in pricing behaviour and to s

November 22, 2023

The Bells Are Tolling as the Spiking Cycle Continues: South Africa’s Inflation Jumped to 5.9% in October

November 22, 2023 3:48 PM UTC

Figure 1: CPI Inflation Rate, October 2021 – October 2023

Source: Datastream

Price increases in food and fuel were remarkable last month, which directly hit the consumers purchasing power. Inflation for food and non-alcoholic beverages accelerated for a second consecutive month, rising to 8.7% in O

November 16, 2023

Long-term Forecasts to download in Excel

November 16, 2023 10:38 AM UTC

We present our annual forecasts that go out to 2030 for GDP Growth, Inflation, and Monetary Policy and to 2028 for Exchange Rates. The file contains five sheets: a Country Coverage summary page and a sheet for each of the four indicators.

The forecasts are consistent with the Long-term Forecasts: DM

Long-term Forecasts: DM Policy Easing

November 16, 2023 8:44 AM UTC

The Continuum Economics research team has spent much of the last month researching, reviewing and debating our long-term GDP, CPI inflation and central bank policy rate forecasts for 2025-30. Alongside a reassessment of long-term factors such as productivity and demographics, we have examined the la

November 15, 2023

Russian Economy Expands by 5.5% in Q3, Rosstat Reports

November 15, 2023 5:25 PM UTC

Figure 1: GDP Growth (%, YoY), Q3 2020 – Q3 2023

Source: Datastream, Continuum Economics

The Russian economy continues to grow fast in 2023 so far, after partly relieved from the negative impacts of the war in Ukraine. (Note: Russian GDP decreased by 1.8% in Q1 2023, and grew by 4.9% in Q2.) The mai

November 14, 2023

South Africa: Structural Issues to Dominate Long Term Growth

November 14, 2023 1:07 PM UTC

Figure 1: South Africa GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics

Figure 2: Population Forecasts to 2030 (Thousand)

Source: Continuum Economics

Technology is also one positive driver of productivity in the 2020's alongside increased climate change investments but the impacts of Tec

November 10, 2023

Russia’s Inflation Stays Strong in October

November 10, 2023 5:06 PM UTC

Figure 1: $/RUB Rate, November 2021 - November 2023

Source: Datastream, Continuum Economics

According to Rosstat, prices of food, non-food products and services rose by 1.35%, 0.55% and 0.48% on a monthly basis in October, respectively. The consumer price index (CPI) also rose by 0.83% on a monthly b

Turkiye: Macroeconomic Problems to Limit Long Term Growth

November 10, 2023 10:01 AM UTC

Figure 1: Turkiye GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics/Datastream

A number of forces impact our long-term growth forecast for Turkiye.

Figure 2: Turkiye 15+ Population Forecasts to 2030 (Thousand)

Source: Continuum Economics/Datastream

Figure 3: Turkiye Capacity Utilization

November 09, 2023

Russia: War Related Sanctions and Shrinking Labor Force Pose Threats to Long Term Growth

November 9, 2023 12:02 PM UTC

Figure 1: Russia GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics/Datastream

Figure 2: Russia Population Forecasts to 2030 (Thousand)

Source: Continuum Economics/Datastream

Figure 3: Russia Industrial Production Forecast to 2030

Source: Continuum Economics/Datastream

Technology is also o

November 03, 2023

Turkish Inflation Continued Its Spiking Cycle in October

November 3, 2023 8:08 AM UTC

Figure 1: Inflation (YoY, % Change), October 2018 – October 2023

Source: Turkish Statistical Institute, Datastream, Continuum Economics

When annual rate of changes (%) in the CPI’s main groups are examined in October, we see that housing with 25.9% was the main group with the lowest annual increas

November 01, 2023

Russia’s GDP Grew Faster Than Expected in January - September 2023

November 1, 2023 2:23 PM UTC

Figure 1: Industrial Production (%, YoY), October 2018 – September 2023

Source: Datastream, Continuum Economics

The main accelerator for Russian growth continues to be the surge in the military spending after the war in Ukraine started. Despite there being a pause on territorial advance by Russia o

AI and Technology Impact on Growth and Inflation

November 1, 2023 10:01 AM UTC

The huge buzz around artificial intelligence has also raised a debate about the growth, jobs and inflation impact of this latest phase of the 4th industrial revolution (5G, AI, Internet of Things and Big Data)? What is the likely medium-term impact?

