EM Central Banks

View:

May 10, 2024

Banxico Review: Hold Rates

May 10, 2024 12:44 PM UTC

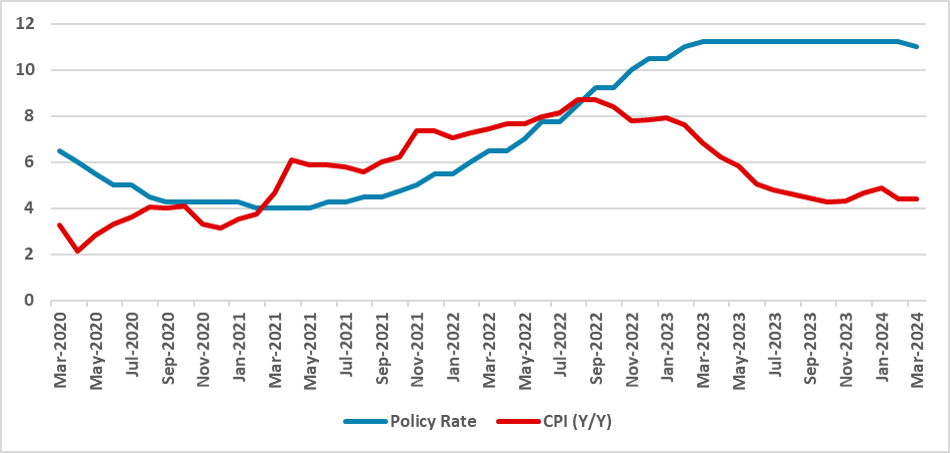

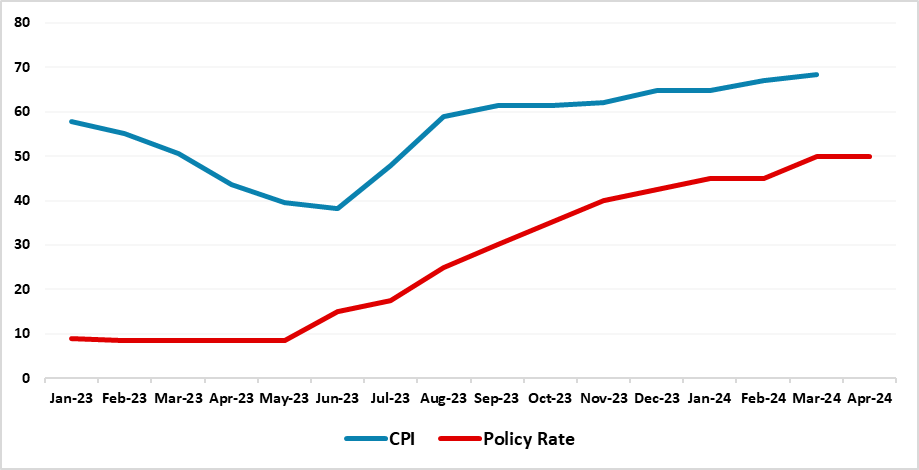

Banxico's decision to maintain the policy rate at 11% reflects a cautious stance amidst rising inflation and a slowing economy. Despite external volatility, the MXN remains resilient. The main concern is services inflation being stickier. With a revised inflation forecast indicating a longer period

Benign Inflation Allows BNM to Hold Rate

May 10, 2024 9:24 AM UTC

In its latest decision, the Monetary Policy Committee (MPC) of Bank Negara Malaysia (BNM) opted to keep the overnight policy rate (OPR) steady at 3.0%, marking the seventh consecutive meeting without a change. This decision aligns with market projections and underscores BNM's commitment to support g

May 09, 2024

Mexico CPI Review: 0.2% Growth in April

May 9, 2024 6:11 PM UTC

April's CPI data, despite a 0.2% m/m growth, reveals a significant y/y uptick to 4.6% from March's 4.4%, challenging norms due to electricity tariff adjustments. Core CPI maintained stability with a 0.2% increase, while Core Goods CPI rose by 0.3% and Services CPI by 0.1%, accumulating a 5.2% y/y gr

May 07, 2024

Banxico Preview: Continuing at 25bps

May 7, 2024 12:43 PM UTC

Banxico will convene on May 9 to decide on the policy rate, having initiated a possible cutting cycle. Despite concerns, the MXN remains stable. The 25bps adjustment aims to maintain tight monetary policy while mitigating inflation. The board may split over this decision, but Banxico is likely to co

