United States

View:

May 10, 2024

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

May 06, 2024

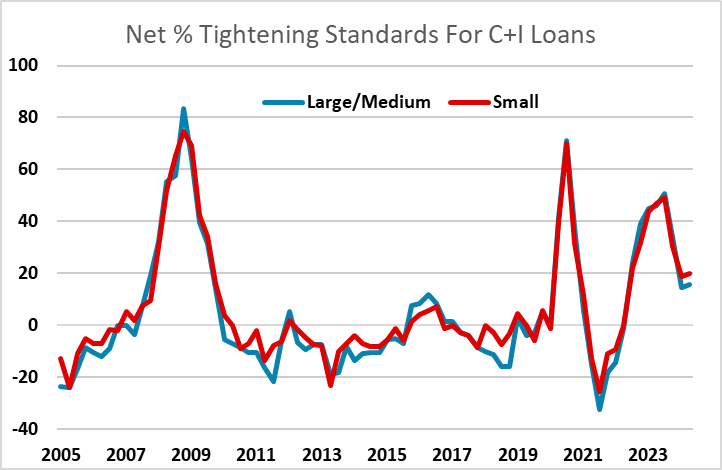

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

May 03, 2024

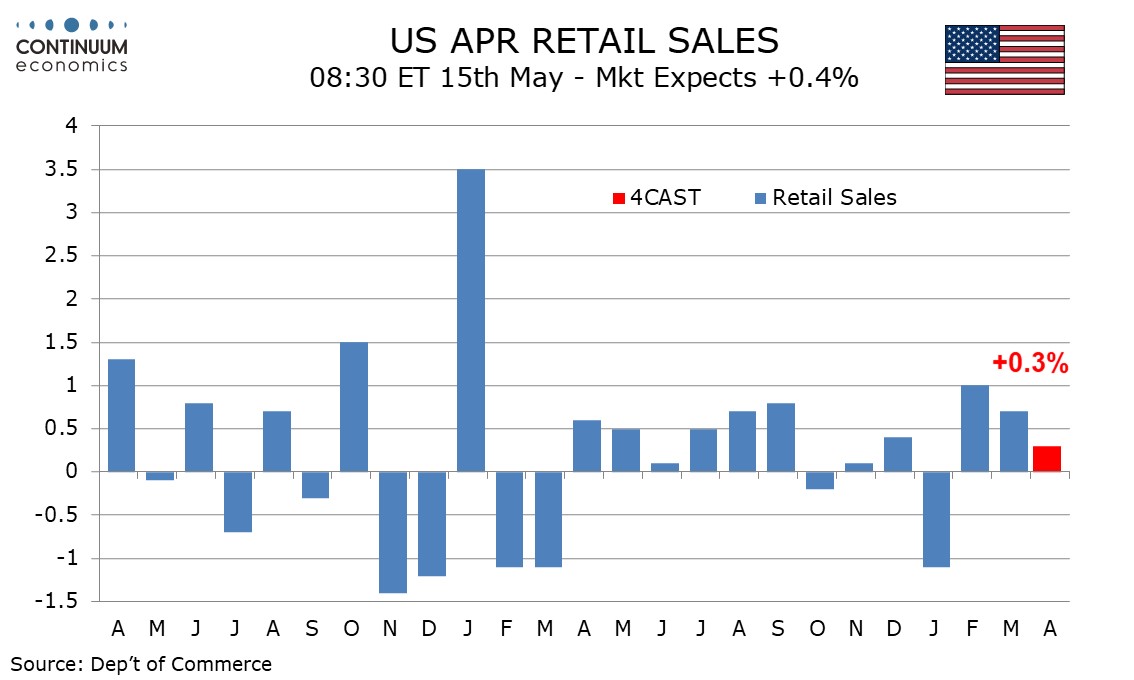

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 3, 2024 5:00 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

