DM Country Research

View:

May 10, 2024

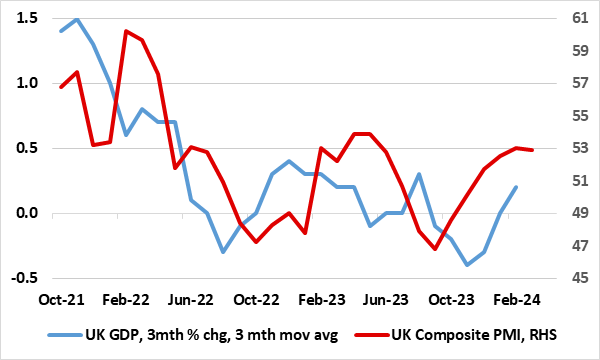

UK GDP Review: Clearer Growth Momentum But Mainly Import Led?

May 10, 2024 6:26 AM UTC

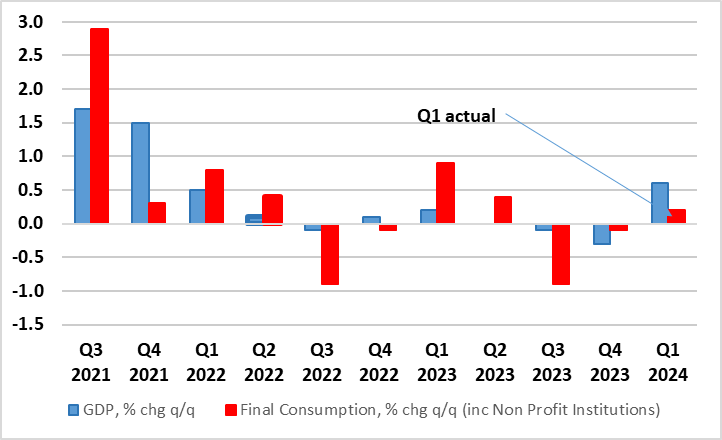

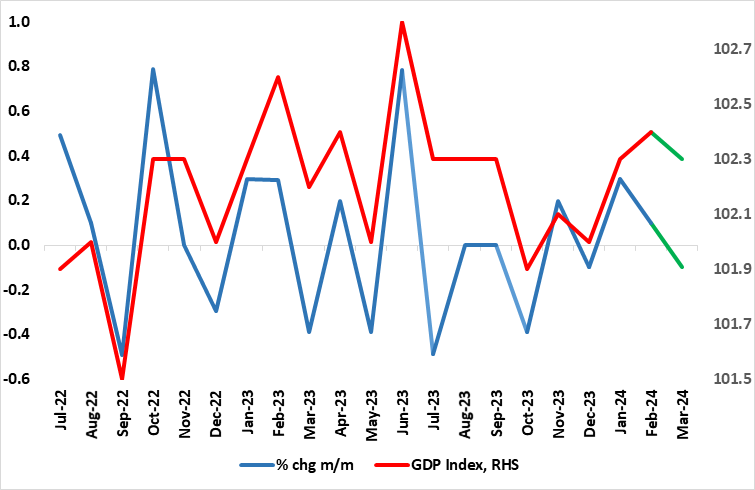

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is much clearer than any expected with GDP growth notably positive. Indeed, coming in more than expected, and despite industrial action, GDP rose by 0.4% m/m in March accentuating the upgraded boun

May 09, 2024

BoE Review: Data Dependent Easing Bias Clearer?