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

Indonesia CPI Review: Inflation Inches Down but BI on Alert

May 3, 2024 10:33 AM UTC

Indonesia’s consumer price inflation eased marginally to 3% yr/yr in April on the back of declining food prices. Despite the easing, food price remain the key inflationary factor. Additionally, imported inflation as the IDR comes under pressure could keep inflation elevated in the near term. Bank

May 02, 2024

Moody’s Improves Outlook Perspective Due to Higher Growth

May 2, 2024 2:27 PM UTC

Moody’s upgraded Brazil's outlook to positive from stable, maintaining its Ba2 rating, signaling a potential move to Ba1 soon. Strong growth prospects, attributed to institutional reforms, drove this shift. Despite lingering doubts, improved fiscal conditions and anticipated tax reform are bolster

April 30, 2024

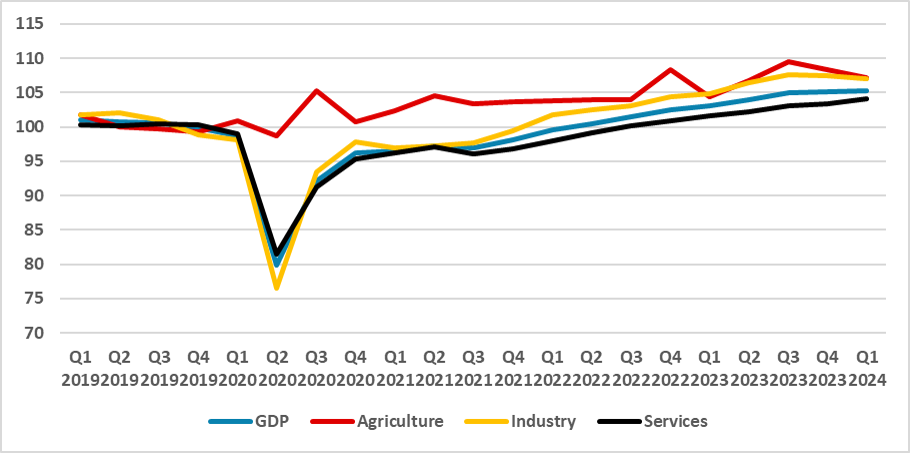

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

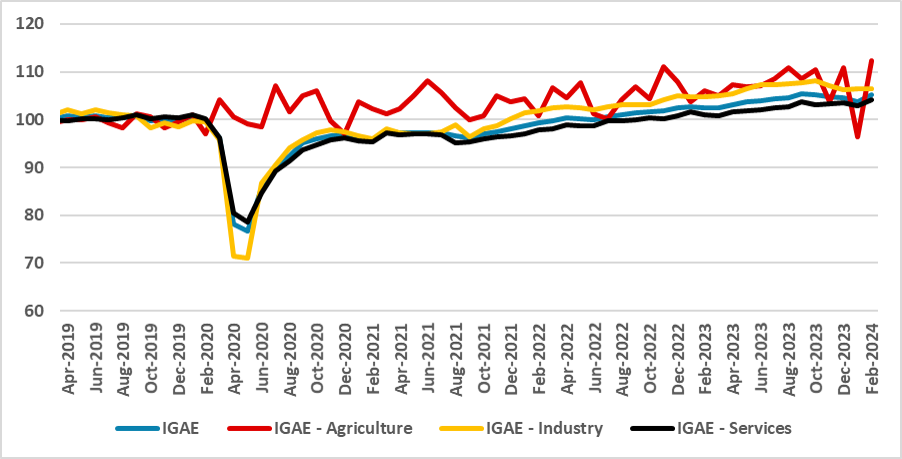

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service

April 29, 2024

Mexico GDP Preview: Stagnation in the First Quarter

April 29, 2024 5:22 PM UTC

INEGI will release Mexico's Preliminary GDP data, indicating 0% growth in Q1, likely due to stagnation in key sectors like manufacturing and construction. The service sector, hit hard by the pandemic, also shows signs of sluggishness. While recovery is expected, sustained poor growth raises concerns

