Outlook

View:

April 03, 2024

March 27, 2024

March 26, 2024

March 25, 2024

EMEA Outlook: Elections Set the Scene in Q2

March 25, 2024 2:00 PM UTC

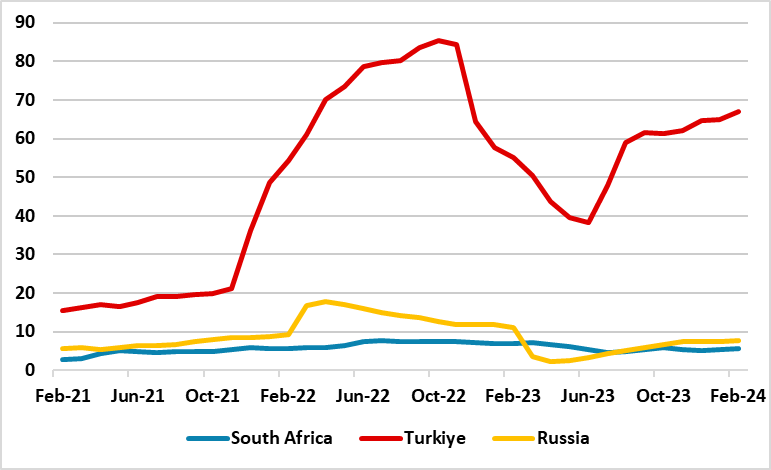

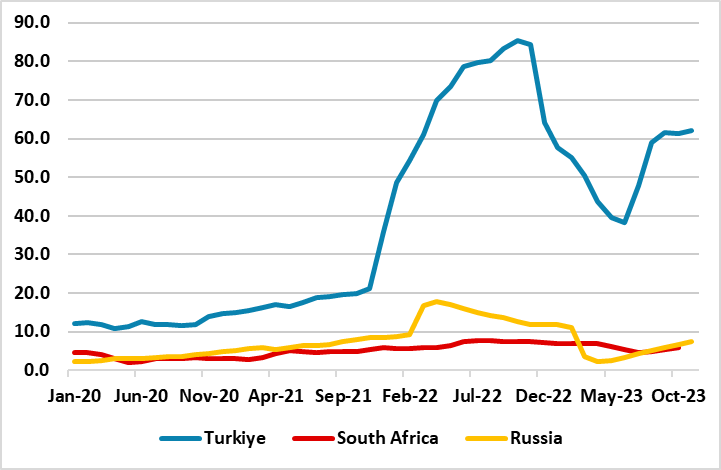

· Unlike South Africa and Russia, Turkiye continued with tightening monetary policy in Q1 due to stubborn inflation, pressure on FX and reserves. Meanwhile, Russia and South Africa halted their tightening cycles as of 2024 and will likely start cutting interest rates in Q3 depending on how

DM FX Outlook: JPY weakness to reverse

March 25, 2024 12:21 PM UTC

· Bottom Line: Q1 has seen a generally seen a rangebound USD against riskier currencies, but JPY weakness has resumed in spite of a BoJ rate hike and narrowing yield spreads. This reflects continued positive risk sentiment in developed market equities, but we still expect JPY strength t

Equities Outlook: Cyclical Recovery Versus Structural Headwinds

March 25, 2024 9:00 AM UTC

· In the U.S., a tug of war between momentum and U.S. exceptionalism on the one side versus valuations and any deviations from the U.S. goldilocks scenario now means volatility and a risk of a correction. We feel that the U.S. equity market recovery can push onto 5250 for the S&P5

Japan Outlook: Beginning of A New Era?

March 25, 2024 4:54 AM UTC

Bottom Line:

Forecast changes: We revised 2024 GDP lower to +0.8% from +0.9% because private consumption is now expected to contract in Q1 2024. 2024 CPI is revised higher to +2.1% from +1.7% to address the stronger wage hike Japanese unions secured.

March 22, 2024

LatAm Outlook: Getting Deeper in the Cutting Cycle

March 22, 2024 7:04 PM UTC

· Brazil and Mexico growth will decelerate from the growth rates seen in 2023. The stronger basis of comparisons in 2023 and the tight monetary policy will diminish growth during 2024. Brazil robust agricultural growth will not repeat in 2024, while Mexico growth is restrained by a tigh

Asia/Pacific (ex-China/Japan) Outlook: Election Spending to Drive Growth

March 22, 2024 12:18 PM UTC

· In 2024, growth trends across emerging Asia will exhibit a mixed pattern. Encouragingly, there will be a resurgence in demand for global electronics following a period of stagnation in 2022‑23, which will provide a boost to regional trade. Moreover, the initiation of monetary policy

Western Europe Outlook: Easing Cycle Underway?