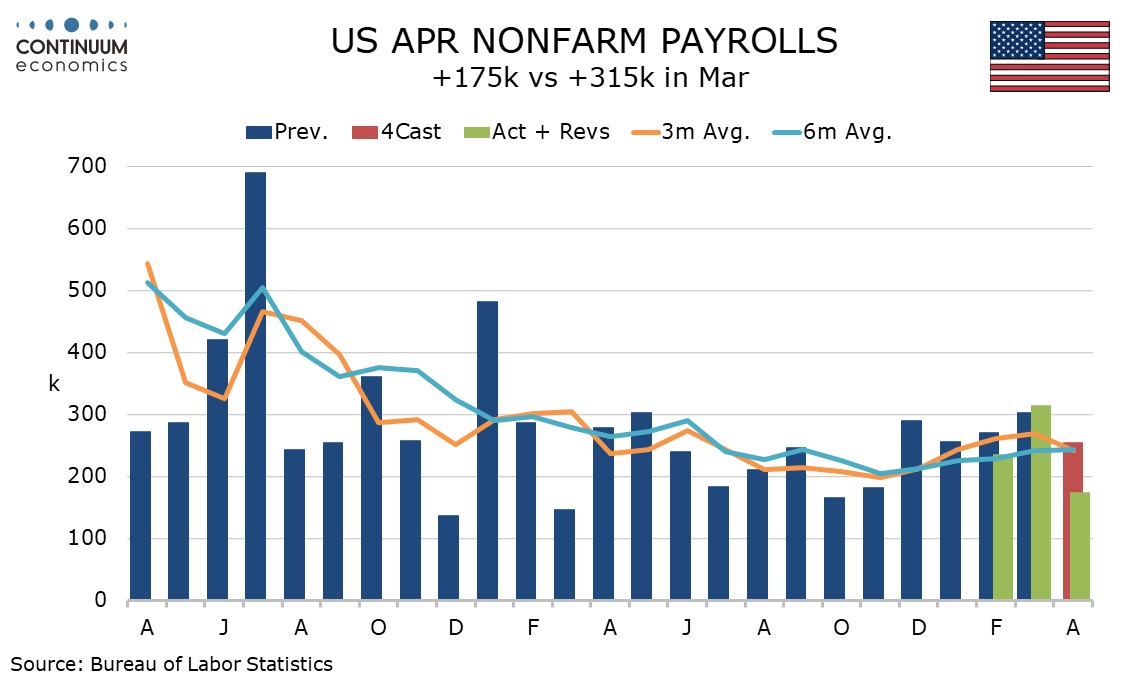

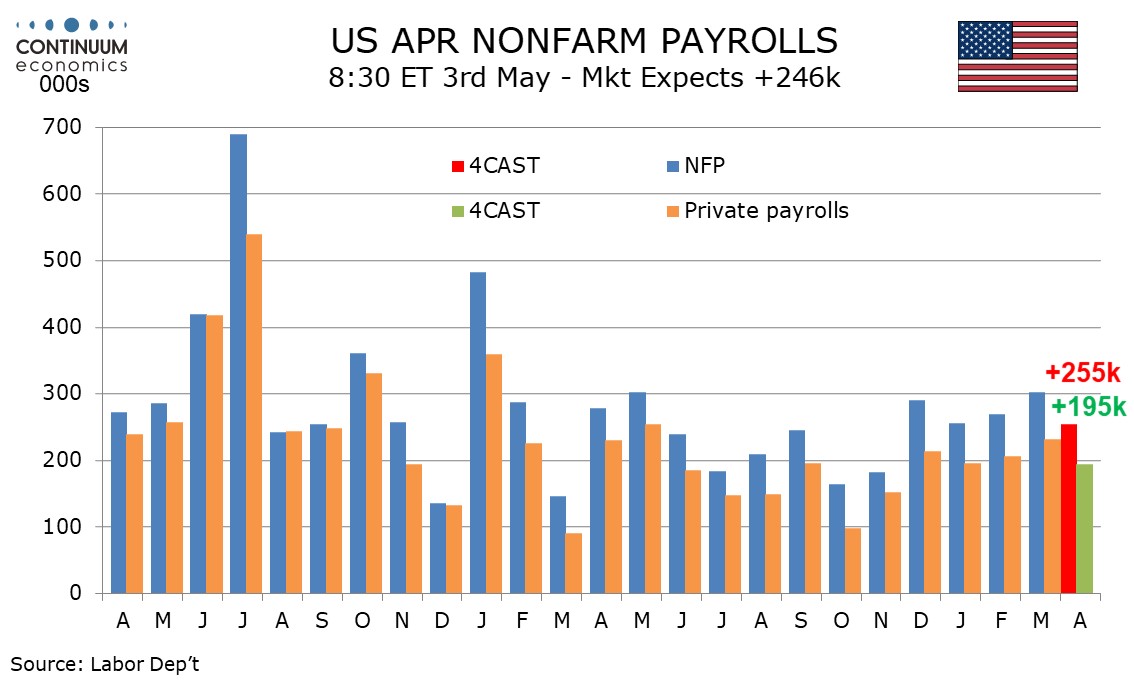

U.S. April Employment - On the weak side in all key details, following strength in March

May 3, 2024 1:18 PM UTC

April’s non-farm payroll is on the low side of consensus across the board, with a 175k increase (though the 167k private sector rise is only modestly below consensus), with a 0.2% rise in average hourly earnings, a fall in the workweek and a rise in unemployment to 3.9% from 3.8%. The data should