April 26, 2024

Argentina: Activity is Shrinking but that is the Price to Stabilize

April 26, 2024 5:52 PM UTC

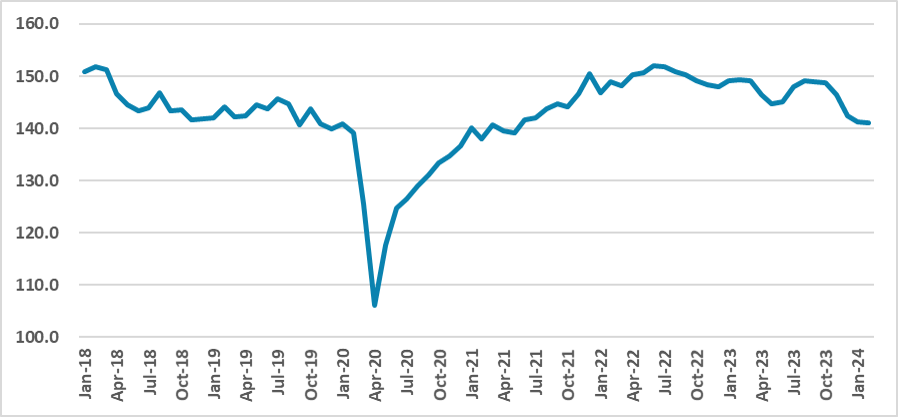

The INDEC data for February reveals a 0.2% economic shrinkage, signalling a 5.1% drop since August 2023, potentially leading to a Q1 2024 recession. High inflation and fiscal adjustments are primary causes. Some foresee 0% April inflation due to price realignment and stable ARS. Despite low reserves

April 25, 2024

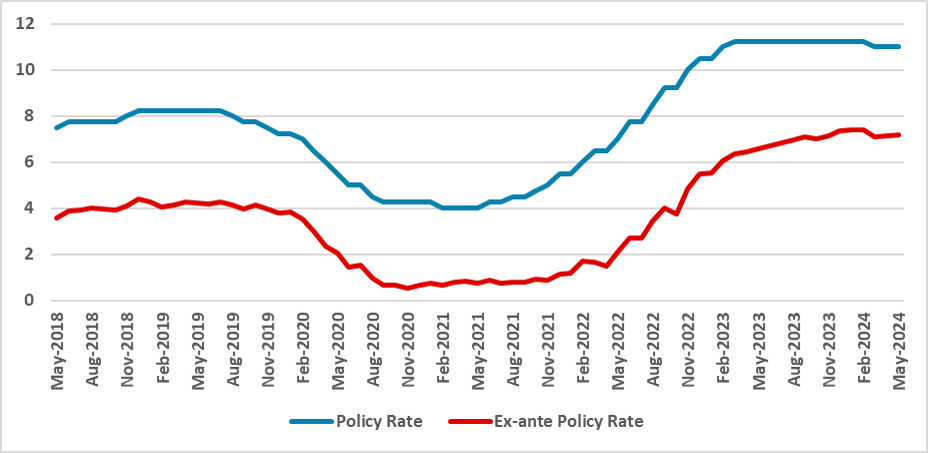

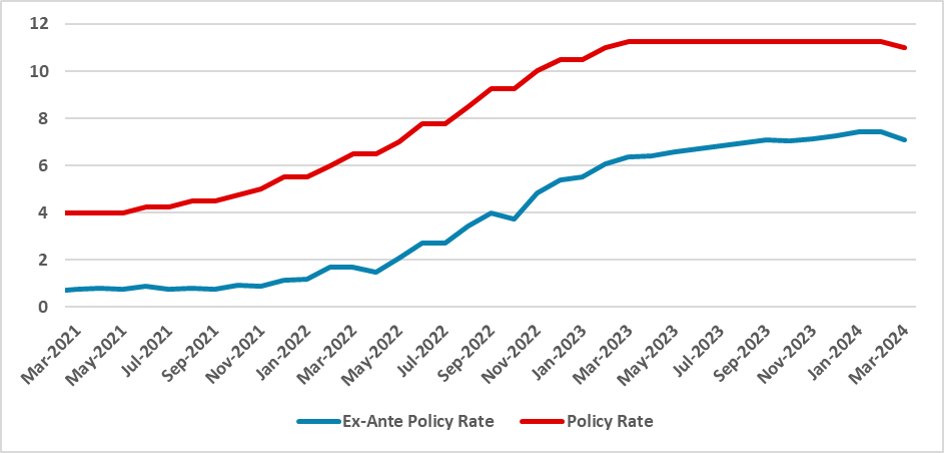

CBRT Kept Key Rate Unchanged at 50%

April 25, 2024 3:25 PM UTC

Bottom Line: As predictions were centred around no change, Central Bank of Turkiye (CBRT) kept the policy rate stable at 50% on April 25 despite galloping inflation, and pressure on FX lately. According to the CBRT statement, monetary policy stance will be tightened in case a significant and persist