May 9, 2024 12:52 PM UTC

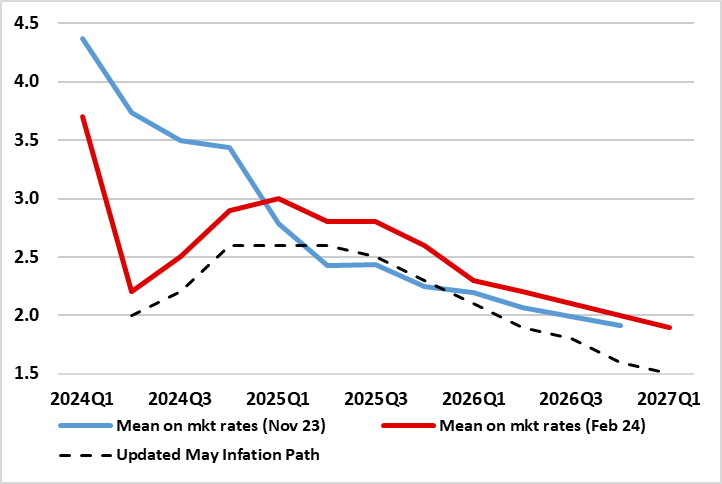

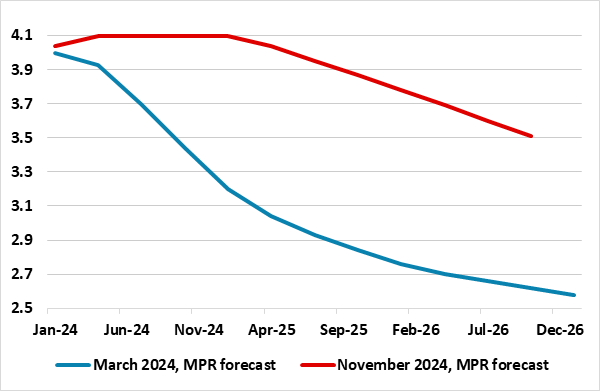

There was little surprise that Bank Rate was kept at 5.25% for the sixth successive MPC meeting, nor that the dissent in favor of an immediate rate cut doubled to two as a result of Dep Gov Ramsden confirming more dovish leanings. The updated projections at least validated the rate path discounted

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

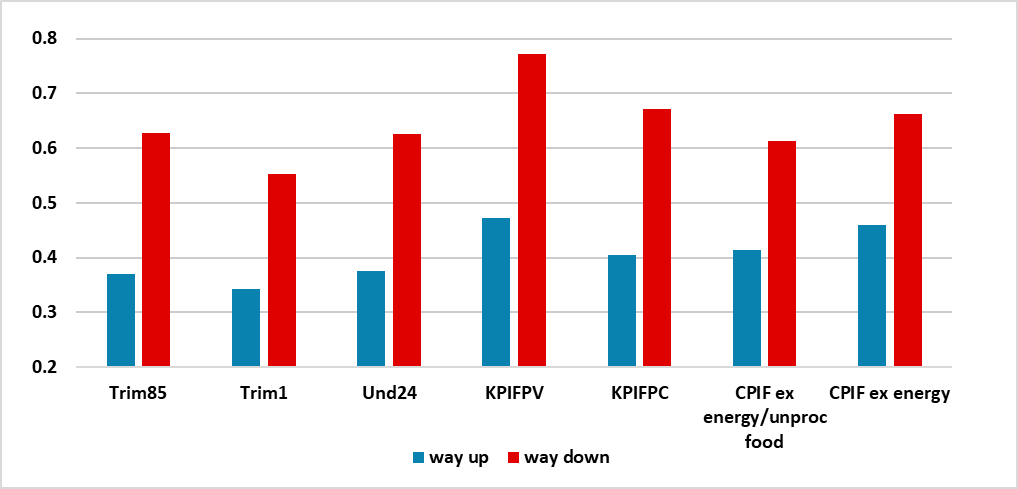

Sweden Riksbank Review: Biting the Bullet

May 8, 2024 8:24 AM UTC

It very much seemed to be a question of when, not if, as far as policy easing is concerned for the Riksbank. In this regard, albeit surprising in terms of timing, the Riksbank delivered, cutting its policy rate by 25 bp (to 3.75%), despite clear concerns it has flagged about recent and continued k

May 07, 2024

U.S. Fiscal Problems: 2025 More Than 2024

May 7, 2024 1:10 PM UTC

Current real yields in the U.S. government bond market already large reflect the large government deficit trajectory. Even so, H1 2025 could see some extra fiscal tensions that add 30-40bps to 10yr U.S. Treasury yields as the post president election environment will either see a reelected Joe Bide

May 03, 2024

Norges Bank Review: Even More Caution?