Figure 1: Survey of Impact on Global GDP Per Annu

October 27, 2023

CBR Maintains Strong Hawkish Stance by Lifting the Rate to 15%

October 27, 2023 1:34 PM UTC

Figure 1: $/Ruble, October 2022 - October 2023

Source: Datastream

According to the Monetary Policy press release by the CBR today, CBR remained concerned about multiple issues such as higher inflationary pressure seen across an increasingly broader range of goods and services, growing domestic dema

October 26, 2023

CBRT Continued Strong Monetary Tightening on October 26 MPC

October 26, 2023 3:35 PM UTC

Figure 1: Key Rate (%), September 2020 – October 2023

Source: Datastream

The CBRT raised the policy rate from 30% to 35% on October 26 MPC meeting to establish the disinflation course as soon as possible, to anchor inflation expectations, to control the deterioration in pricing behaviour and to s

October 19, 2023

CBRT will Likely Halt Tightening Cycle Transiently on October 26 MPC

October 19, 2023 10:52 AM UTC

Figure 1: Key Rate (%), September 2020 – September 2023

Source: Datastream

Despite inflation remained on the upside in September (there are still signs that inflation will continue to spike in the upcoming months mostly due to deterioration in pricing behaviour), cost and demand pressures and slo

October 18, 2023

South Africa’s Inflation Spiked to 5.4% in September

October 18, 2023 12:10 PM UTC

Figure 1: CPI Inflation Rate, October 2021 – September 2023

Source: Datastream

Annual CPI amounted to 5.4% in September 2023, up from 4.8% in August. The food and non-alcoholic beverages contributed to the 5.4% annual inflation rate by 1.4 percentage points; housing and utilities by 1.3 percentage

October 16, 2023

Climate Change: 2025-30 Rather than Long-Term Impacts

October 16, 2023 2:15 PM UTC

Climate economists and policymakers traditionally think about climate change issues out to 2050, but what are the macroeconomic impacts out to 2025-30 from investment plans and also the climate events that are already happening?

Figure 1: Implications of Net Zero Policy Packages on Debt, Relative to

October 12, 2023

Russia’s Inflation Surged Fast in September

October 12, 2023 6:05 PM UTC

Figure 1: CPI Inflation Rate (%, YoY), September 2022- September 2023

Source: Datastream, Continuum Economics

According to Rosstat, prices of food, non-food products and services rose by 0.86%, 1.09% and 0.61% on a monthly basis in September, respectively. The consumer price index (CPI) also hiked by

October 10, 2023

South Africa’s Inflation is Expected to Increase in September

October 10, 2023 1:15 PM UTC

Figure 1: CPI Inflation Rate, October 2018 – August 2023

Source: Datastream

First, the weakening currency remained as one of the major risks against the inflation outlook. USD to Rand rate fell to a four-month low to 19.57 as of October 5 and the lagged feedthrough of previous declines is still fe

October 04, 2023

South Africa’s Current Account Deficit Remains Cloudy in 2023

October 4, 2023 1:38 PM UTC

Figure 1: Current Account Balance (Million Rand), November, 2018 – May, 2023

Source: Datastream, Continuum Economics

Figure 2: Foreign Trade (Million Rand), November, 2018 – May, 2023

Source: Datastream, Continuum Economics

After experiencing current account deficits (CAD) every year for nearly tw

October 03, 2023

Turkish Inflation Surged in September, but with a Decelerating Pace Compared to August

October 3, 2023 12:28 PM UTC

Figure 1: Inflation (YoY, % Change), October 2018 – September 2023

Source: Turkish Statistical Institute, Datastream

When annual rate of changes (%) in the CPI’s main groups are examined in September, we see that housing with 20.2% was the main group with the lowest annual increase while hotels, c