April 24, 2024

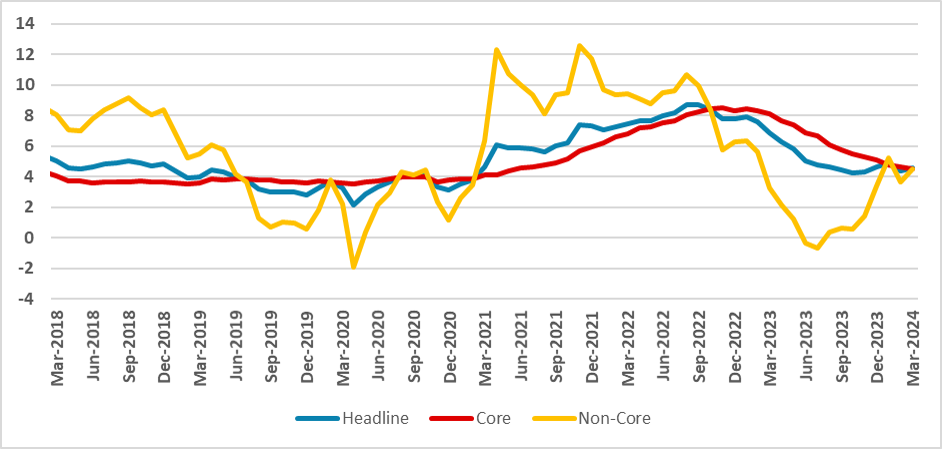

Brazil: Wage Inflation Will Likely Not Be a Big Deal

April 24, 2024 3:19 PM UTC

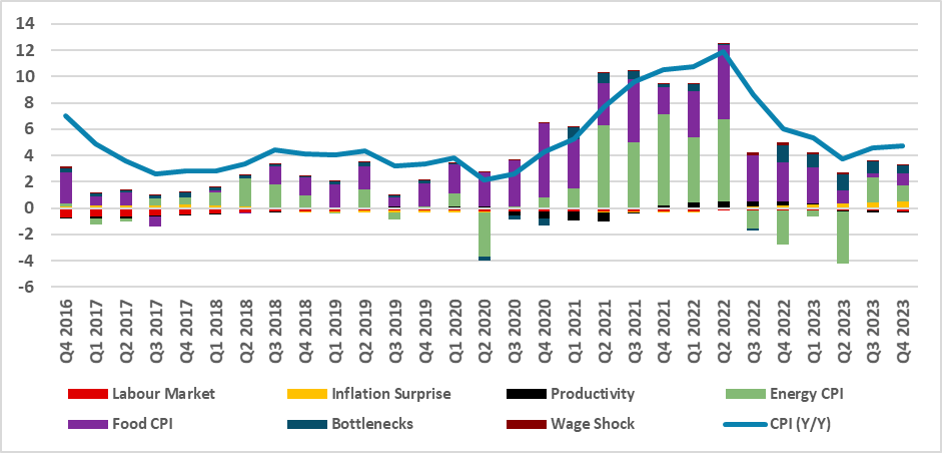

Our analysis delves into recent trends in the Brazilian labor market, focusing on CPI and wage inflation. Utilizing a model akin to Ghomi et al. (2024) and Blanchard and Bernanke (2023), we dissect recent spikes in wage inflation and CPI growth. Notably, our findings suggest that recent wage spikes

April 23, 2024

Indonesia: MPC Preview: Bank Indonesia to Hold Rate Despite Currency Volatility

April 23, 2024 11:12 AM UTC

With inflation within target range and the need to defend the currency amid global uncertainties and US dollar strength, Bank Indonesia (BI) is likely to extend its pause on rate adjustments in the upcoming monetary policy meeting on April 24. BI remains committed to stabilising the Indonesian rupia

April 22, 2024

Indonesian Court Delivers Verdict: Prabowo prevails

April 22, 2024 3:18 PM UTC

The Constitutional Court dismissed cases against Vice President Gibran Rakabuming Raka and President Joko Widodo. In Gibran's case, the court didn't disqualify him from running for president but sanctioned the election committee for not amending regulations following a previous ruling. This ruling l