May 3, 2024 8:46 AM UTC

Surprising few, the Norges Bank Board left the policy rate at 4.5% for a third successive meeting at its latest Board meeting. It also retained the thinking first aired at the December meeting, namely ‘policy to stay on hold for some time ahead’ rhetoric, this more formally evident in what wer

May 02, 2024

BoE Preview (May 9): Easing Bias Clearer?

May 2, 2024 11:06 AM UTC

In flagging no need to be dominated by Fed policy, we think that the BoE is not only moving towards rate cuts but the MPC majority may be overtly advertising such a likelihood. But we do not see any move at the looming May 9 verdict, with Bank Rate again likely to remain at 5.25%. But the accompan

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

Sweden Riksbank Preview (May 8): When, Not If?

May 1, 2024 8:09 AM UTC

It seems to be a question of when, not if as far as policy easing is concerned. Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its last decision

April 30, 2024

UK GDP Preview (May 10): Fragile Sideways-Moving Activity Continues?

April 30, 2024 2:19 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

April 29, 2024

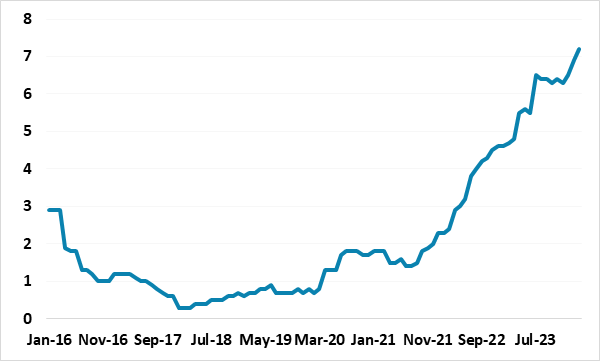

UK Consumers: Rent the Growing Hit to Spending Power

April 29, 2024 2:02 PM UTC

The UK has faced a series of cost-of-living shocks in the last few years. Some such as the surge in food prices may even be reversing, while it now looks likely the BoE hiking cycle may also start to reverse, although rising market rates may mean little further fall in effective mortgage rates in

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

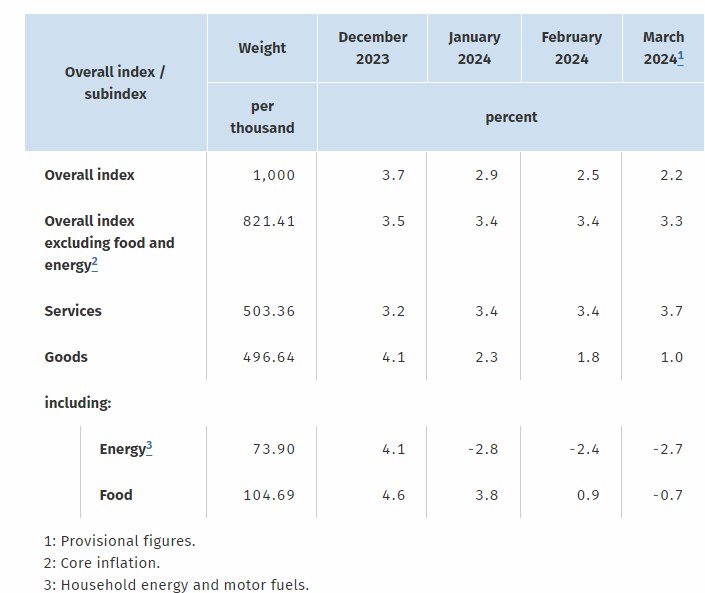

German Data Review: Inflation Edges up Amid Less Resilient Services and Core Rate?

April 29, 2024 12:38 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

April 26, 2024

Headwinds To Long-term Global Growth

April 26, 2024 9:30 AM UTC

Bottom line: While much focus is on the cyclical economic position to determine 2024 monetary policy prospects, the 2025-28 structural growth trajectory differs to the pre 2020 GDP trajectory for major economies. While global fragmentation has a role to play, aging populations are already having a

April 25, 2024

Norges Bank Preview: Nothing New to Note?

