Japan

View:

May 02, 2024

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

April 29, 2024

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

April 26, 2024

Headwinds To Long-term Global Growth

April 26, 2024 9:30 AM UTC

Bottom line: While much focus is on the cyclical economic position to determine 2024 monetary policy prospects, the 2025-28 structural growth trajectory differs to the pre 2020 GDP trajectory for major economies. While global fragmentation has a role to play, aging populations are already having a

April 25, 2024

BoJ's Intervention and its impact

April 25, 2024 6:24 AM UTC

In the period of time when JPY significantly weakens or strengthens, BoJ will intervene in the FX market either through verbal or actual intervention. As JPY weakened significantly in the past months, once again we found ourselves in the proximity of FX intervention with unknowns for anonymity is ke

April 22, 2024

BoJ Preview: Showing no hurry

April 22, 2024 6:13 AM UTC

Our central forecast is for the BoJ to remain on hold for interest rate and signals the market they are in no rush to further tighten while allowing trend inflation data to lead policy direction in their forward guidance. BoJ has moved interest rate to 0% and officially removed YCC in March, citing

April 17, 2024

Markets: Fed Rather Than Middle East Worries

April 17, 2024 12:34 PM UTC

Global markets are being driven by a scale back in Fed easing expectations and we see a 5-10% U.S. equity market correction being underway. However, with the market now only discounting one 25bps Fed cut in 2024, any downside surprises on U.S. growth or better controlled monthly inflation numbers

April 03, 2024

April 02, 2024

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

March 27, 2024

Japan: 10yr JGB Yields To Exceed 1% in 2024?

March 27, 2024 10:00 AM UTC

Though BOJ soothed markets with last Tuesday’s rate hike and scrapping of yield curve control, we see scope for 10yr JGB yields to rise through 1% by summer/autumn. The current pace of net JGB purchases is a lot lower than H1 2023, while Ueda noted that this pace could be slowed in the future.

March 26, 2024

March 25, 2024

Japan Outlook: Beginning of A New Era?