May 02, 2024

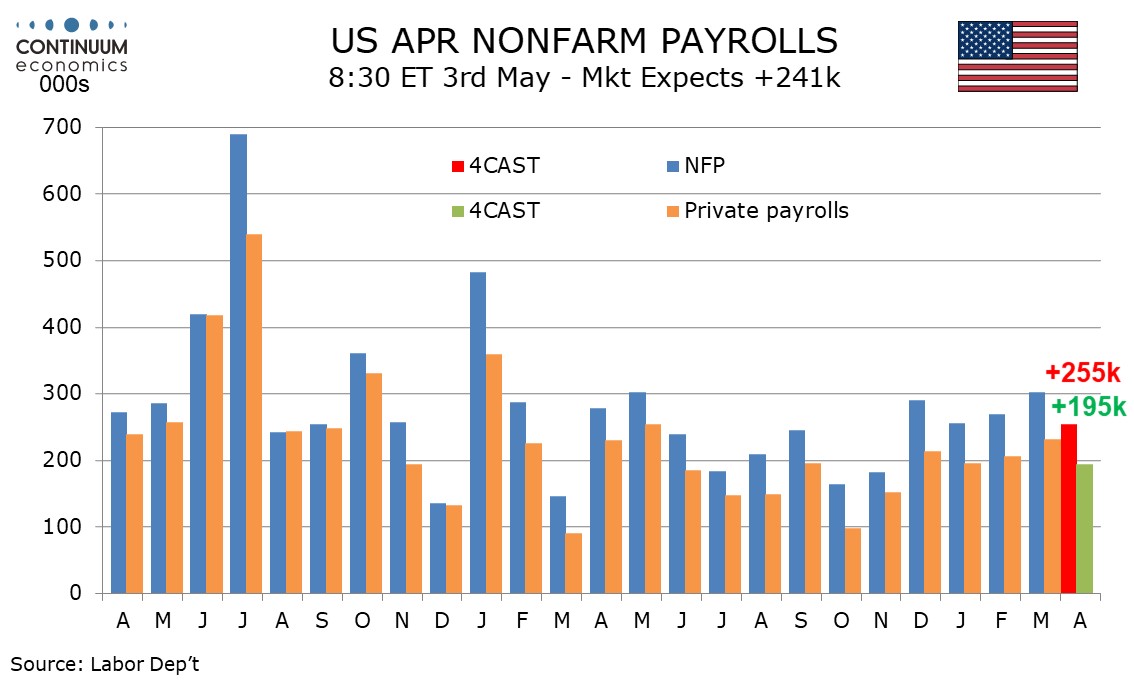

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

May 2, 2024 2:03 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

May 01, 2024

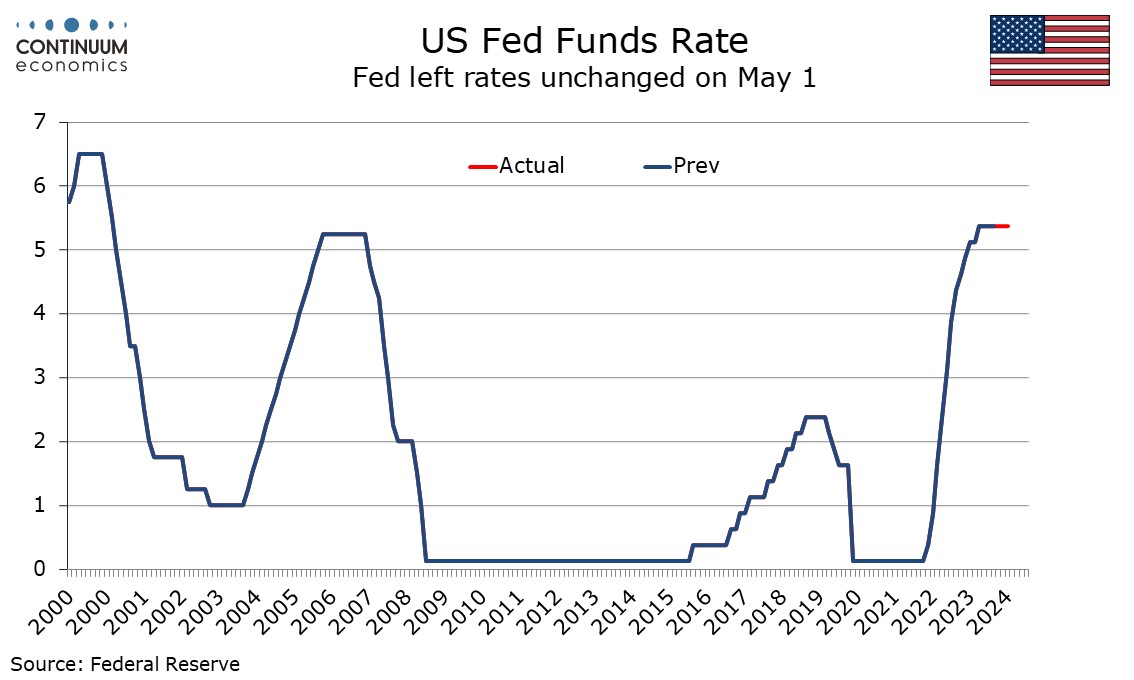

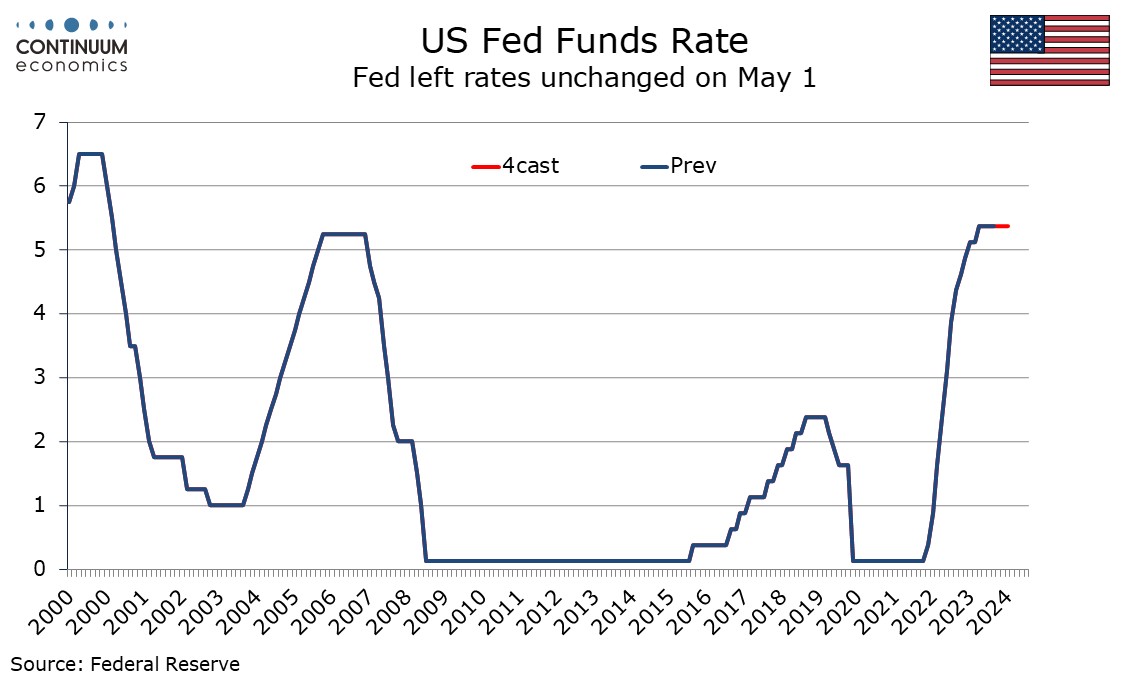

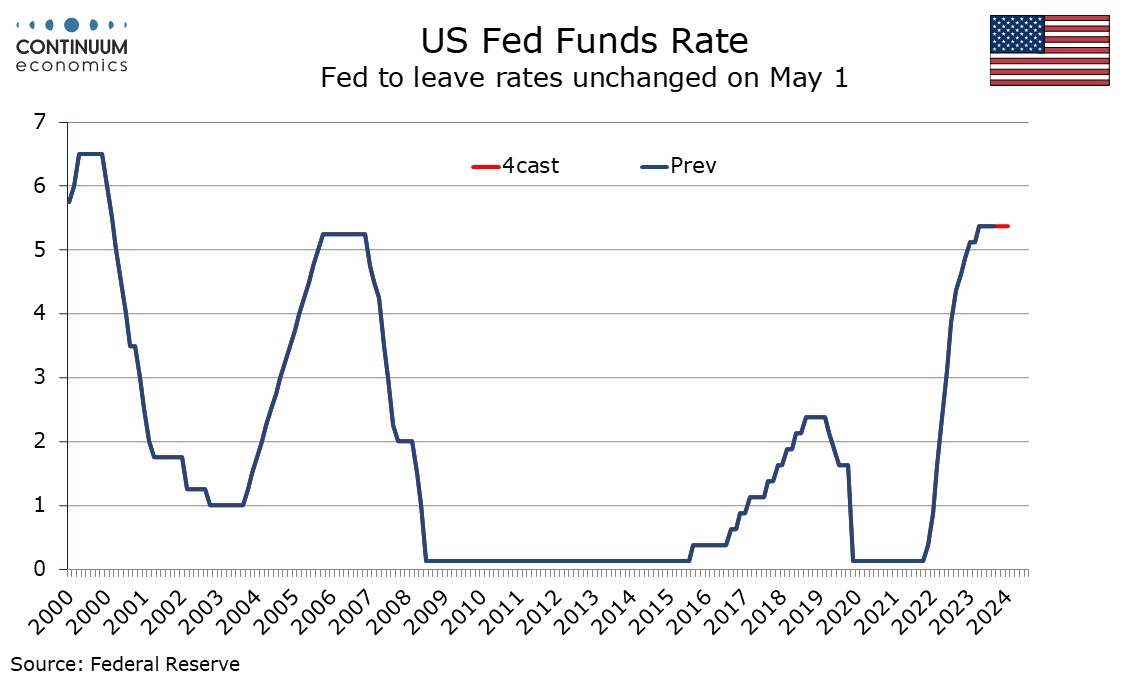

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

FOMC Notes Lack of Further Inflation Progress, QT to be Tapered in June

May 1, 2024 6:27 PM UTC

The FOMC has left rates at 5.25%-5.50% as expected and added to its statement that in recent months there has been a lack of further progress towards the 2% inflation objective. Otherwise the changes to the statement were fairly minor other than announcing a slowing in the pace of balance sheet redu