April 18, 2024

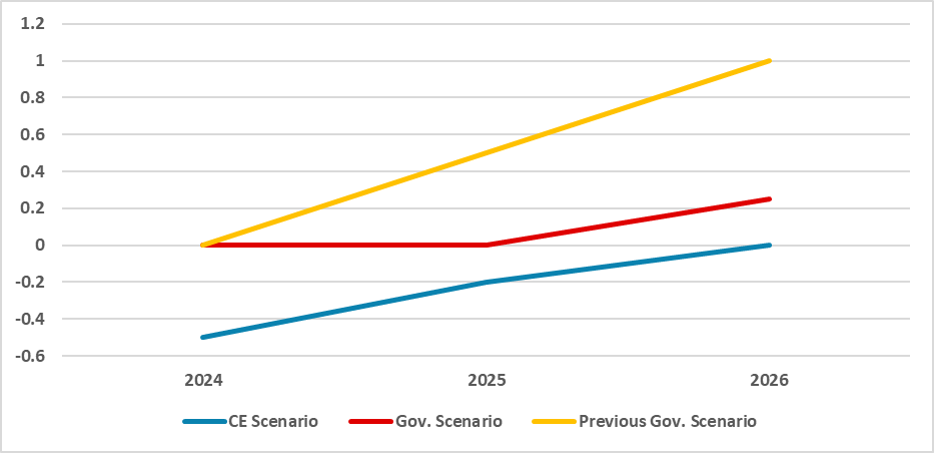

Brazil: Revision of Targets Shows the Weakness of the New Fiscal Framework

April 18, 2024 1:39 PM UTC

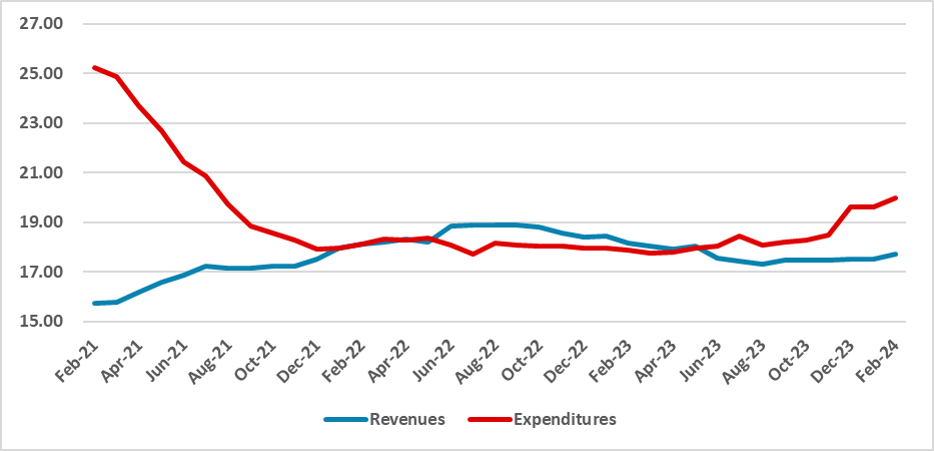

The Brazilian government has revised its budget targets for 2025 and 2026, lowering the deficit to 0% and a 0.25% surplus in 2025 and 2026 respectively, from 0.5% surplus in 2025 and 1% in 2026. However, reliance on revenue increases poses challenges amid resistance from Congress. Despite reduced ta