March 25, 2024 4:54 AM UTC

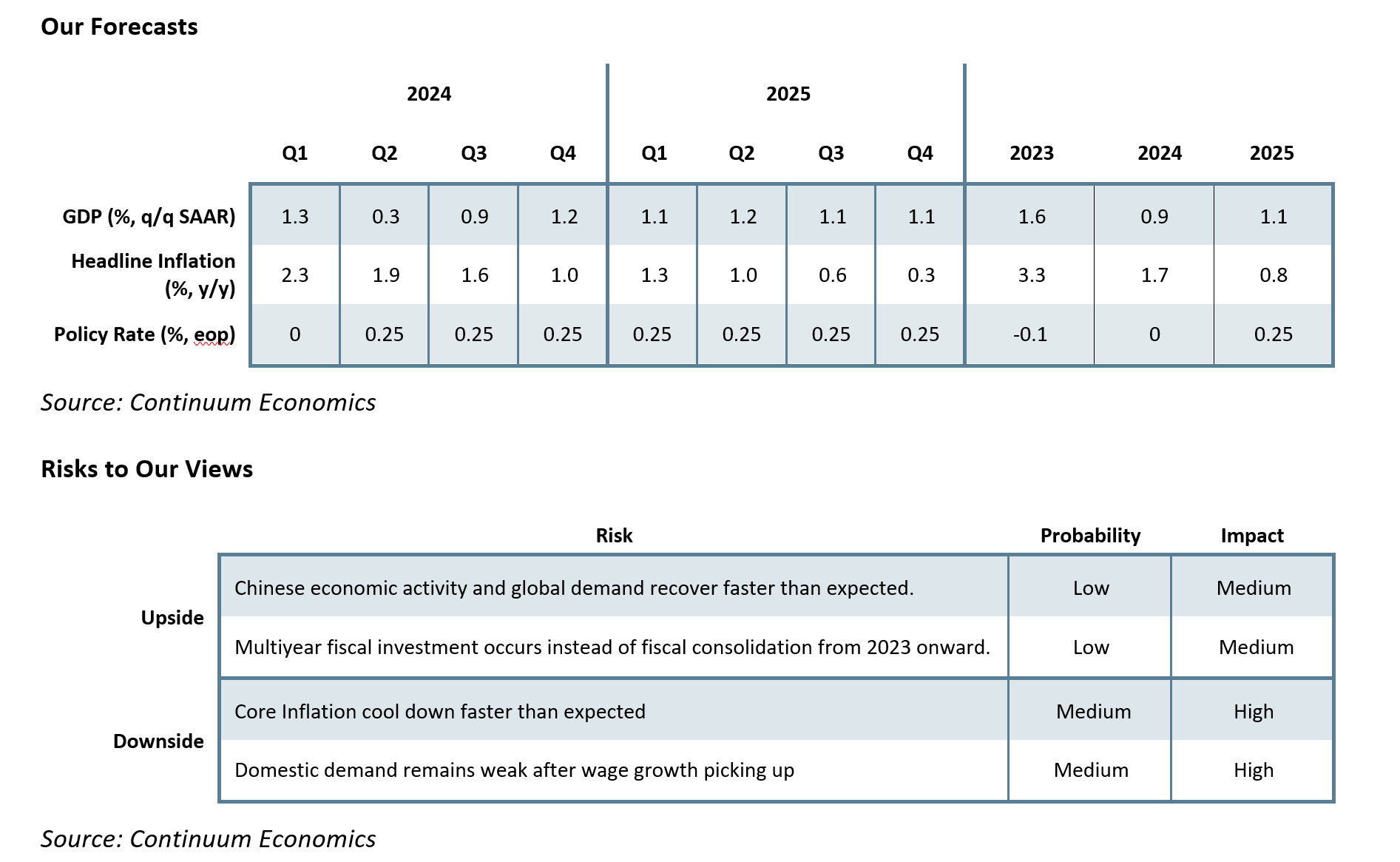

Bottom Line:

Forecast changes: We revised 2024 GDP lower to +0.8% from +0.9% because private consumption is now expected to contract in Q1 2024. 2024 CPI is revised higher to +2.1% from +1.7% to address the stronger wage hike Japanese unions secured.

March 22, 2024

March 19, 2024

March 13, 2024

BoJ Preview: 50-50

March 13, 2024 3:17 AM UTC

Our central forecast is for the BoJ to change forward guidance in March, indicating trend inflation will be achieving target and ultra-ease monetary policy is no longer necessary and hike interest rate to 0% in April as wage growth has accelerated and the latest wage negotiation is likely to ensure

March 12, 2024

Japanese Equities: Yen Headwind Rather than Tailwind

March 12, 2024 11:23 AM UTC

Bottom Line: Japanese equities tailwind from a weak JPY boosting corporate earnings will likely go into reverse, as the extreme JPY undervaluation ebbs with small BOJ rate hikes and Fed easing. We also forecast less nominal GDP growth in 2024 and 2025 than the market consensus. As this come thro

February 26, 2024

January 30, 2024

January 23, 2024

January 18, 2024

Japan: 10yr JGB Yields set to Rise Moderately

January 18, 2024 10:15 AM UTC

The more subdued profile of Japanese wages, plus a delay in the 1st BOJ hike, has prompted us to lower the forecast of a rise in 10yr JGB yields in 2024 – though we still see a rise above 1% (Figure 1). As BOJ tightening stops, we see 10yr JGB yields falling back again in 2025.