April 25, 2024 9:29 AM UTC

Surprising few, the Norges Bank Board is very likely to leave its policy rate at 4.5% for a third successive meeting when it gives it next verdict on May 3. It is also likely to retain the thinking first aired at the December meeting, namely the ‘policy to stay on hold for some time ahead’ rhe

BoJ's Intervention and its impact

April 25, 2024 6:24 AM UTC

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is ke

April 24, 2024

Eurozone GDP Preview (Apr 30): Less Weak?

April 24, 2024 11:06 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation is likely to have continued into Q1 (Figure 1) where we see a flat o

April 23, 2024

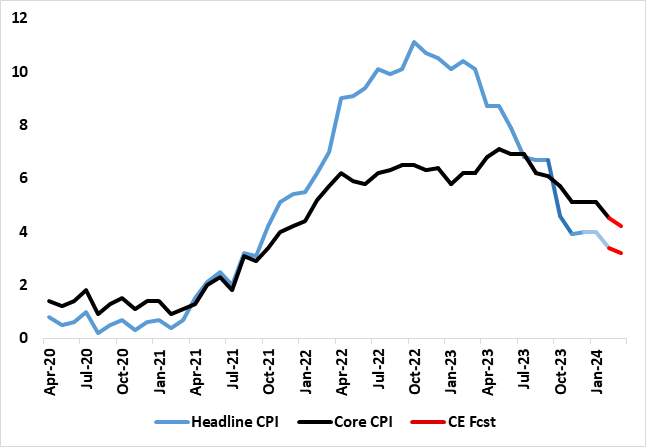

EZ HICP Preview (Apr 30): Core Disinflation Signs to Flatten Out Further?

April 23, 2024 9:43 AM UTC

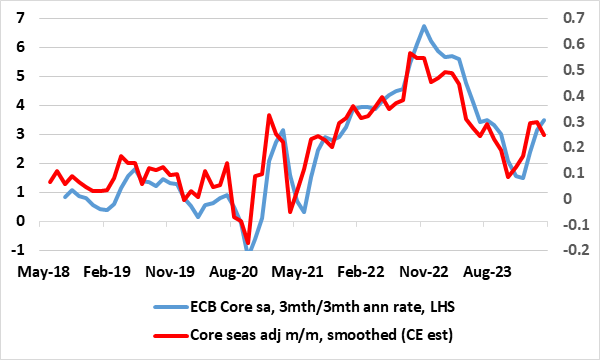

Very much having affected ECB thinking, there has been repeated positive EZ news in the form of falling EZ HICP inflation and somewhat broadly so. This continued in the March HICP numbers, with the 0.2 ppt drops in both headline and core being a notch more sizeable than most anticipated. Regardless,

April 22, 2024

Short-end European Government Bonds Following U.S. But June Decoupling

April 22, 2024 1:15 PM UTC

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a Jun

German Data Preview (Apr 29): Inflation Drop to Continue Amid Less Resilient Services?

April 22, 2024 12:58 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

BoJ Preview: Showing no hurry

April 22, 2024 6:13 AM UTC

Our central forecast is for the BoJ to remain on hold for interest rate and signals the market they are in no rush to further tighten while allowing trend inflation data to lead policy direction in their forward guidance. BoJ has moved interest rate to 0% and officially removed YCC in March, citing