April 17, 2024

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

April 16, 2024

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

April 14, 2024

Argentina CPI Review: Small Improvements Amid the Uncertainty

April 14, 2024 1:26 PM UTC

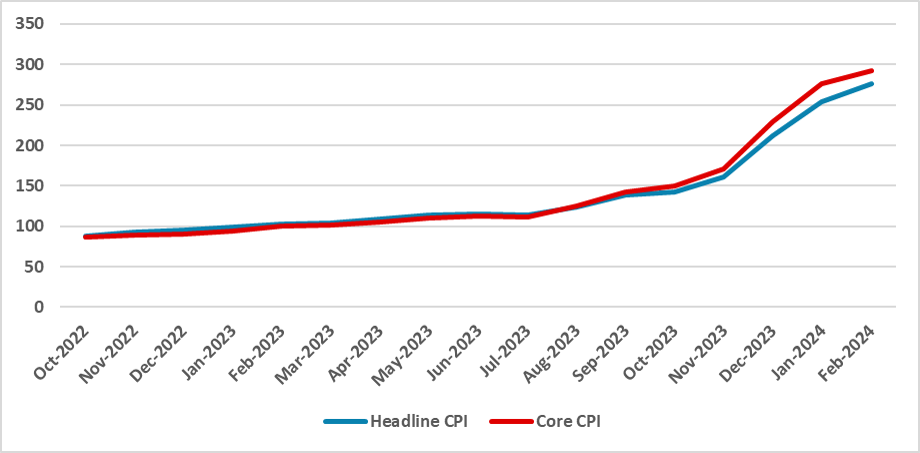

The INDEC's March CPI data reveals an 11.0% increase, down from February's 13.2%. Annually, Argentine CPI rose by 287% (Y/Y), with core CPI below 10%. Despite past shocks, we foresee continued monthly CPI slowdown. Argentina focuses on fiscal measures and on stabilize the exchange rate to accumulate

April 09, 2024

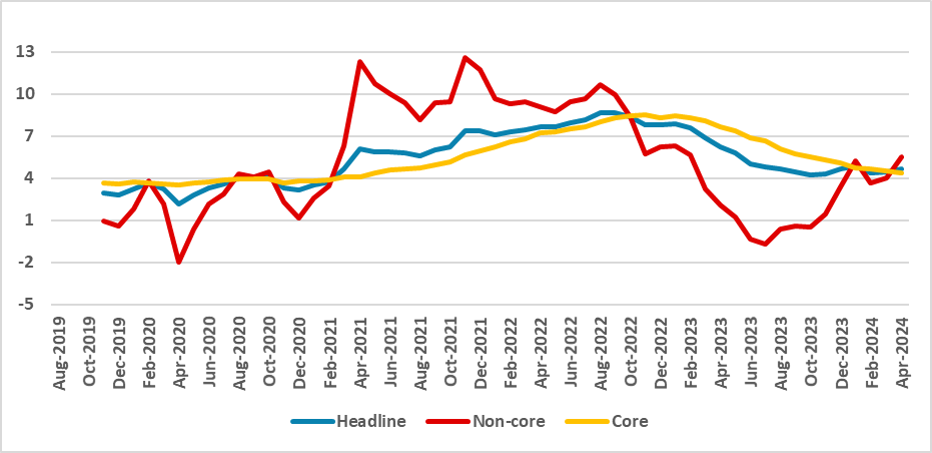

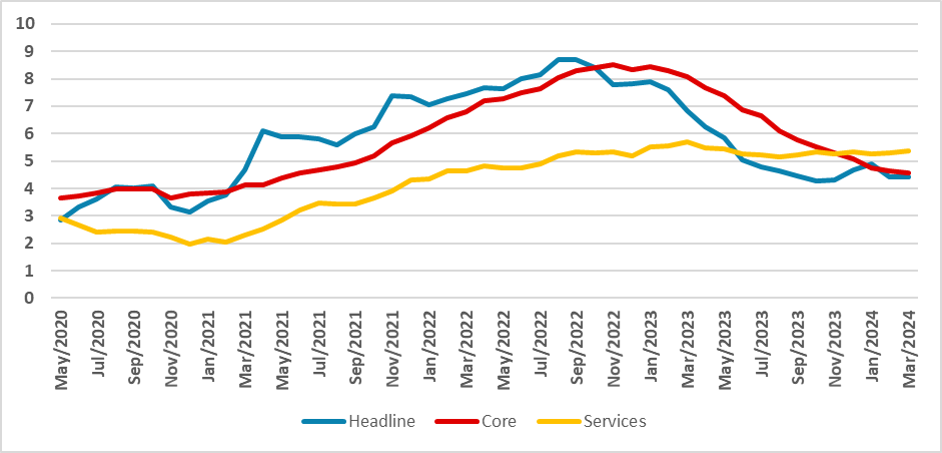

Mexico CPI Review: Slightly Below Expectations, with Concerns in Service

April 9, 2024 6:43 PM UTC

Mexico's March CPI data, released by the National Statistics Institute, shows a slight increase of 0.29%, below the 0.36% expectation. Year-on-year CPI remains stable at 4.4%, above Banxico's 3.0% target. While fruit and vegetable prices dropped, transport costs rose. Concerns arise with Services CP

April 08, 2024

Mexico CPI Preview: Well Behaved March

April 8, 2024 1:10 PM UTC

On April 9th, Mexico's National Institute for Statistics will release March's CPI data. Forecast suggests a 0.4% rise, keeping YoY CPI stable at 4.5%, mainly due to base effects. Core CPI likely to remain steady at 4.5%, showing progress in disinflation despite non-alignment with Banxico's 3.0% targ

April 05, 2024

Banxico Minutes: Hawkish Cut and Different Views

April 5, 2024 2:18 PM UTC

Banxico's recent meeting minutes reveal a split among board members regarding monetary policy, with a 25bps rate cut to 11.0%. Despite progress in curbing inflation, differing views on policy direction persist. Inflation expectations deviate from targets, with potential risks in fiscal policy and wa

April 03, 2024

Brazil: What About the Fiscal?