January 15, 2024

BoJ: The Pace of Exit

January 15, 2024 5:41 AM UTC

The BoJ has kicked the can down to the spring wage negotiation before another step in monetary policy. While current inflation forecast has exceeded BoJ's 2% target in all three items of headline, ex fresh food and ex fresh food & energy, the wage growth did not reach a "sustainable" level, which Ue

January 11, 2024

Webinar Recording December Outlook: Rate Cuts Into 2024

January 11, 2024 8:22 AM UTC

You can now access the webinar for the December Outlook here.

To read the individual chapters please see the weblink below.

Outlook Overview: Rate Cuts Into 2024 (here)

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

China Outloo

January 09, 2024

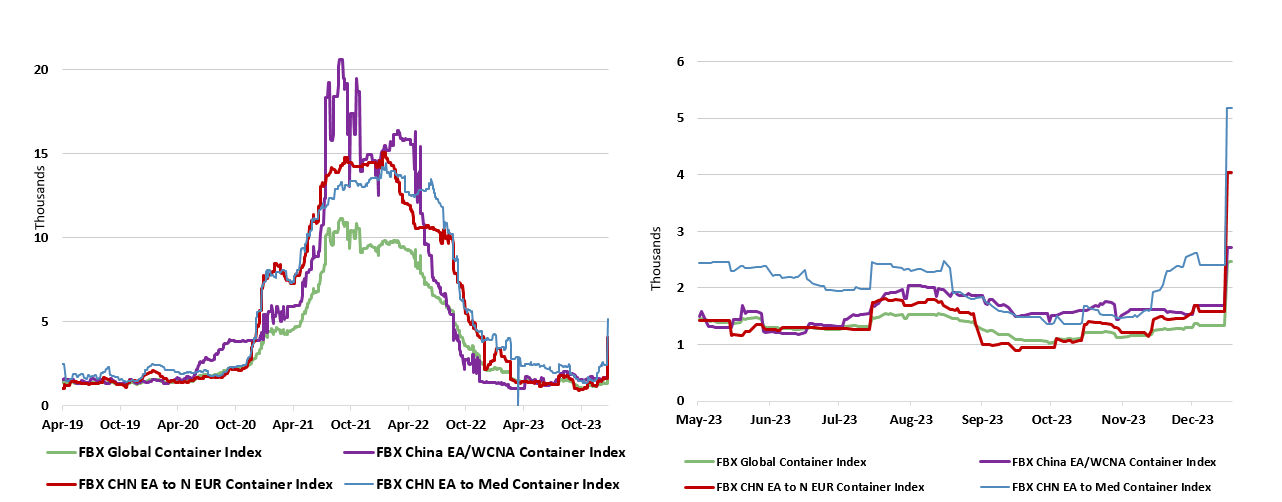

Shipping Freight Cost Jump and Inflation – Some Perspectives

January 9, 2024 2:24 PM UTC

Figure 1: Freight Cost Surge in Perspective

Source: DataStream

How Long?

Houthi rebels have been attacking some ships in the Red Sea in recent weeks. The key question is how long this will last? One line of thinking is that the Houthi attacks are part of Iran axis of resistance alongside attacks

January 08, 2024

Charting our Views December Outlook

January 8, 2024 9:05 AM UTC

Outlook Overview: Rate Cuts Into 2024 (here)

Economic Scenarios

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

Brazil Policy Rate and CPI Inflation (YoY, %)

China Outlook: Headwinds To China Growth (here)

Japan Outlook: Normalizing

January 03, 2024

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

January 02, 2024

December Outlook: Rate Cuts Into 2024

January 2, 2024 9:53 AM UTC

Outlook Overview: Rate Cuts Into 2024 (here)

U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture (here)

LatAm Outlook: Diverging Paths in 2024 (here)

China Outlook: Headwinds To China Growth (here)

Japan Outlook: Normalizing Monetary Policy Soon (here)

Asia/Pacific (ex-China/Japan) Outlook:

December 19, 2023

Japan Outlook: Normalizing Monetary Policy Soon

December 19, 2023 9:00 AM UTC

Macroeconomic and Policy Dynamics

Japanese headline inflation continues to moderate throughout 2023 as post COVID pent up demand fades and as supply chain disruption dissipates still further. However, the pace of moderation has been on a rocky road for food inflation (record chicken culling on bird f

Preview: BoJ to Announce New Forward Guidance

December 19, 2023 12:00 AM UTC

The BoJ meeting on December 18-19 is going to announce a change in forward guidance by suggest BoJ will be ready to exit ultra-loose monetary policy as trend inflation is in close sight of 2% target. Some hawkish market participants maybe anticipating an immediate hike from the BoJ to bring rates to

December 18, 2023

Outlook Overview: Rate Cuts Into 2024

December 18, 2023 3:42 PM UTC

· Uncertainty still prevails around this central view. The impact of lagged monetary tightening could be greater than our estimates and deliver mild recessions in some DM countries. We also feel that the disinflationary process could be stronger and this would help bring inflation back

December 15, 2023

Equities Outlook: Rate Cuts To Help in 2024

December 15, 2023 11:00 AM UTC

Equities Outlook: Rate Cuts To Help in 2024

· For other DM equity markets, EZ and UK are undervalued in contrast to the U.S., but are in or close to recessions and economic recovery will likely be weak and disappointing. Though the ECB and BOE will likely ease in Q2 with the Fed, we

December 08, 2023

This week's five highlights

December 8, 2023 10:34 AM UTC

U.S. November NFP Likely firmer due to returning strikers

USD/JPY Slumped on Ueda's Speech

Bank of Canada Tightening Bias Persists but is Reduced

USD/CAD Slipping on Weak Oil

RBA Continue to be data dependent

We expect a 200k increase in November's non-farm payroll, stronger than October's 150k though ex

November 22, 2023

November 21, 2023

European Equities Outlook for 2024 and Into 2025

November 21, 2023 8:14 AM UTC

European Equities are faced with the prospect of a mild recession, but less valuations strains than U.S. equities.What is the outlook in 2024 and into 2025?

While EZ corporate earnings hopes for 2024 will likely be trimmed by a sluggish economic outlook, ECB rate cuts and relief that inflation is fal

November 16, 2023

Long-term Forecasts to download in Excel

November 16, 2023 10:38 AM UTC

We present our annual forecasts that go out to 2030 for GDP Growth, Inflation, and Monetary Policy and to 2028 for Exchange Rates. The file contains five sheets: a Country Coverage summary page and a sheet for each of the four indicators.