March 22, 2024 11:26 AM UTC

· In the UK, downside economic risks may have dissipated but the tighter monetary stance has far from fully bitten. This accentuates and/or prolongs an already weak domestic backdrop into 2025 that will complement friendlier supply conditions in easing inflation. The BoE will likely e

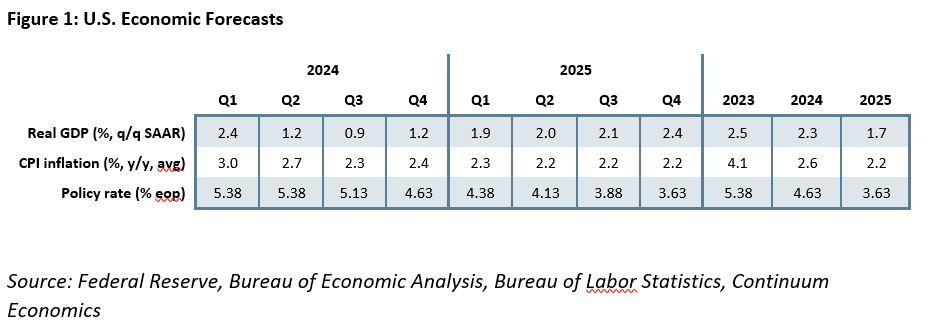

U.S. Outlook: Fed to Ease as Economy Gradually Slows

March 22, 2024 10:00 AM UTC

• The U.S. economy has continued to see growth surprising to the upside supported in particular by consumer spending. While the momentum of the second half of 2023 will be difficult to sustain the economy now looks poised for a soft landing, with risk that continued resilience in the econom

March 20, 2024

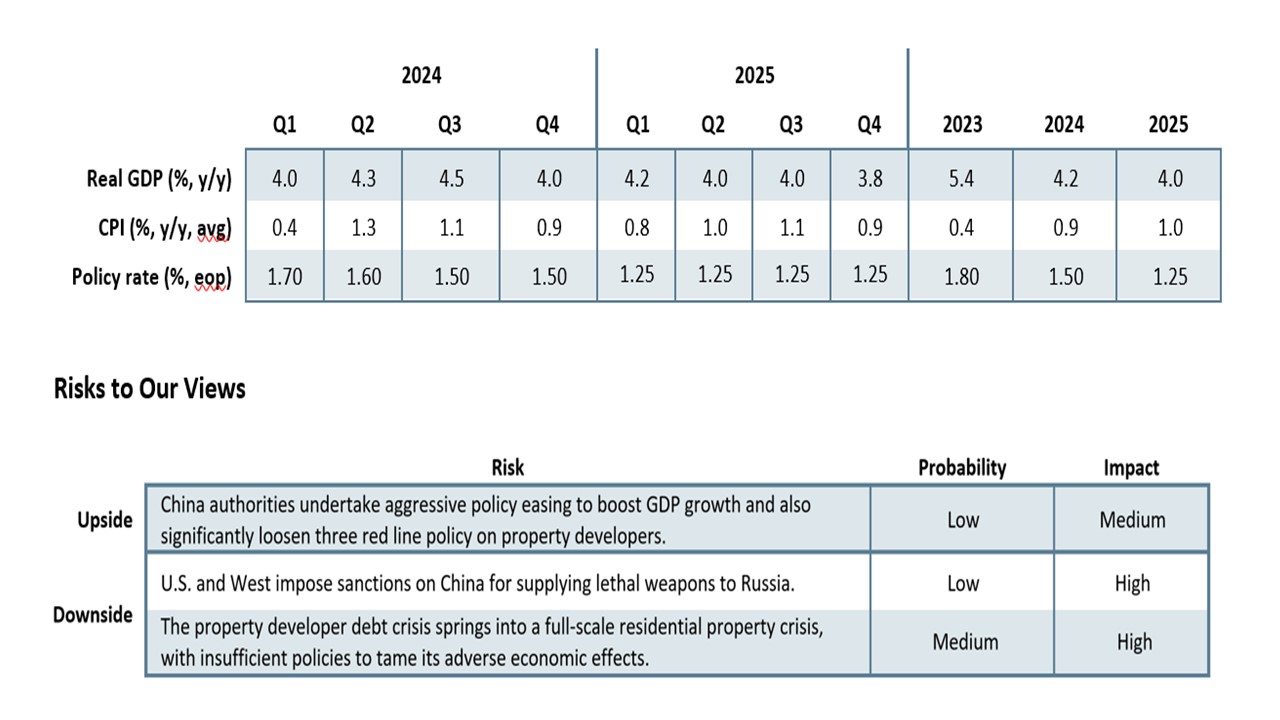

China Outlook: The Struggle to Hit 5% Growth

March 20, 2024 11:00 AM UTC

China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means some of the old engines of growth are not firing. Some additional fiscal stimulus will likely

January 11, 2024

Webinar Recording December Outlook: Rate Cuts Into 2024

January 11, 2024 8:22 AM UTC

You can now access the webinar for the December Outlook here.

To read the individual chapters please see the weblink below.