April 30, 2024

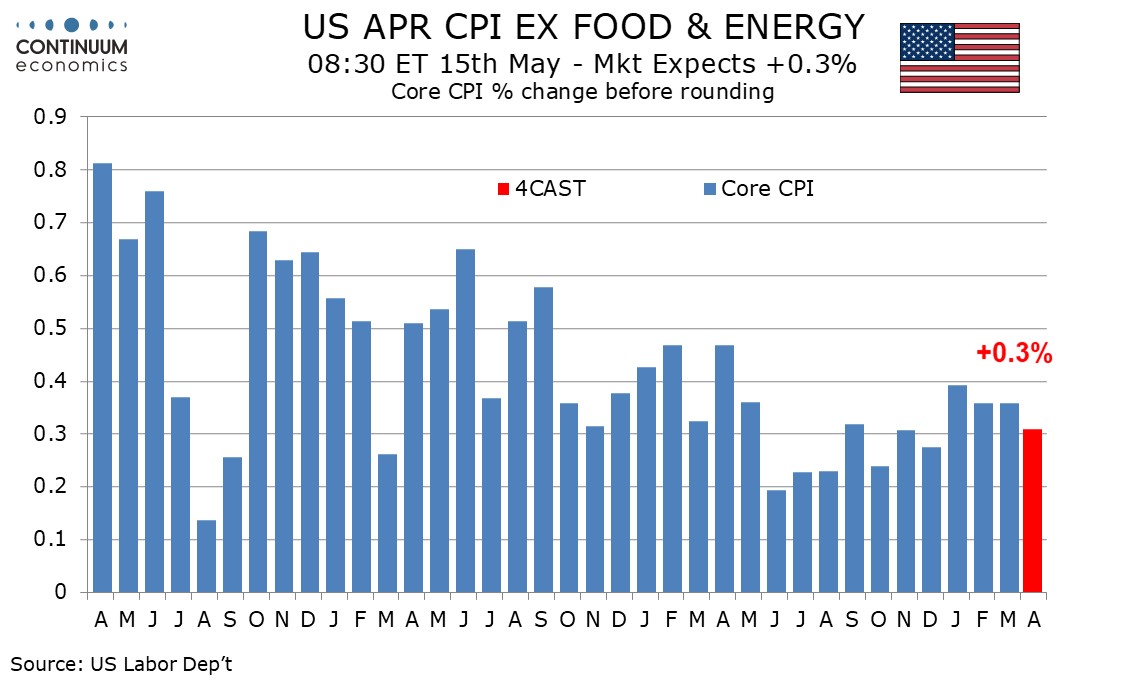

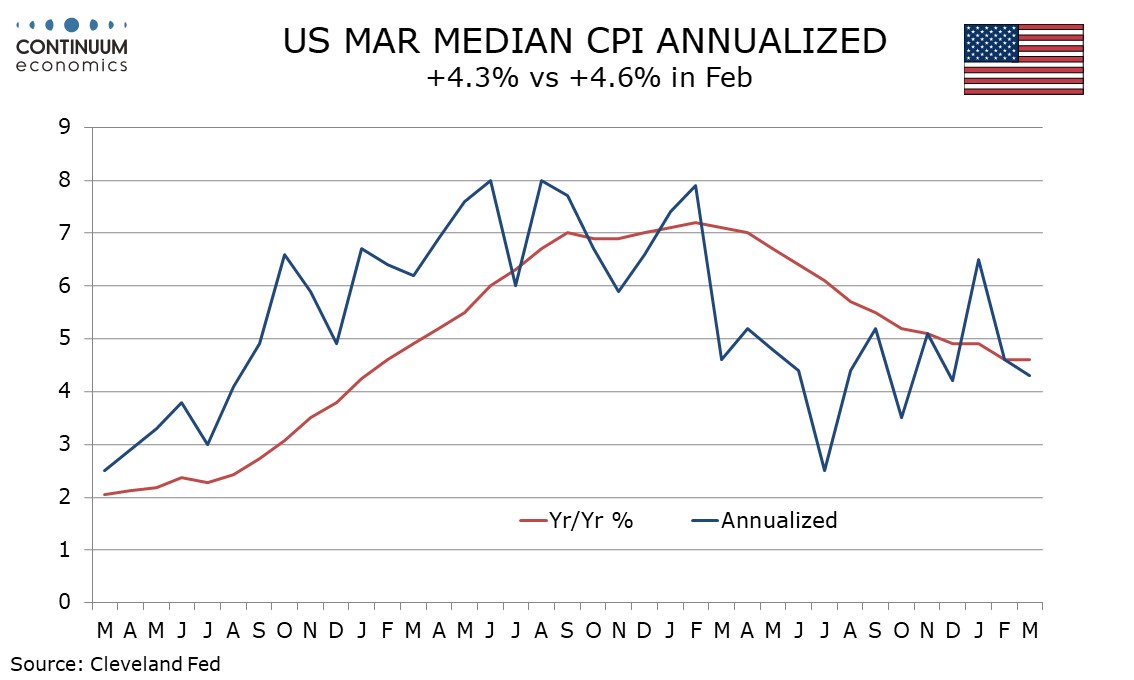

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

April 30, 2024 5:15 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though inflationary pressures will still look quite significant in A