April 18, 2024

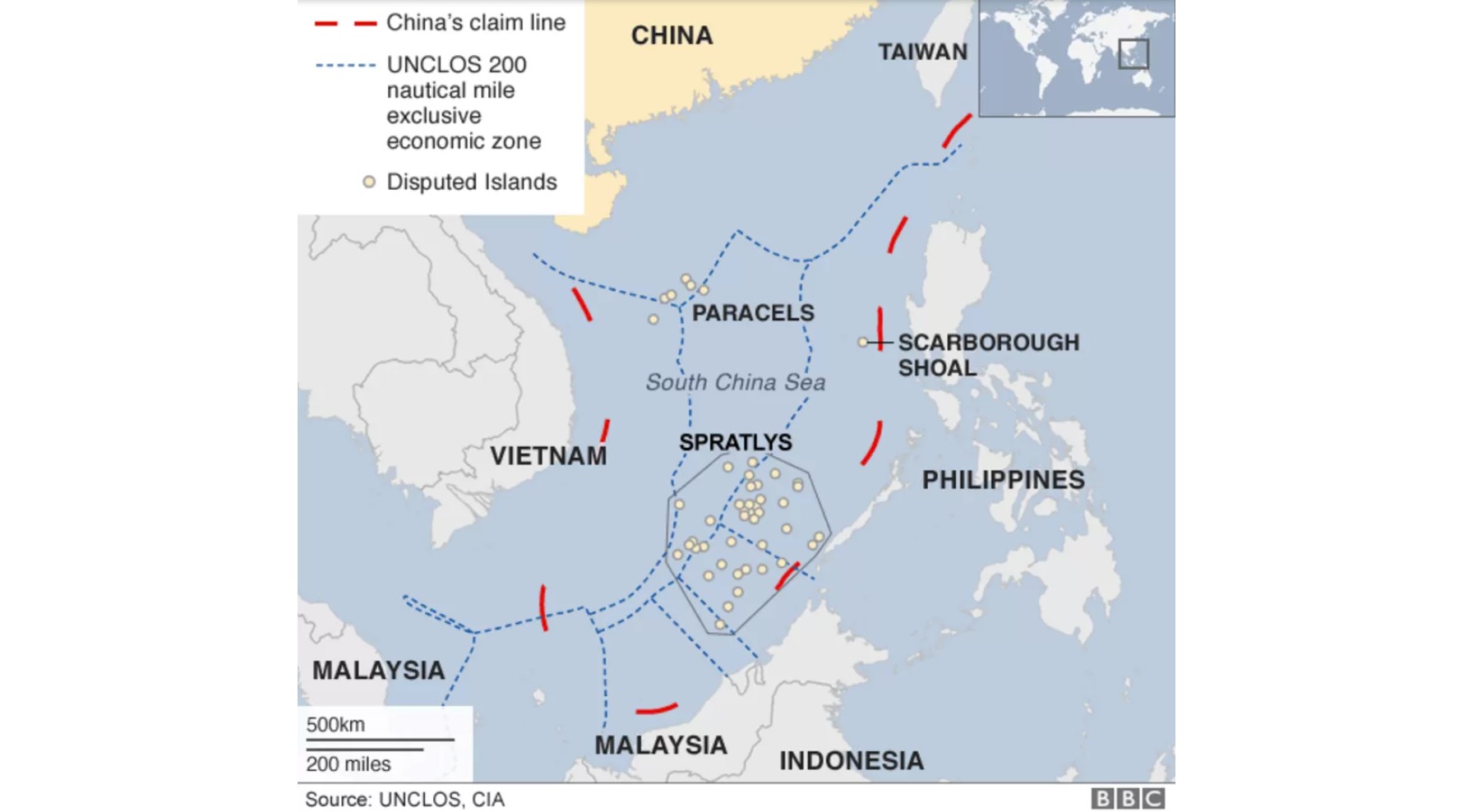

China and the South China Sea

April 18, 2024 2:00 PM UTC

Bottom Line: A China coastguard vessel blocked two Philippines government vessels over the weekend in the Second Thomas shoal area near the Philippines, which has raised questions over whether the South China Sea will be another geopolitical flashpoint. We would say not in 2024, both given China