Outlook Overview: Rate Cuts Into 2024 (here)

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

China Outloo

January 08, 2024

Charting our Views December Outlook

January 8, 2024 9:05 AM UTC

Outlook Overview: Rate Cuts Into 2024 (here)

Economic Scenarios

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

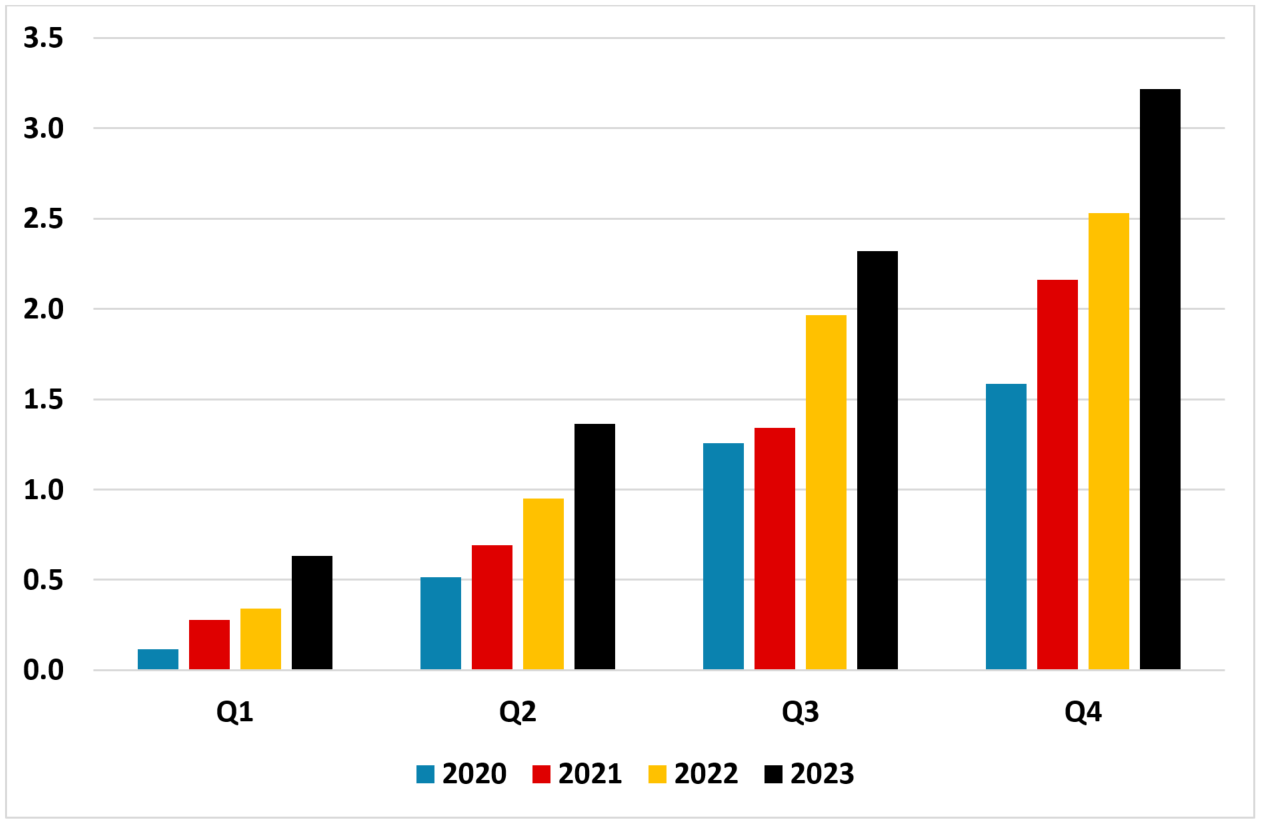

Brazil Policy Rate and CPI Inflation (YoY, %)

China Outlook: Headwinds To China Growth (here)

Japan Outlook: Normalizing

January 02, 2024

December Outlook: Rate Cuts Into 2024

January 2, 2024 9:53 AM UTC

Outlook Overview: Rate Cuts Into 2024 (here)

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

China Outlook: Headwinds To China Growth (here)

Japan Outlook: Normalizing Monetary Policy Soon (here)

Asia/Pacific (ex-China/Japan) Outlook:

December 20, 2023

Outlook Forecasts to download in Excel

December 20, 2023 7:31 AM UTC

We forecast across 23 countries annual and quarterly. Our annual forecasts go out to 2028, while our quarterly forecasts are now updated out to Q4 2025. The forecasts are consistent with the December Global Outlook ‘Rate Cuts Into 2024’ published on 18th December 2023.