April 29, 2024

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

April 26, 2024

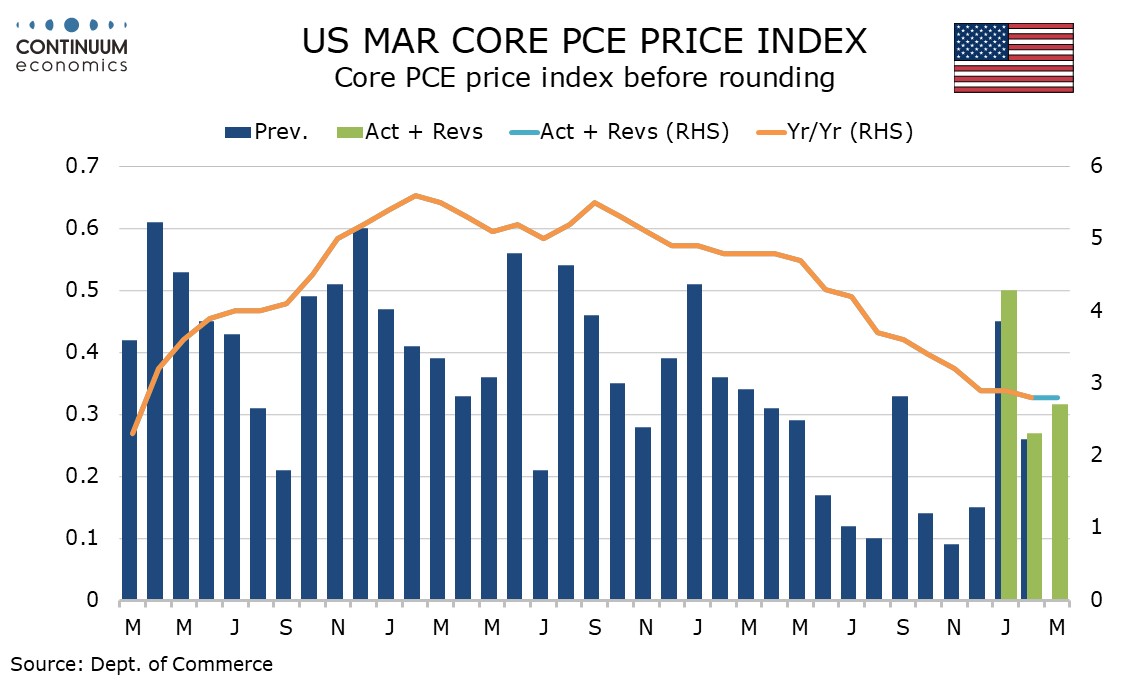

U.S. March Personal Income and Spending - Q1 totals confirmed, Core PCE Prices provide some relief

April 26, 2024 1:12 PM UTC

March’s personal income and spending data confirms the Q1 totals released with the GDP report. Core PCE prices at 0.3% provide some relief by avoiding the 0.4% implied by Q1’s stronger than expected 3.7% annualized rise. March rose by 0.317% before rounding with revisions to February (to 0.266%

April 25, 2024

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

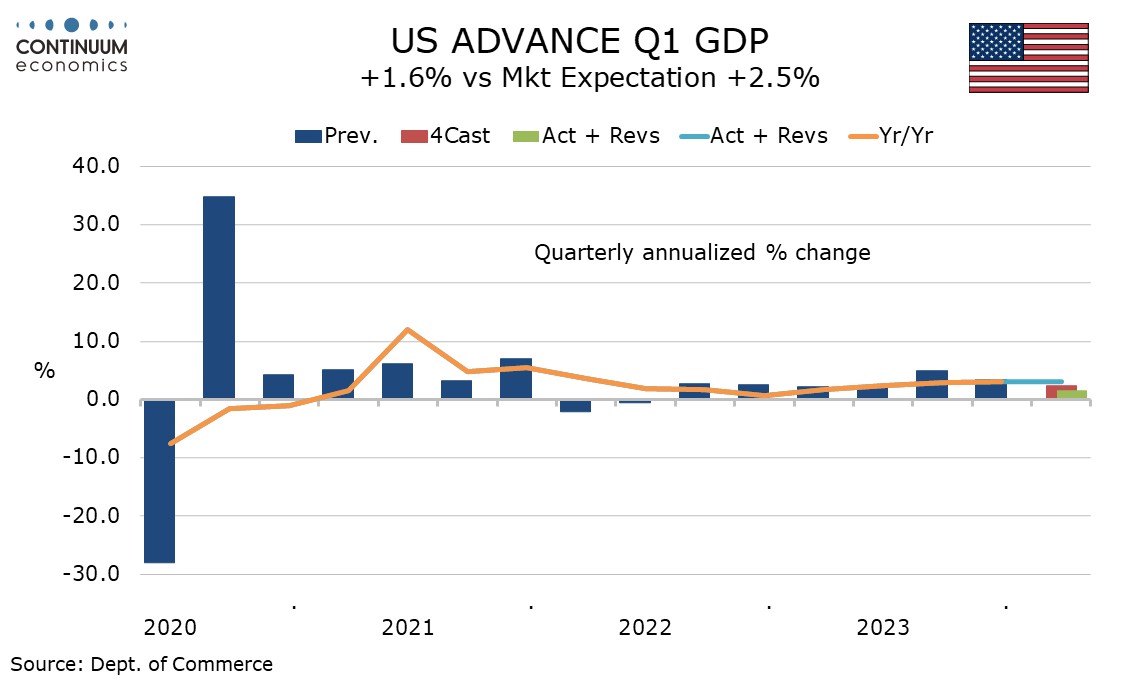

Q1 U.S. GDP Slows on Imports and Inventories, Core PCE Prices Stronger on the Quarter

April 25, 2024 1:14 PM UTC

Q4 GDP has come in weaker than expected at 1.6% annualized but with a stronger than expected 3.7% annualized increase in the core PCE price index. Weaker inventories and stronger imports are the main reason for the GDP slowing so the data is not a clear signal of underlying weakness. Lower initial (