April 3, 2024 2:31 PM UTC

In 2023, Brazil witnessed a significant fiscal decline, with the GDP surplus of 0.5% in 2022 turning into a 2.1% deficit, surpassing the targeted 0.5% deficit set by the new fiscal rule. Despite measures aimed at reinstating fiscal sustainability, immediate adjustments are unlikely. The deterioratio

April 02, 2024

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

April 01, 2024

Indonesia CPI Review: Ramadan Demand Drives Up Inflation

April 1, 2024 1:33 PM UTC

Indonesia's latest Consumer Price Index (CPI) data has revealed a notable acceleration in inflation, surpassing expectations and marking the highest rate since August 2023. The surge, driven primarily by heightened demand during the fasting month of Ramadan, highlights significant price pressures ac

March 27, 2024

Beware of Inflation: SARB Held the Key Rate Stable at 8.25%

March 27, 2024 3:26 PM UTC

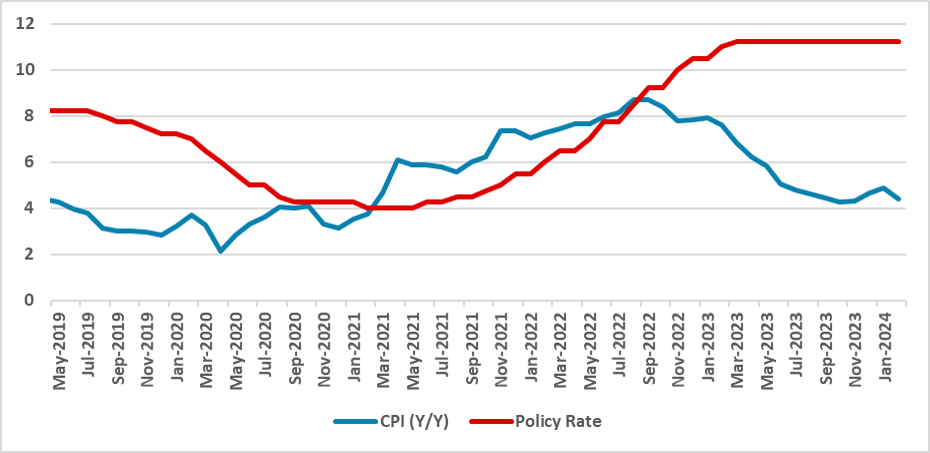

Bottom line: As widely expected, South African Reserve Bank (SARB) kept the key rate constant at 8.25% on March 27. It appears the decision targeted to anchor inflation expectations around the target midpoint, and enhance confidence in achieving the inflation goal as SARB signalled that its fight to

March 26, 2024

EM FX Outlook: Domestic Drivers Key

March 26, 2024 9:01 AM UTC

In terms of spot EM FX projections domestic drivers remain critical, with a desire to avoid appreciation versus the USD for some countries. Fed easing in H2 2024 should however help EMFX more broadly and allow some recovery in spot rates (e.g. Indonesian Rupiah (IDR), South African Rand (ZAR)

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

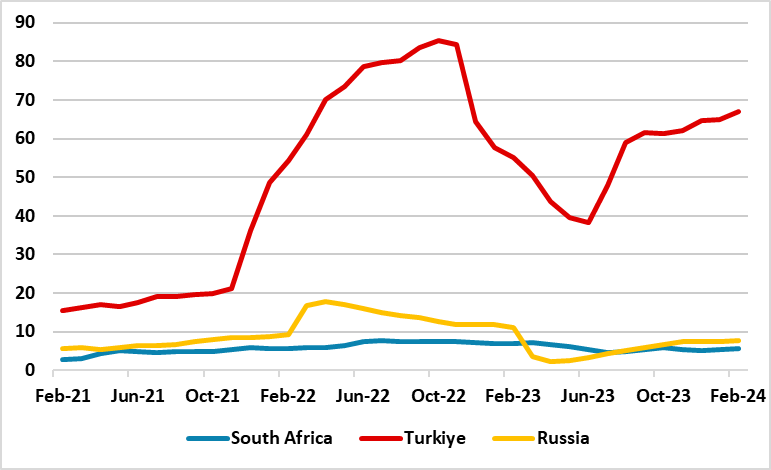

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

March 22, 2024

LatAm Outlook: Getting Deeper in the Cutting Cycle

March 22, 2024 7:04 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates seen in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust agricultural growth will not repeat in 2024, while Mexico growth is restrained by a tigh