The file contains nine sh

December 19, 2023

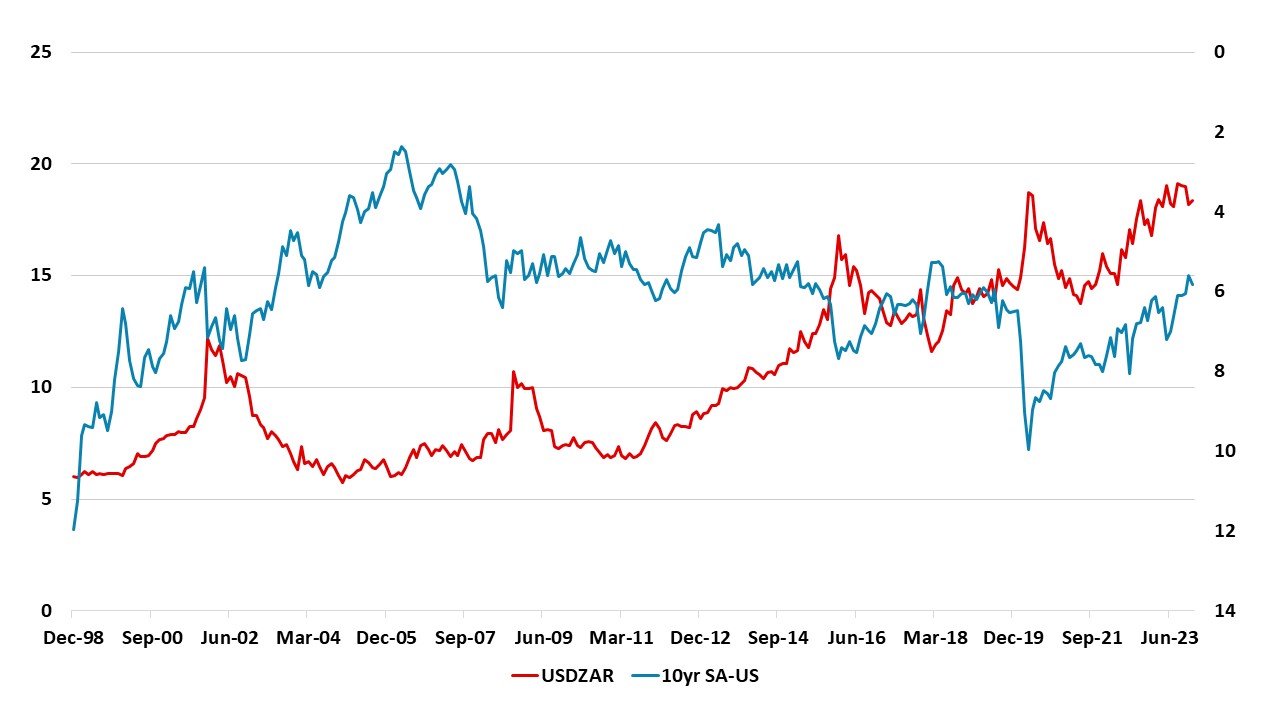

EM FX Outlook: USD Decline v Inflation Differentials

December 19, 2023 9:59 AM UTC

· In spot terms, we see the Indonesian Rupiah (IDR) and Malaysian Ringgit (MYR) rising against the USD as Fed rate cuts narrow interest rate differentials and a move away from an overvalued USD occurs. Brazilian Real (BRL) and Mexican Peso (MXN) will likely be stable against the USD

DM FX Outlook: 2024 - The Year of the Yen

December 19, 2023 9:06 AM UTC

Figure 1: Real effective exchange rates

Source: BIS

JPY weakness has been dramatic

The JPY has fallen more than 30% in real effective terms against other major currencies in the last 3 years, as a result of the rise in inflation seen in the U.S. and Europe and the consequent rise in interest rates in t

Japan Outlook: Normalizing Monetary Policy Soon

December 19, 2023 9:00 AM UTC

Macroeconomic and Policy Dynamics

Japanese headline inflation continues to moderate throughout 2023 as post COVID pent up demand fades and as supply chain disruption dissipates still further. However, the pace of moderation has been on a rocky road for food inflation (record chicken culling on bird f

December 18, 2023

Outlook Overview: Rate Cuts Into 2024

December 18, 2023 3:42 PM UTC

· Uncertainty still prevails around this central view. The impact of lagged monetary tightening could be greater than our estimates and deliver mild recessions in some DM countries. We also feel that the disinflationary process could be stronger and this would help bring inflation back