April 24, 2024

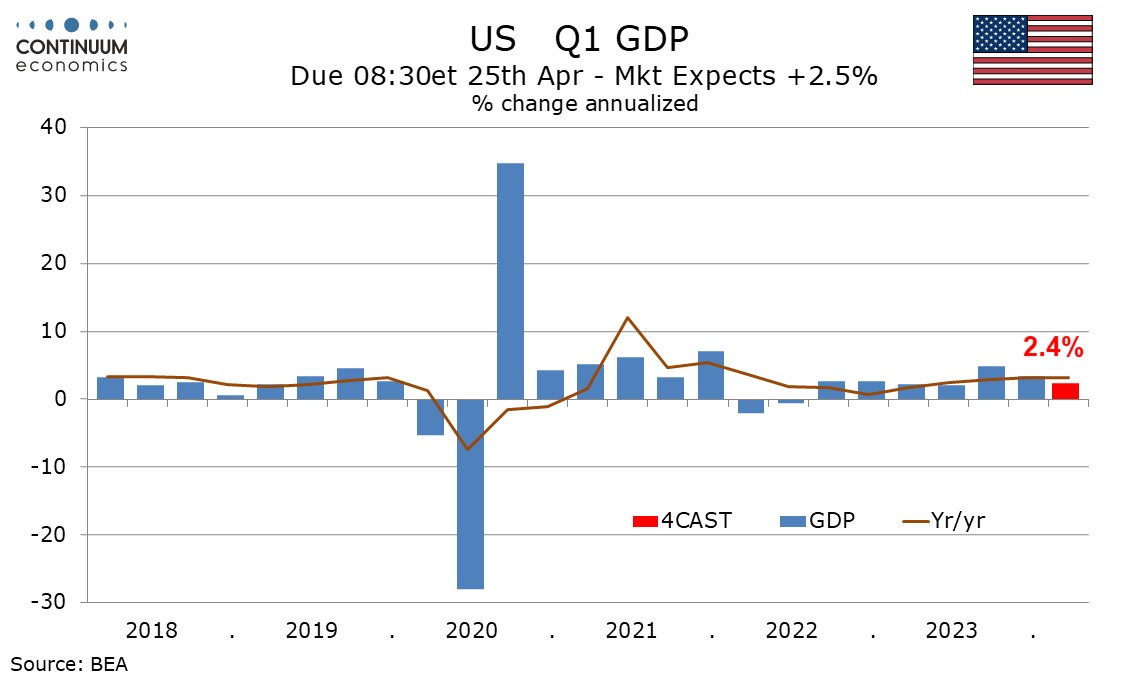

Preview: Due April 25 - U.S. Q1 GDP - Slower but Still Healthy With Stronger Core PCE Prices

April 24, 2024 1:54 PM UTC

We expect a 2.4% annualized increase in Q1 GDP, significantly slower than the second half of 2023 but slightly stronger than the first half and still a heathy pace of growth. We expect a pick up in the core PCE price index to 3.4% annualized after two straight quarters at 2.0%.

April 22, 2024

Preview: Due May 3 - U.S. April Employment (Non-Farm Payrolls) - Still strong if a little less so, earnings may be above trend

April 22, 2024 4:44 PM UTC

We expect a 255k increase in April’s non-farm payroll, still strong if the slowest since November, with a 195k increase in the private sector. We expect an unchanged unemployment rate of 3.8% and a slightly above trend 0.4% increase in average hourly earnings, lifted by a minimum wage hike in Cali

April 19, 2024

Preview: Due April 30 - U.S. Q1 Employment Cost Index - Trend slowing, but still quite firm

April 19, 2024 1:08 PM UTC

We look for the Q1 employment cost index (ECI) to increase by 0.9%, matching the Q4 increase that was the slowest since Q1 2021. Yr/yr growth will continue to slow, to 3.9% from 4.2%, reaching its slowest since Q3 2021, but will remain well above the pre-pandemic trend.

April 18, 2024

April 17, 2024

April 16, 2024

April 15, 2024

Preview: Due April 26 - U.S. March Personal Income and Spending - Core PCE prices seen less strong than core CPI

April 15, 2024 4:40 PM UTC

We expect March to deliver a second straight 0.3% increase in the core PCE price index, softer than the third straight 0.4% rise in core CPI, which was up by 0.36% before rounding for a second straight month. We also expect a 0.5% increase in personal income and a 0.7% increase in personal spendin