April 17, 2024

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

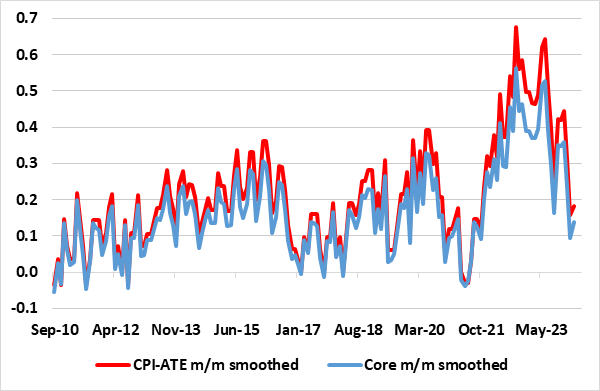

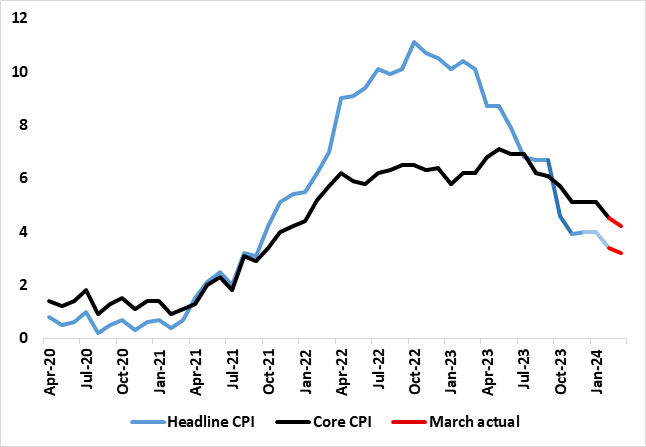

UK CPI Inflation Review: Inflation Fall Further, But Services Momentum Still Evident

April 17, 2024 6:52 AM UTC

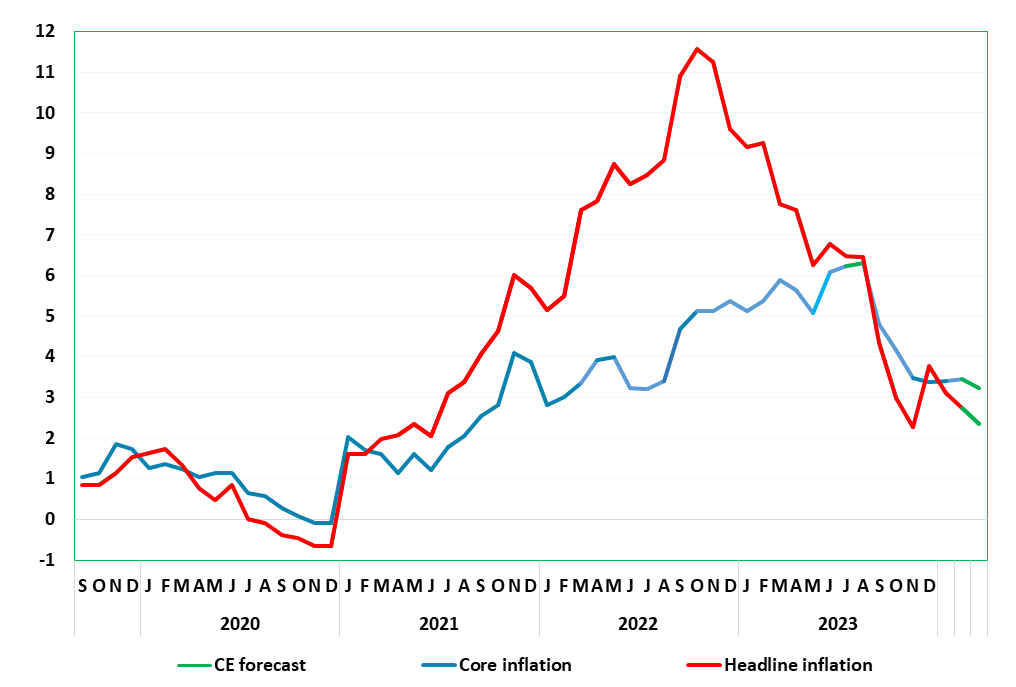

UK headline and core inflation have been on a clear downward trajectory in the last few months, the former having peaked above 10% in February last year and the latter at 7.1% In May. After a pause in the preceding three months, this downtrend seemingly resumed in the February CPI numbers and clearl

April 12, 2024

UK GDP Review: Less Fragile Recovery to Fuel BoE Hawks?

April 12, 2024 6:50 AM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

April 11, 2024

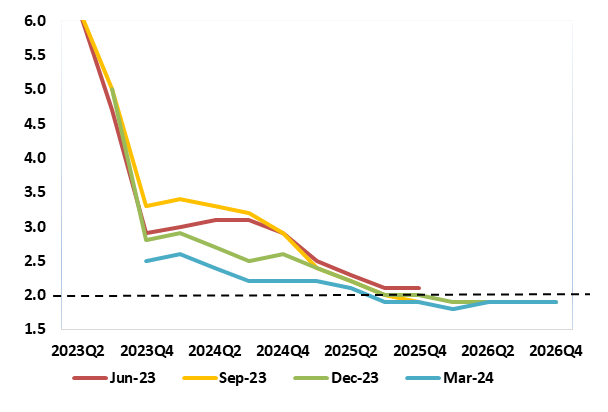

ECB Review: ECB Hums Easing Tune for June

April 11, 2024 1:58 PM UTC

Surprising hardly anyone, the ECB is preparing to cut official rates, after what are now five successive stable policy decisions. It explicitly suggested that it could be appropriate to reduce the current level of monetary policy restriction, a policy hint backed up by dropping its previous rhetoric