Asia/Pacific (ex-China/Japan) Outlook: Going Big, Going Strong

December 18, 2023 10:05 AM UTC

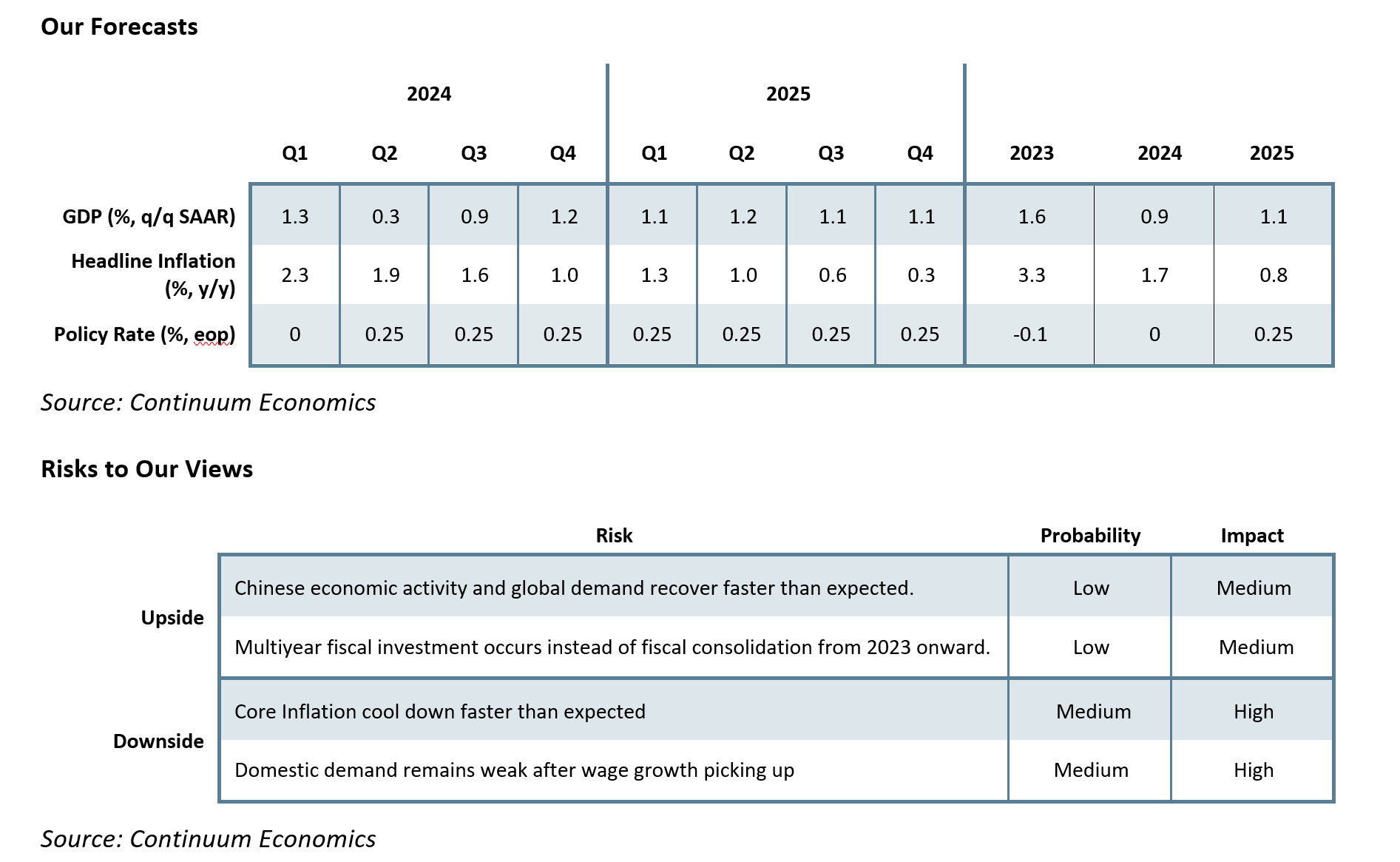

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

Regional Dynamics: Mixed Prospects in 2024

In H1-2024, much like in 2023, the emerging economies in Asia will continue to outperform other emerging markets and display notable resilience in comparison to develope

EMEA Outlook: Inflationary Pressures Remain Strong

December 18, 2023 10:01 AM UTC

Our Forecasts

Source: Continuum Economics

Risks to Our Views

Source: Continuum Economics

EMEA Dynamics: Inflationary Concerns Remain High

EMEA economies continue to be squeezed by macroeconomic problems such as elevated inflation and financial pressures. We think country specific factors, geopolitics,

December 15, 2023

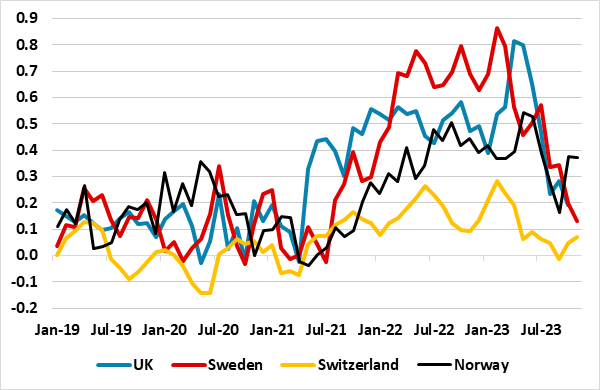

Western Europe Outlook: Inflation Succumbing?

December 15, 2023 2:44 PM UTC

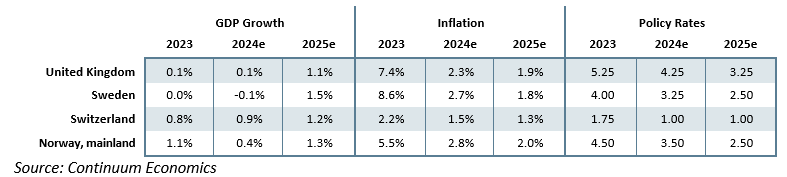

Our Forecasts

Risks to Our Views

Common Themes

There continue to be clear cross currents across Western Europe’s economies that may continue into 2024 and possibly beyond, all inter-related. Firstly, while we have made little alteration to the 2024 outlooks for all four countries, they remain very

LatAm Outlook: Diverging Paths in 2024

December 15, 2023 12:25 PM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Switching Back to Slow Growth?