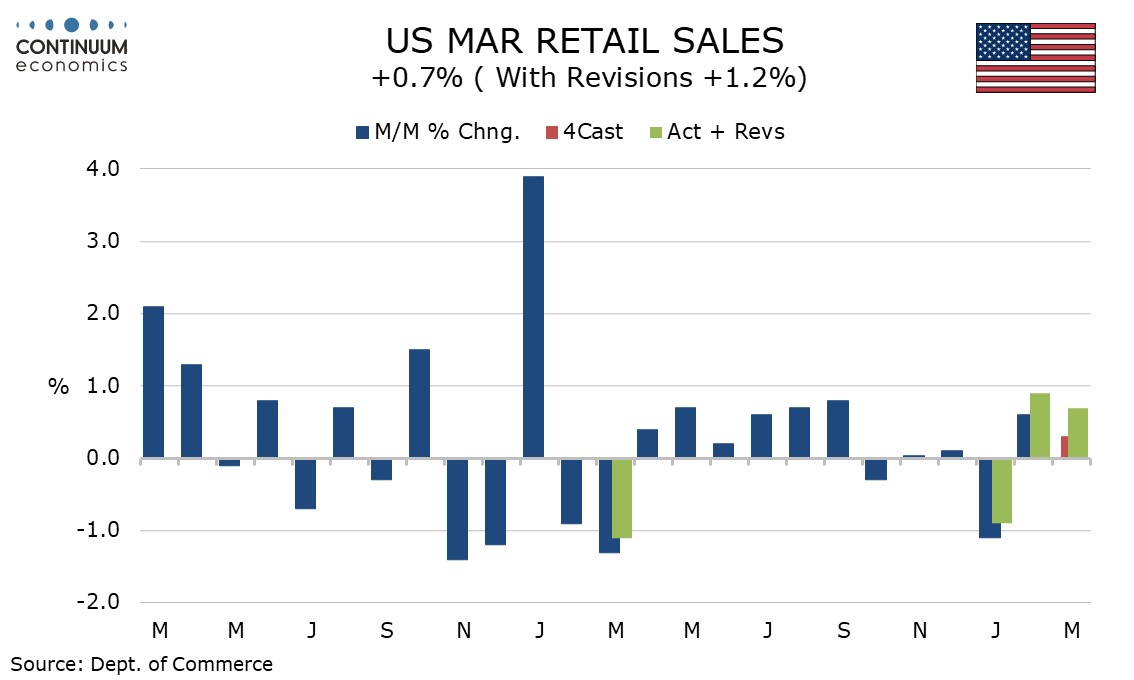

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

April 12, 2024

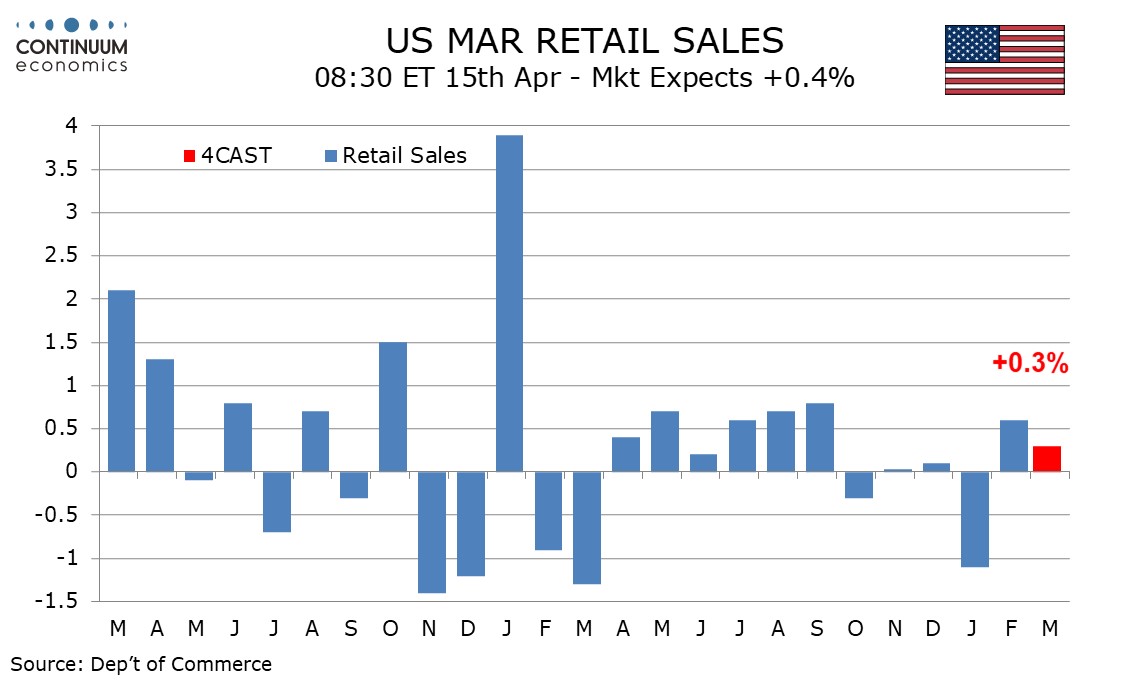

Preview: Due April 15 - U.S. March Retail Sales - Up again on the month but weaker in Q1

April 12, 2024 1:18 PM UTC

We expect a 0.3% increase in March retail sales, which after a 0.6% February increase would not fully erase January’s 1.1% decline that was blamed on bad weather. Ex autos however we expect a rise of 0.5%, which after a 0.3% February increase would complete a reversal of a 0.8% decline in January.

April 11, 2024

April 10, 2024

Tone of FOMC Minutes From March 20 is Not Hawkish

April 10, 2024 6:54 PM UTC

FOMC minutes from March show little sign of disagreement and the tone is not hawkish, with participants expecting both inflation and the economy to slow, and there being a clear majority view that the pace of balance sheet reduction should soon be trimmed. Optimism on inflation is however cautious