March 21, 2024

Banxico Review: 25bps Cut but not Unanimously

March 21, 2024 9:09 PM UTC

Banxico has cut the policy rate by 25bps to 11% from 11.25%. The board stressed the drop on core inflation although their balance of risks is biased to upside. Banxico has not given any forward-guidance stating the next decision will be data-dependent. We believe Banxico will continue to cut the pol

March 19, 2024

Banxico Preview: Ready to Start Cutting

March 19, 2024 2:40 PM UTC

The Banxico board will meet on Mar. 21 to decide the policy rate after 12 months of unchanged rates at 11.25%. With inflation now at 4.4% and signs of economic deceleration, a cutting cycle is anticipated. Banxico's exclusion of forward guidance hints at potential cuts, despite possible dissent amon

March 18, 2024

China: Unbalanced Growth

March 18, 2024 8:28 AM UTC

The February monthly data shows unbalanced growth. Industrial production and public investment picked up, but retail sales slowed and residential property remains a negative drag on GDP. While H1 GDP growth will be ok, it will likely slow in H2 and we still stick to a forecast of 4.4% for 2024 a

March 15, 2024

China: No PBOC MTF Cut and Protesting Low Government Bond Yields

March 15, 2024 8:51 AM UTC

Bottom Line: The PBOC decided not to cut the Medium-Term Facility (MTF) rate, but surprised by also withdrawing liquidity in what looks like a protest at the recent decline in government bond yields. A 10bps MTF cut should still arrive in Q2, but later rather than sooner.

March 13, 2024

Argentina CPI Review: Inflation Eases in February to 13%, but it Still a Long Road

March 13, 2024 8:09 PM UTC

The February CPI release by Argentina's INDEC shows a slight ease in inflation to 13.8% (m/m), yet on an annual basis, it has soared to 276%, hitting a record high since the 1980s. Major increases were noted in Transport (21%), Food and Beverages (11%), and Housing (20%). While indicating initial im

March 11, 2024

China: Lunar New Year Boosts CPI, But Disinflation Still In Place

March 11, 2024 8:29 AM UTC

Bottom Line: February China CPI surged to +0.7% v -0.8% Yr/Yr due to three factors. The late lunar New Year boosted CPI seasonally, while the good lunar New Year also boosted pork/food prices and travel prices. The bounce is unlikely to be sustained and we see a fall back to 0.3-0.4% Yr/Yr in Ma

March 08, 2024

Brazil CPI Preview: 0.7% in February will likely be only a Transitory Problem

March 8, 2024 8:56 PM UTC

IBGE will release February's CPI data on Mar. 12, forecasting a 0.7% increase, driven mainly by education and food sectors. While some rises may persist, they're not indicative of a general price surge. Despite a 0.7% rise, Y/Y CPI is expected to drop to 4.4%, aligning with BCB targets. Forecasts su

March 07, 2024

Mexico CPI Review: CPI Grew 0.1% in February

March 7, 2024 10:16 PM UTC

The February CPI figures released by Mexico's National Institute of Statistics and Geography show a slight 0.1% increase, aligning with expectations. Year-on-year CPI dropped to 4.4%, ending a three-month rise. Food and Beverages notably fell by 1.3%, while Housing and Transports saw positive growth

March 05, 2024

China: 5% 2024 Goal Tough with L Shaped Residential Property

March 5, 2024 9:43 AM UTC

Bottom Line: China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means the old engines of growth are not firing. Some additionally fiscal stimulus will

March 04, 2024

Mexico CPI Preview: Easing Inflation to Back March Cut

March 4, 2024 1:21 PM UTC

INEGI will release February's CPI data, with an expected growth of only 0.1%. Despite this, the Y/Y index is forecasted to fall to 4.4% from January's 4.8%. Notably, Non-Core food CPI contracted by 3.9% in February, showing a reversal from January's rise. We anticipate a 0.3% increase in Core CPI, a