Brazil growth has finally begun to decelerate (here), as the growth in the third quarter dropped to 0.1% (q/q). However, growth for 2023 is expected to stand at 3.2% (Yr/Yr) which is quite a bit higher th

Commodities Outlook: Economic Forces at Play

December 15, 2023 11:21 AM UTC

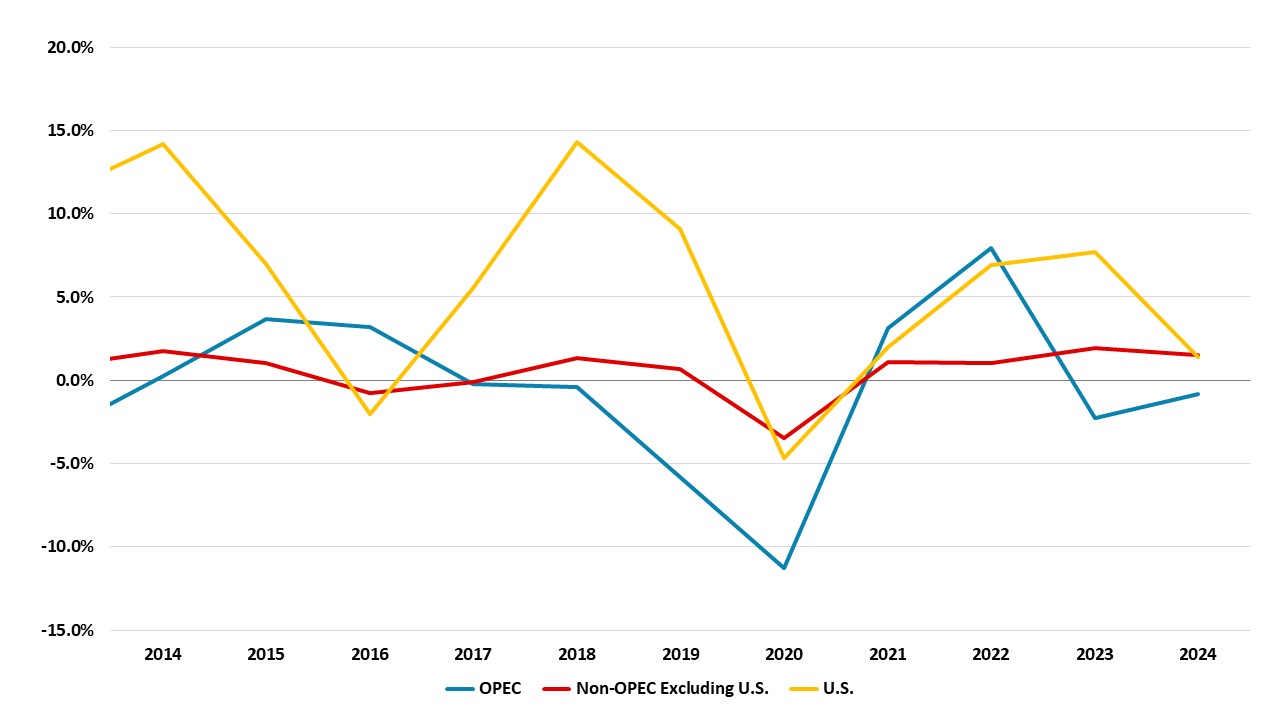

• Oil: Production Cuts and Demand DynamicsThe trajectory of oil prices will be significantly shaped by both the production policies to be adopted by OPEC and the global economic growth. In light of the voluntary cuts agreed upon by several countries within the cartel during the November 202