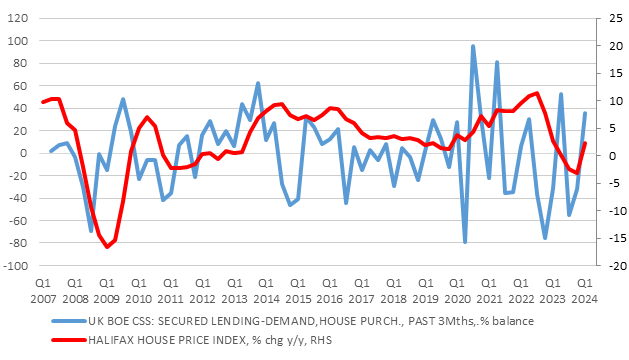

How Durable are Better UK Housing Market Signs?

April 11, 2024 9:45 AM UTC

Amid some mixed remarks from one the MPC hawks, the BoE will be noting more positive housing market signs. The latest RICS survey very much points to a clear pic-up in housing demand, something that chimes with the results in the just-published BoE Credit Conditions Survey (CCS), which also sugges

April 09, 2024

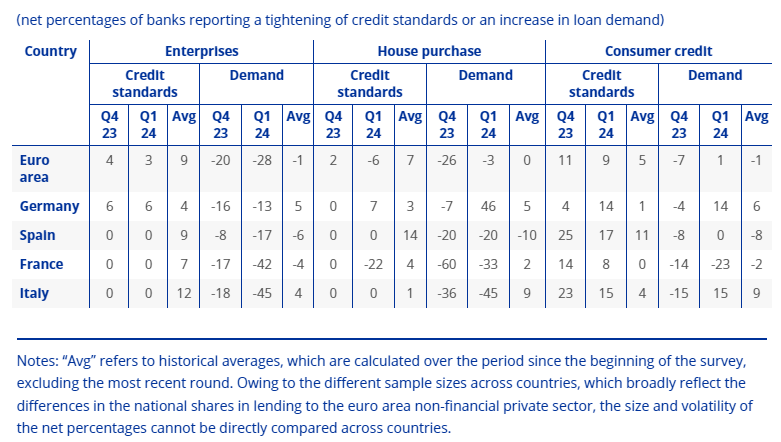

Eurozone Banks See Company Loan Demand Slump as ECB Unconventional Tightening Bites Further

April 9, 2024 9:22 AM UTC

While there may be few positive straws in the wind in the latest (April) 2024 bank lending survey (BLS), the ECB should fund the balance of results still troubling. Company credit demand slumped afresh amid rising interest rates and deferred capex plans. Admittedly, credit supply to firms tighte

April 08, 2024

UK CPI Inflation Preview (Apr 17): Inflation to Fall Broadly Further, But Momentum Still Evident

April 8, 2024 2:12 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expUK headline and core inflation have been on a clear downward trajectory in the last few mont

April 05, 2024

BoE Forecast Report: Uncertain How to Assess Uncertainty?

April 5, 2024 8:14 AM UTC

A long-awaited review of BoE forecasting techniques and goals is due on Apr 12 with a report commissioned by the BoE but authored by ex-Fed Chair Ben Bernanke. It is set to offer alternatives to the way the MPC currently produces and communicates its outlook and has been prompted by marked forecas

April 04, 2024

ECB Preview (Apr 11): Still the Focus on Words Not Deeds – For Now!

April 4, 2024 12:22 PM UTC

As has been the case for several times now, the ECB meeting verdict due next Thursday (Apr 11) will be notable not for what the Council does but rather what is said just as at the March meeting whose minutes were released today. A fifth successive stable policy decision is very much expected, albe

April 03, 2024

UK GDP Preview (Apr 12): Fragile Recovery?