The forecasts are consistent with the Long-term Forecasts: DM

November 07, 2023

U.S. Equities Bounce, But What About the Overvaluation

November 7, 2023 9:05 AM UTC

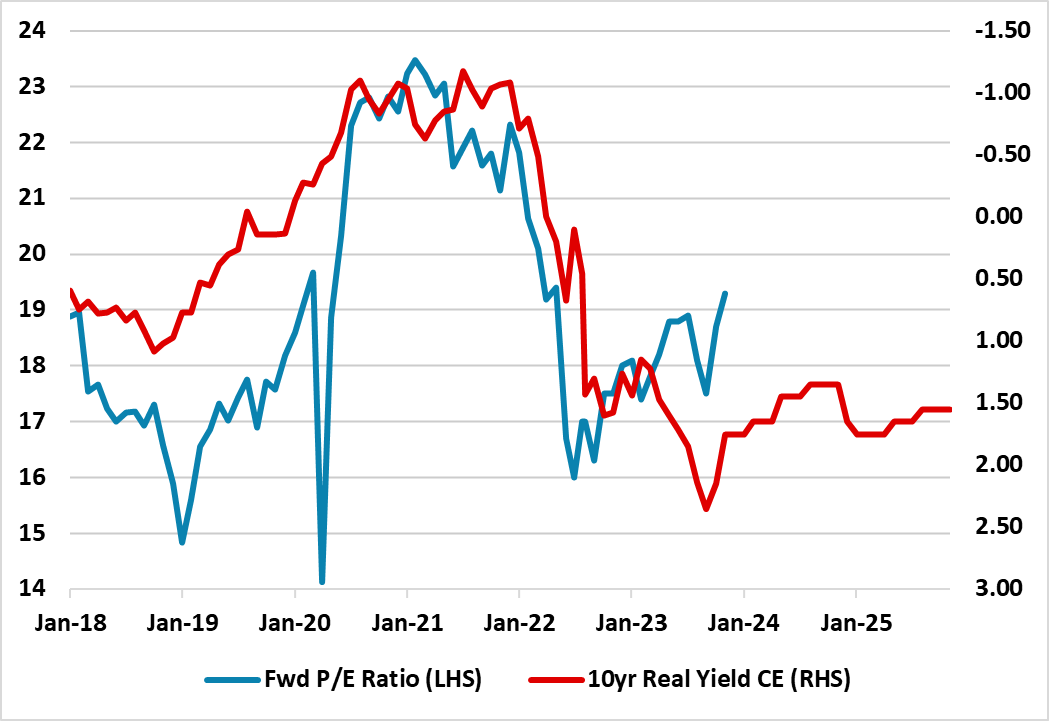

Figure 1: S&P500 12mth Forward P/E Ratio and U.S. 10yr Real Bond Yield (%)

Source: Datastream/Continuum Economics (using 10yr breakeven inflation for real bond yields)

The decline of 10yr U.S. Treasuries from 5% is bringing some relief for the battered U.S. equity market over the last week. Prospect

November 06, 2023

U.S. Yield Movements and Prospects for Bunds/JGB’s

November 6, 2023 10:03 AM UTC

Though rising U.S. yields since the summer had dragged up government bond yields elsewhere, 10yr government bond spreads became wider versus the U.S. for other major DM government bond markets. This has now started to reverse after last week yield drop and what are the prospects into 2024?

Figure

September 28, 2023

Equities Outlook: Diverging Earnings and Valuations

September 28, 2023 6:33 AM UTC

Risks to our views: Larger than expected effects from DM monetary tightening could cause downside surprises on U.S./EZ growth and hurt the global economy and earnings outlook. Equities would see a volatile 2024, with downside and then a rebound (on more aggressive policy easing) but less overall net

September 27, 2023

Japan Outlook: The First Step to Exit

September 27, 2023 6:00 AM UTC

Macroeconomic and Policy Dynamics

Japanese headline inflation has been moderating for 2023 so far, as global supply chains swing back to normal and energy prices rotates lower before the recent bounce. However, the pace of moderation has been hindered by stronger food prices (record chicken culling o

September 25, 2023

Long-Term U.S. Bond Yields and Little Primary Budget Deficit Progress

September 25, 2023 12:14 PM UTC

Figure 1: Primary Deficit Projections (% of GDP)

Source: IMF April Fiscal Monitor

U.S. 2020’s Structural Budget Deficit

The U.S. is making no real attempts to reduce the structural budget deficit build up over the COVID period, with the primary deficit projected to remain close to 4% into the lat

September 06, 2023

Trump: Policy Issues on Re-election

September 6, 2023 12:57 PM UTC

The current odds are around 40% Joe Biden to win the November 2024 presidential election and 33% Donald Trump, with the rest of the field some way distant. As we progress into 2024, more questions will be asked about what happens in the scenario that Trump is re-elected.

Our central scenario remain

September 04, 2023

DM Government Bonds Diverging

September 4, 2023 9:31 AM UTC

As DM policy tightening nears a peak, 10yr government bond spreads are starting to diverge.What is driving this and how much further can they diverge?

Figure 1: 10yr U.S. Treasury-Bund Spread and Fed Funds-ECB Depo Rate (%)

Source: Datastream/Continuum Economics

U.S. Soft Landing and EZ/UK Recess