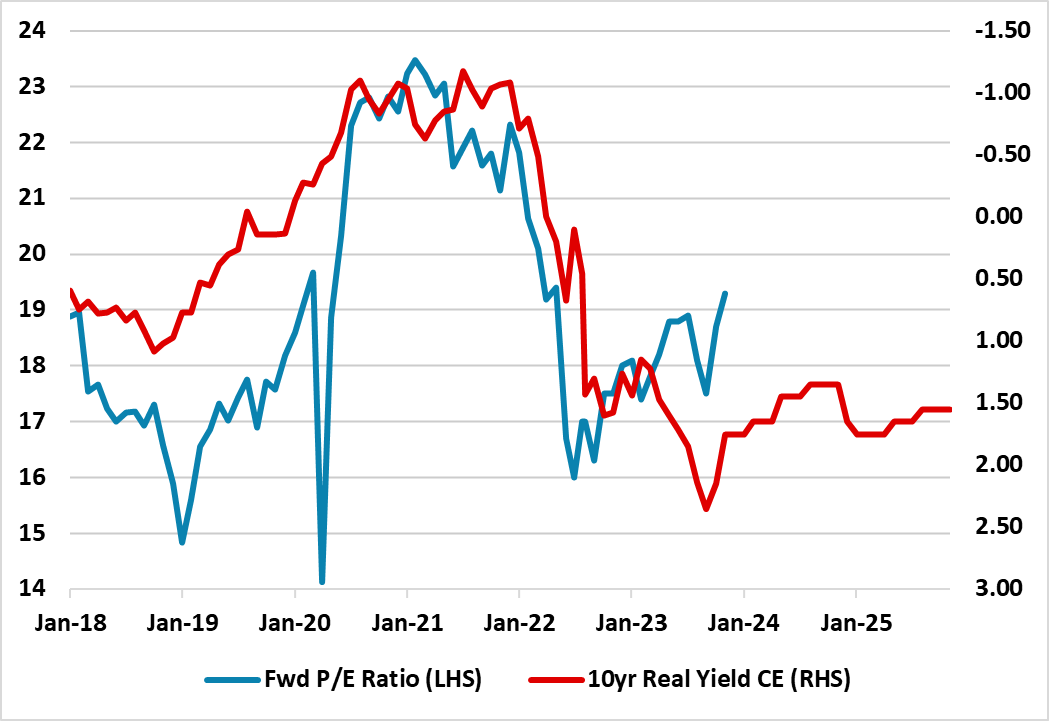

Equities Outlook: Rate Cuts To Help in 2024

December 15, 2023 11:00 AM UTC

Equities Outlook: Rate Cuts To Help in 2024

· For other DM equity markets, EZ and UK are undervalued in contrast to the U.S., but are in or close to recessions and economic recovery will likely be weak and disappointing. Though the ECB and BOE will likely ease in Q2 with the Fed, we

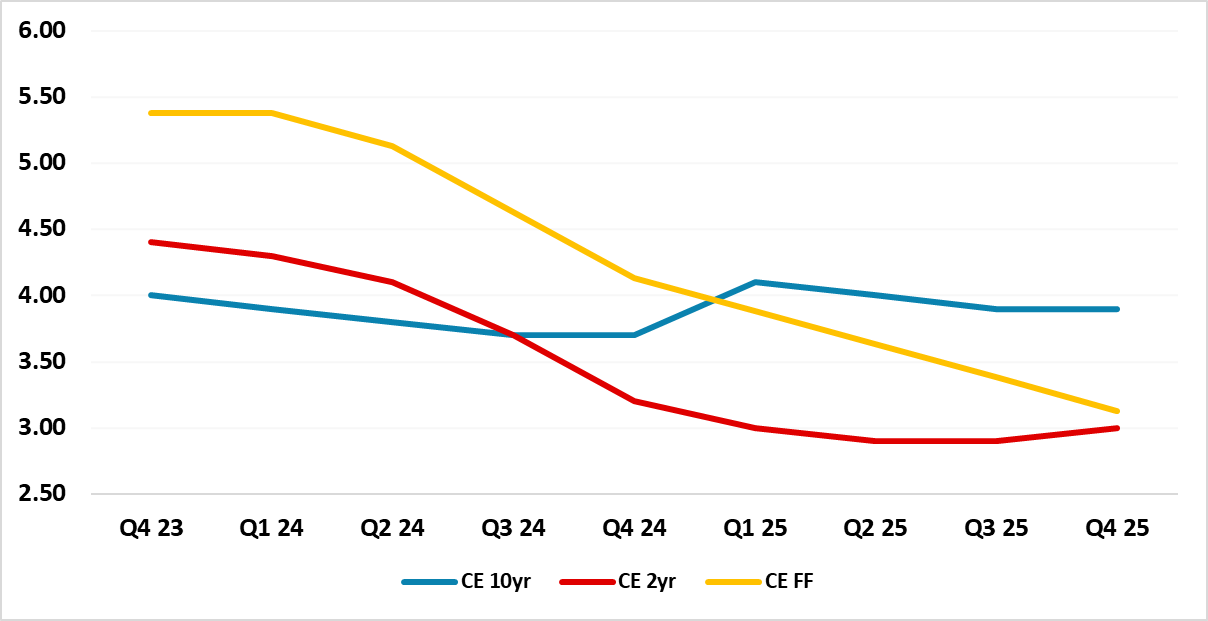

DM Rates Outlook: Front End Favored

December 15, 2023 10:19 AM UTC

• EZ debt yields will also see a swing back towards a positive shaped yield curve. Gradual ECB rate cuts will translate into a persistent decline in 2yr yields in 2024, but slower in 2025 as the market will be uncertain about the terminal policy rate and the ECB forward guidance will like

Eurozone Outlook: A Different Inflation Story?

December 15, 2023 10:16 AM UTC

Our Forecasts

Risks to Our Views

Eurozone: Price Pressures Receding Clearly

That the EZ economy is probably in recession, albeit a modest one, misses the point as the zero growth of the last year would have been some two ppt weaker were it not for the slump in imports. This is important as it not onl

China Outlook: Headwinds To Growth

December 15, 2023 10:06 AM UTC

Our Forecasts

Source: Continuum Economics

Policy Stimulus Insufficient to Stop Slowing

China is facing a number of headwinds that will make 5% growth difficult to achieve in 2024. Key issues include:

· Property construction downturn. China authorities have undertaken

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture

December 15, 2023 10:01 AM UTC

· Given the strength of recent GDP growth the Fed is rightly cautious about declaring victory on inflation despite recent encouraging progress. Should data surprise to the upside, the Fed could still tighten again, even if it now looks unlikely. However, we believe that data will sh

November 16, 2023

Long-term Forecasts to download in Excel

November 16, 2023 10:38 AM UTC

We present our annual forecasts that go out to 2030 for GDP Growth, Inflation, and Monetary Policy and to 2028 for Exchange Rates. The file contains five sheets: a Country Coverage summary page and a sheet for each of the four indicators.