April 3, 2024 1:26 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly going to feel much better with GDP growth hardly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.2% m/m in January more than reversing th

EZ HICP Review: Core Disinflation Flattening Out?

April 3, 2024 9:34 AM UTC

Very much having affected ECB thinking, there has been repeated positive EZ news in the form of falling inflation and somewhat broadly so. This continued in the March HICP numbers, with the 0.2 ppt drops in both headline and core being a notch more sizeable than most anticipated. Regardless, the hea

April 02, 2024

German Data Review: Inflation Drop Continues But Amid Still Resilient Services

April 2, 2024 12:19 PM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the March data came in a notch below expectations for a third successive month. Indeed, it fell from 2.7% to a 33-month low of 2.3% in the March HICP data, dominated by a clear fall in food inflati

EZ: Labour Costs in Retreat Amid Hoarding and Workforce Jump

April 2, 2024 9:46 AM UTC

It is ever clearer how the labour market (and particularly labour costs) are the dominant theme for the ECB is assessing the policy backdrop and outlook. While HICP inflation continues to subside amid an economy backdrop which is flat at best, the labor market still looks apparently unmoved, with

March 27, 2024

EZ HICP Preview (Apr 3): Core Disinflation Signs Start to Flatten Out?

March 27, 2024 1:25 PM UTC

Enough to have affected ECB thinking, there has been repeated positive EZ news in the form of plunging inflation. This continued in the February numbers, albeit with the 0.2 ppt drops in both headline and core being less that most anticipated. Regardless, the headline, at 2.6%, continued its recent

Sweden Riksbank Review: Early Easing to Allow Gradual Moves

March 27, 2024 9:58 AM UTC

Even at it previous policy assessment in February it was clear(er) that the Riksbank accepted that it could and should make its policy stance less contractionary, at least in conventional terms. But its latest decision, again keeping the policy rate at 4%, and no change to the pace of bond sales,

March 26, 2024

German Data Preview (Apr 2): Inflation Drop to Continue Amid Less Resilient Services?

March 26, 2024 10:58 AM UTC

As we have repeatedly underlined, base effects continue to distort the German HICP/CPI readings, but the January data came in a notch below expectations, and reversed half of the surge in the y/y rate seen in December. And February data continued the downtrend, as the HICP rate fell from 3.1% to 2

March 25, 2024

Japan Outlook: Beginning of A New Era?

March 25, 2024 4:54 AM UTC

Bottom Line:

Forecast changes: We revised 2024 GDP lower to +0.8% from +0.9% because private consumption is now expected to contract in Q1 2024. 2024 CPI is revised higher to +2.1% from +1.7% to address the stronger wage hike Japanese unions secured.

March 22, 2024

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

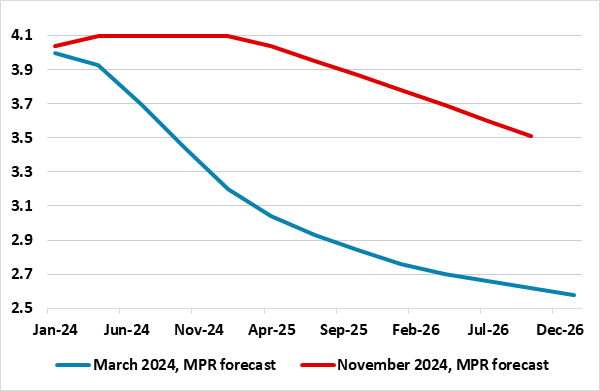

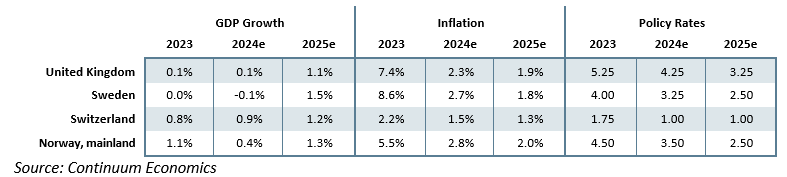

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e