The forecasts are consistent with the Long-term Forecasts: DM

Long-term Forecasts: DM Policy Easing

November 16, 2023 8:44 AM UTC

The Continuum Economics research team has spent much of the last month researching, reviewing and debating our long-term GDP, CPI inflation and central bank policy rate forecasts for 2025-30. Alongside a reassessment of long-term factors such as productivity and demographics, we have examined the la

October 03, 2023

Webinar and Q3 Outlook Chapters Links

October 3, 2023 12:46 PM UTC

U.S. Outlook: Slower Growth but no Recession (here)

LatAm Outlook: Growth Continues (here)

China Outlook: Policy Stimulus Not Enough (here)

Japan Outlook: The First Step to Exit (here)

Asia/Pacific (ex-China/Japan) Outlook: Public Spending to be Catalyst (here)

Eurozone Outlook: Monetary Masochism (here

September 29, 2023

Q3 Outlook Chapters Links

September 29, 2023 8:41 AM UTC

U.S. Outlook: Slower Growth but no Recession (here)

LatAm Outlook: Growth Continues (here)

China Outlook: Policy Stimulus Not Enough (here)

Japan Outlook: The First Step to Exit (here)

Asia/Pacific (ex-China/Japan) Outlook: Public Spending to be Catalyst (here)

Eurozone Outlook: Monetary Masochism (here

September 28, 2023

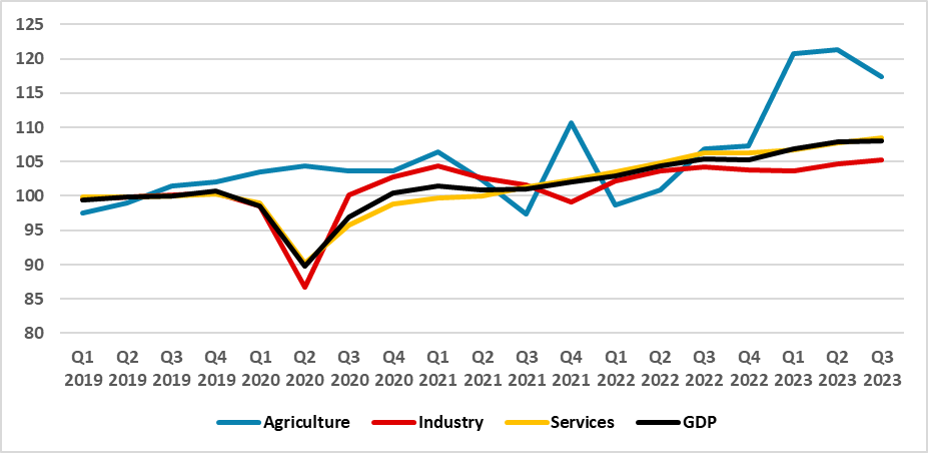

LatAm Outlook: Growth Continues

September 28, 2023 8:46 PM UTC

Our Forecasts

Risks to Our Views

Source: Continuum Economics

Brazil: Brighter than Expected

The Brazilian economy has surpassed expectations in the first half of this year. In the initial quarter, robust growth was predominantly driven by an exceptional surge in the agricultural sector, as soybean produ

EM FX Outlook: Divergent Prospects

September 28, 2023 8:29 AM UTC

Figure 1: Our Forecast for Total Returns by end-2023 (vs. USD)

Source: Continuum Economics. Note: Spot prices as of September 27

EM Asia FX

Our view remains that China is willing to accept a slow and moderate decline in the Yuan to help exports but wants to avoid a quick move that could trigger capit

DM FX Outlook: USD strength to fade into 2024

September 28, 2023 8:26 AM UTC

Figure 1: EUR/USD has declined as U.S. 2 year yields have risen

Source: Continuum Economics/Datastream

Rising U.S. yields and rising spreads in favour of the USD have been the prime driver of USD strength

The USD has strengthened through the summer as the market has priced in a less dovish view of the

EMEA Outlook: Domestic Factors and Geopolitics Dominate Heading to 2024 Election Year

September 28, 2023 7:45 AM UTC

EMEA Dynamics: Domestic Factors and Geopolitics Continue to Dominate the Outlook during 2024 Election Year

EMEA economies continue to be squeezed by the elevated DM interest rates, high oil and certain food prices, EU and China slowdown. However, country specific factors and geopolitics will continue

DM Rates Outlook: Peaking Policy Rates and Less Yield Curve Inversion

September 28, 2023 7:16 AM UTC

Risks to our views: A mild recession in the U.S. would lead to larger than projected Fed easing in 2024, which would bring yields down across the curve – though still with disinversion occurring. The spillover would impact government bond yields in other DM countries except Japan.

Figure 1: U.S.

Equities Outlook: Diverging Earnings and Valuations

September 28, 2023 6:33 AM UTC

Risks to our views: Larger than expected effects from DM monetary tightening could cause downside surprises on U.S./EZ growth and hurt the global economy and earnings outlook. Equities would see a volatile 2024, with downside and then a rebound (on more aggressive policy easing) but less overall net